Tuesday, 24 March 2015 18:34

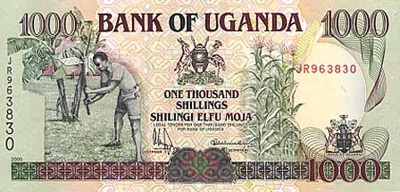

KAMPALA: The Ugandan shilling weakened further on Tuesday after a surge in end-month dollar demand from manufacturing firms and an injection of liquidity by the central bank.

KAMPALA: The Ugandan shilling weakened further on Tuesday after a surge in end-month dollar demand from manufacturing firms and an injection of liquidity by the central bank.

At 0853 GMT commercial banks quoted the shilling at 2,980/2,990, weaker than Monday’s close of 2,960/2,970.

“The shilling is taking in pressure from end of month (dollar) demand by manufacturing firms,” said Isaac Iga, chief dealer at Orient Bank.

“The central bank has also injected in liquidity via a reverse repo so some banks are now able to cover short (dollar)positions.”

The central bank, Bank of Uganda (BoU), had not yet said how much shillings it had injected into the interbank. Increased liquidity in the money markets makes it cheaper to hold dollars.

A combination of strong corporate demand for the US currency, the dollar’s global strength and investor concerns over government spending plans has kept the shilling under pressure, prompting the central bank to sell dollars at least 10 times this year to offer support.

The central bank has also sought to reassure investors that it will use its interest rate policy to control any potential inflationary pressures.

So far this year, the shilling has lost 7.6 percent against the dollar and some traders say the central bank could intervene again if it weakens towards the all-time record low of 3,116/3,126 hit on March 12.

“I would reckon the pace of weakening is likely to start worrying BoU again,” said a trader at a leading commercial bank.

“We might see them come in if it (shilling) crosses 3,000 again in a few days.”

Copyright Reuters, 2015