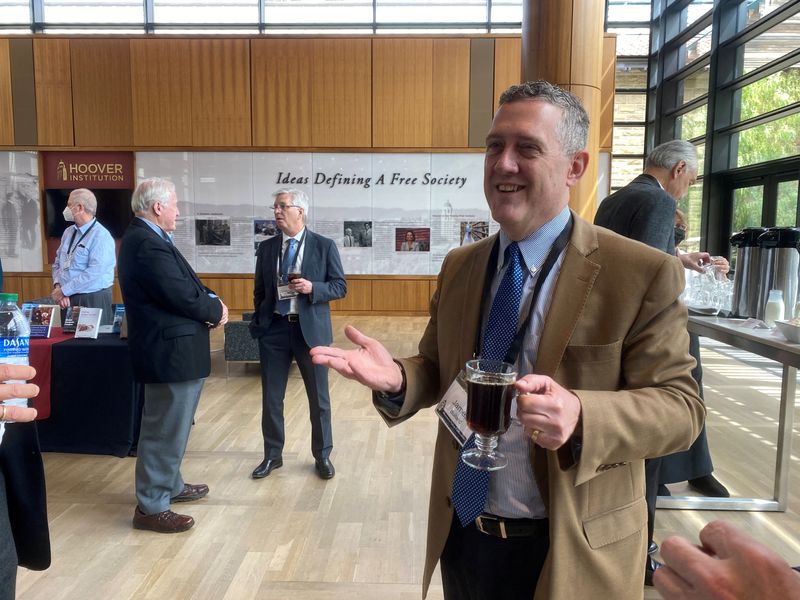

© Reuters. FILE PHOTO: Federal Reserve Bank of St. Louis President James Bullard chats, during a break at a conference on monetary policy at Stanford University’s Hoover Institution, in Palo Alto, California, U.S. May 6, 2022. REUTERS/Ann Saphir/File Photo

By Howard Schneider

WASHINGTON (Reuters) – St. Louis Federal Reserve President James Bullard said on Friday he was ready to keep an “open mind” about whether to raise rates or hold them steady at the Fed’s June meeting, joining the “data dependent” stance of his colleagues after a year of urging them on to consecutive rate increases.

Bullard said he felt the benchmark policy rate will ultimately need to “grind higher” because he anticipates slower progress on inflation, but “I am willing to be data dependent and not prejudge…It is impressive that we moved above the 5% benchmark,” with a rate increase this week to a level between 5% and 5.25%.

The comments from someone who has been an aggressive advocate of higher rates further cements this week’s Fed policy decision opening the door to a possible pause as an important turn from a run of 10 consecutive meetings, dating to March 2020, where the benchmark policy rate was heading predictably higher.

Bullard said he felt the 5% to 5.25% level reached this week was still only at the “low end” of what might be needed; his own projections have suggested rates may need to move up another half point to put inflation on a steadily downward path.

He said he felt there are risks, moreover, in leaving the policy rate where it is if inflation continues to move in what he considers a largely sideways direction, rather than steadily lower.

The economy remained resilient, he said, citing an April jobs report showing the unemployment rate at 3.4% and an additional 253,000 positions added to payrolls. Stress in the banking industry, he said, was unlikely to cause enough of a contraction in credit to damage the macroeconomy, or cause a recession that he continues to view as unlikely.

Still, “I am pleased we got over the 5% mark with the policy rate,” Bullard said. “I am willing to look at data and see where we are when we get to the next meeting” on June 13-14.

Source: Investing.com