BTC/USD

-5.39%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

ETH/USD

-4.26%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

Selling in the cryptocurrency market carried into the new week, with Bitcoin and Ethereum under pressure.

Bitcoin’s rally from last week was halted while Ethereum tested a key support level after coming under selling pressure.

Upcoming US CPI data will be crucial in determining both cryptos’ next direction.

Heavy selling in the cryptocurrency markets over the weekend spilled into the new week. Despite Bitcoin moving up last week within the ascending channel, it struggled to overcome critical resistance and started trading below the short-term channel. Meanwhile, Ethereum faced a decline, approaching a support region it has recently relied on after encountering strong selling pressure around the $2,000 level.

Bitcoin’s upward trajectory during the week was driven by increased demand as it reached the lower end of the ascending channel. However, buyers were unable to push the price beyond the $30,000 level, which coincides with the midline of the channel. The bearish sentiment over the weekend was amplified by BTC network congestion and Binance’s suspension of withdrawals.

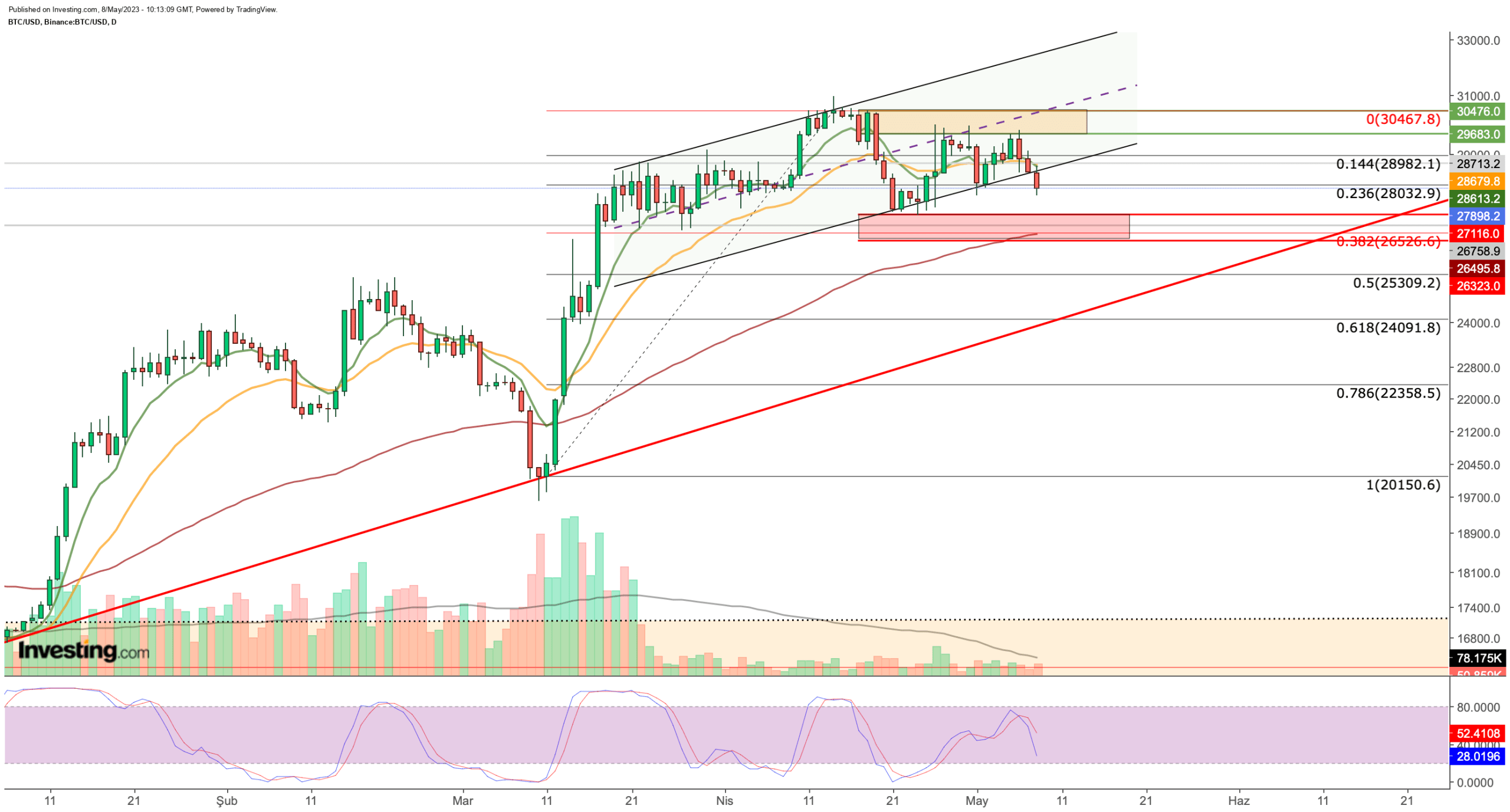

Bitcoin Daily Chart

Bitcoin Daily Chart

BTC broke below the lower boundary of the channel it held last week, signaling further losses could be around the corner. The current outlook suggests that BTC will likely test the $26,500-$27,000 range, which serves as a support area this week after previously acting as resistance.

This range is crucial, supported by the Fib 0.382 value and the 3-month EMA level, aligning with the recent uptrend. Breaking this level could result in BTC declining towards $24,100 (Fib 0.618) and then $22,350 (Fib 0.786). To maintain the overall upward trend, it is vital to stay above $24,000, especially during the ongoing decline, according to the daily outlook.

On the other hand, a daily close above the short-term EMAs in the $28,600 area this week could trigger a rapid recovery in the cryptocurrency. Reclaiming this area would mean BTC’s return to its short-term bullish channel, and a rapid rise towards the $30,000 band could be seen again.

