GOOG

+2.46%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

Big tech took a beating as the Fed began raising interest rates.

But, as traditional sectors like financials are under stress, interest in big tech seems to be returning.

Trading with an upside potential of 22.8%, Alphabet stock presents a great opportunity to buy at current levels.

A softer Fed in the wake of the banking crisis and declining inflation, a general distrust of traditional sectors (especially financials), return of assets classes such as Bitcoin, gold, and the tech sector have rekindled investor interest in some stocks that have been beaten down by the market for some time.

Now that Meta Platforms (NASDAQ:META) has rallied, another tech giant has seen rising buying interest while its stock was heading lower: Alphabet Class C (NASDAQ:GOOG).

So what does the company actually do?

Alphabet is a holding company with investments in Google and other ventures.

The Google segment includes internet products such as search, ads, commercials, maps, YouTube, apps, cloud, Android, Chrome, Google Play, and hardware products, including Chromecast, Chromebook, and Nexus.

It also includes technical infrastructure and virtual reality alongside advertising, digital content sales, applications, cloud services, and the sale of Google-branded hardware.

Others comprise various operating segments, including companies such as Access/Google Fiber, Calico, Nest, Verily, GV, Google Capital, X, and other ventures.

The Other Ventures segment sells Nest hardware products, provides Internet and television services through Google Fiber, and does licensing, research, and development through Verily.

The Data at a Glance

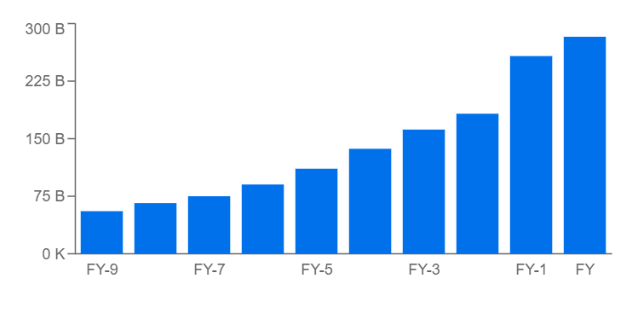

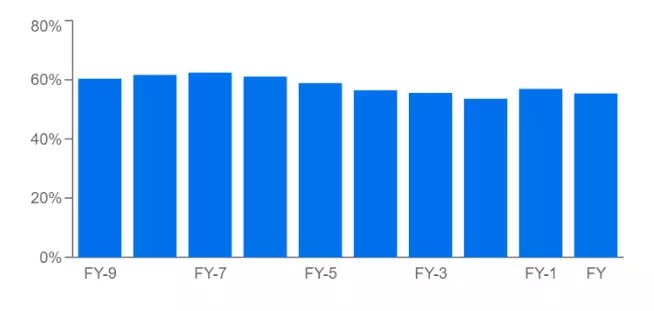

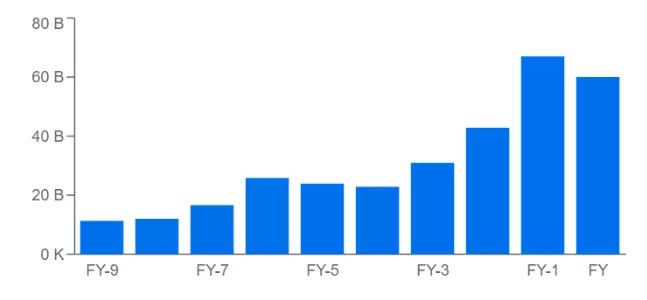

Let’s start with the financial history, which provides several useful insights, including:

Rising revenue and profit trends over time, as well as consistent margins (last year, all the big companies in both tech and advertising took a hit, but Alphabet has the positioning and competitive advantage to bounce back quickly, thanks to Youtube and AI).

Alphabet Revenue Trend

Alphabet Revenue Trend

Source: InvestingPro

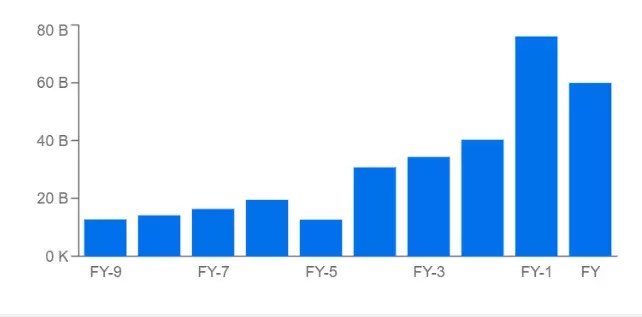

Alphabet Net Income Trend

Alphabet Net Income Trend

Source: InvestingPro

Alphabet Gross Profit Margins

Alphabet Gross Profit Margins

Source: InvestingPro

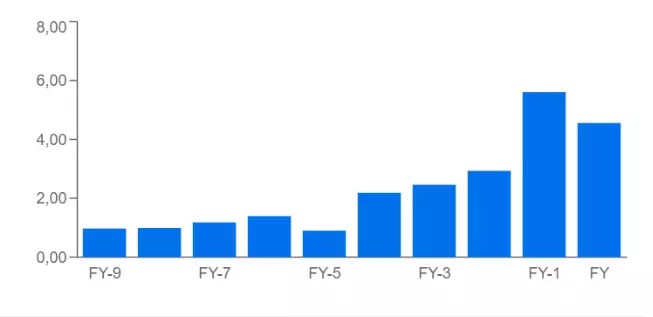

The growth rate of EPSd (diluted earnings per share) has been 18.8% over the last 10 years.

Alphabet Diluted Earnings Per Share

Alphabet Diluted Earnings Per Share

Source: InvestingPro

Balance Sheet and Cash Flows

In the form of cash and short-term investments, Alphabet has more than $114 billion, with total current assets of about $165 billion. This, when compared to its current liabilities ($69 billion), provides an excellent short-term balance sheet.

The debt/equity ratio is really good (currently 0.42, I consider ratios of 0.5/0.6 less optimal).

On the cash flow side, the operating cash flow trend has ebbed and flowed but remains positive overall.

Alphabet Cash Flow Trend

Alphabet Cash Flow Trend

Source: InvestingPro

With an FCF of $60 billion (the latest available), the FCF yield is about 4.5%. Good, but not outstanding (optimal yield for me is about 8-10%).

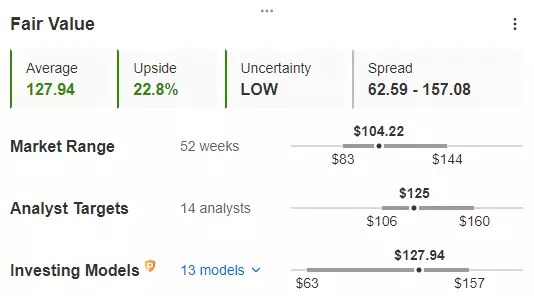

Valuation

Turning to valuations, the stock is currently trading at a discount of just under 23% to its fair value of around $128 per share (based on the average of 13 different models).

The analysts’ target price is $125, and the upside is about 19.9%.

Alphabet Fair Value

Alphabet Fair Value

Source: InvestingPro

All in all, the prospects for further growth are good, especially if the buying interest in the tech sector continues to grow.

The analysis was done using InvestingPro. To access the tool, click HERE.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, consultation, or recommendation to invest and, as such, is not intended to induce the purchase of any assets. I would like to remind you that any type of investment is evaluated from multiple perspectives and is highly risky and, therefore, any investment decision and the associated risk remain with the investor.

Source: Investing.com