Wednesday, 25 March 2015 17:18

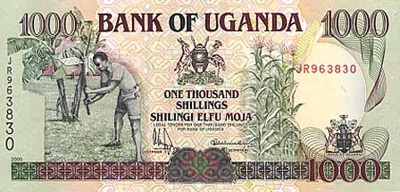

KAMPALA: The Uganda shilling was slightly stronger on Wednesday, buoyed by subdued demand for the U.S. currency, with the market wary the central bank could sell dollars if the local currency breached the key level of 3,000.

KAMPALA: The Uganda shilling was slightly stronger on Wednesday, buoyed by subdued demand for the U.S. currency, with the market wary the central bank could sell dollars if the local currency breached the key level of 3,000.

At 0913 GMT commercial banks quoted the shilling at 2,970/2,980, stronger than Tuesday’s close of 2,980/2,990.

“There’s significant liquidity after a BoU (Bank of Uganda)injection yesterday but players are not taking positions,” said Ahmed Kalule, trader at Bank of Africa.

“Some players think with 3,000 being the psychological level, touching it might trigger BoU to come in.”

On Tuesday the central bank injected 178 billion shillings ($ 60 million) into the money market via a seven day reverse repo, helping ease a scarcity of shillings.

However, Benon Okwenje, trader at Stanbic Bank, said dollar demand was slow from both corporates and banks and that the local currency was likely to trade in the 2,960-3,000 range to the dollar in the short-term with a bias for weakening.

The shilling has been on the back foot since January, losing 6.7 percent of its value against the greenback so far this year.

Much of the depreciation has been fuelled by strong demand from corporate firms looking to pay 2014 dividends and investor concerns about the government’s spending plans ahead of presidential and parliamentary elections early next year.

Copyright Reuters, 2015