The US CPI data will be closely watched this week. Bitcoin’s next move depends on the data. US inflation is expected to remain stable on an annual basis. In case of a decline, BTC could recover in the second half of the year.

This could be due to an increase in demand for risk assets and because of the fact that the pressure on the Fed to tighten monetary policy will ease somewhat. In addition, if inflation comes in higher than expected, BTC will tumble.

Ethereum Tries to Maintain Its Upward Momentum

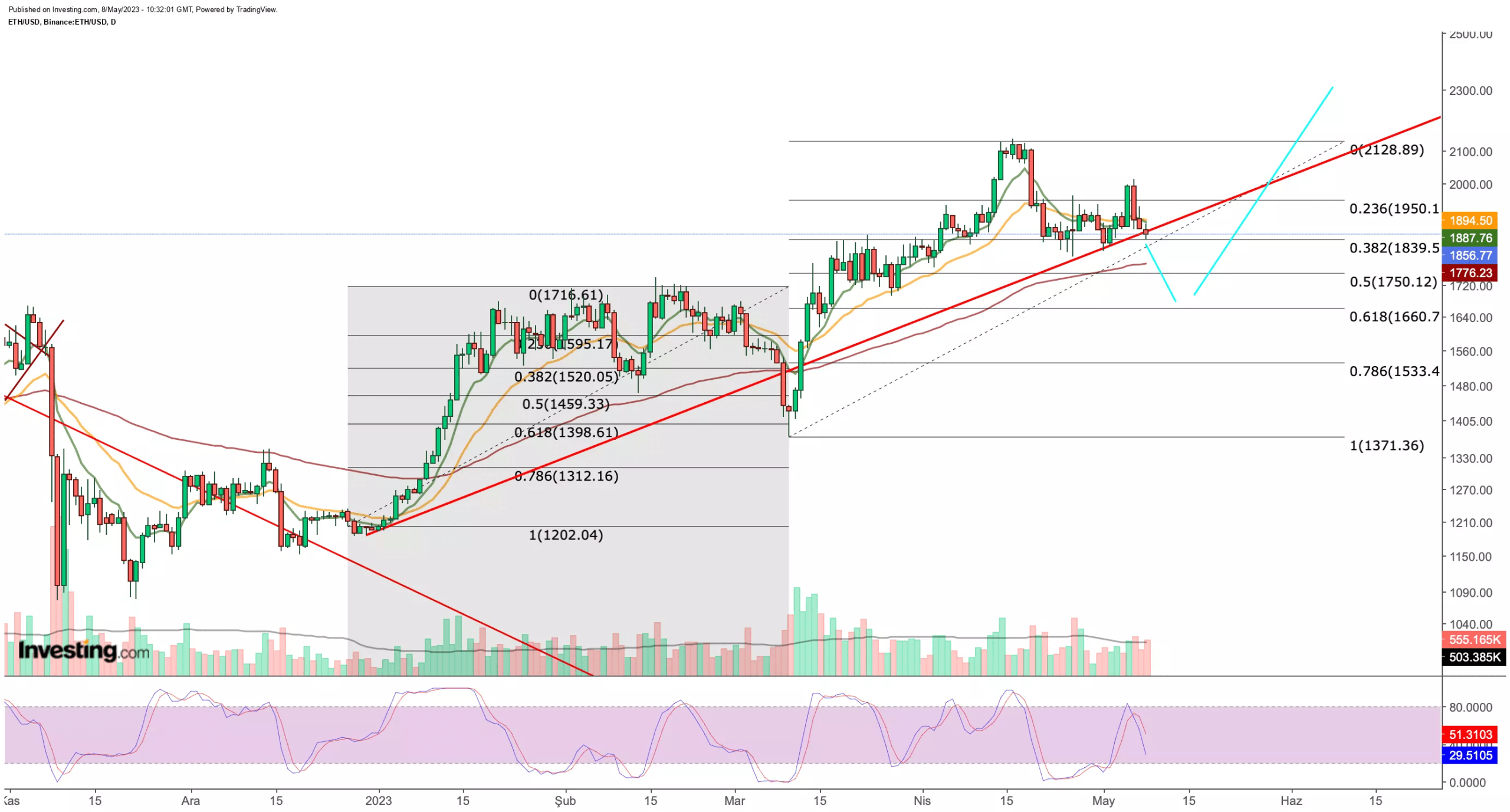

Ethereum rose as high as $2,100 halfway through last month but entered a new correction phase after that.

Ethereum Daily Chart

Ethereum Daily Chart

Ethereum, which lost momentum in the 2023 uptrend, is currently testing a critical support level this week. After falling to an average of $1,840 on April 21, Ethereum experienced an upward bounce from this point, but the $2,000 region has become a selling point.

The recent decline in Ethereum once again brought the $1,840 support (Fib 0.382) into focus. If there is a daily close below this region, it could indicate a breakout from the trend. In that case, we may see ETH retreat towards the 3-month EMA value and Fib 0.5 zone at $1,750.

Breaching the support level at $1,660 (Fib 0.618) could signal a potential move toward Ethereum’s $1,500 range.

However, if Ethereum traders can keep the cryptocurrency’s price above $1,840, it may pave the way for another upward movement before the support levels become significant. To sustain this upward momentum, a clear daily candle closing above $1,950 is required. Meeting this condition would allow ETH to surpass $2,100 and set its sights on the $2,300 region.

Find All the Info you Need on InvestingPro!

Disclaimer: This article is written for informational purposes only; it is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation, advice, counseling, or recommendation to invest. We remind you that all assets are evaluated from different perspectives and are extremely risky, so the investment decision and the associated risk are the investor’s own.

Source: Investing.com