Informist, Thursday, May 11, 2023

By Anjali

NEW DELHI – Government bond prices ended higher today tracking an overnight fall in US Treasury yields, dealers said. US yields slumped after slightly lower-than-expected US inflation data for April.

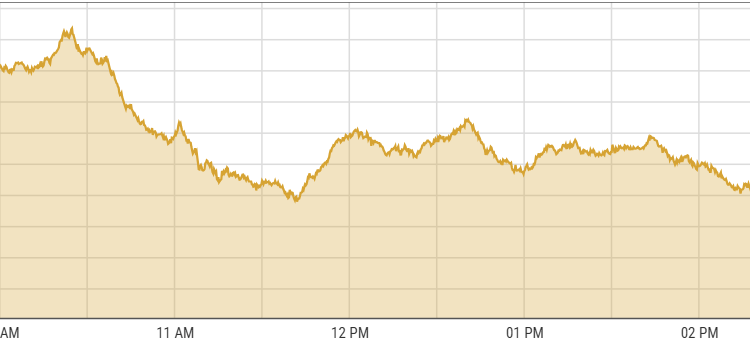

The 10-year benchmark 7.26%, 2033 bond ended at 101.51 rupees, or 7.04% yield, against 101.51 rupees, or 7.04% yield, on Wednesday.

Yield on the benchmark 10-year US Treasury note slumped 10 basis points to 3.42% on Wednesday against the previous day’s close. A fall in US Treasury yields widens the interest rate differential between the safe-haven asset and emerging market debt, making the latter more appealing to foreign investors.

“The market hardly moved anything after the initial rise. The market played between 10–12 paise only,” a dealer at a state-owned bank. “The market will rally if our CPI data comes below 4.8%, unless that happens expect the same range and dull volume.”

Traders refrained from betting on shorter tenure papers due to lack of clarity on any rate cuts in the near future, dealers said. According to dealers, repo rate cuts by the end of the calendar year are likely only if domestic economic growth remains resilient, in line with the Reserve Bank of India’s projections, and headline inflation remains well within the tolerance band of 2-6%.

The domestic consumer inflation data is scheduled to be released after market hours on Friday. According to an Informist poll, CPI inflation is seen falling to an 18-month low of 4.8% in April from 5.66% in March.

The Reserve Bank of India may take durable liquidity action though open market operations in the second half of the current fiscal year started April, leading to the expectations of rate cuts, dealers said.

“The domestic CPI won’t have much effect on market, until it’s above 5%,” a dealer at a primary dealership said. “Until US yields fall below 3.40%, the market won’t go marginally up.”

Dealers speculated that a few traders covered short bets after the release of the US CPI data, which kept the gilts afloat.

Meanwhile, state-owned banks trimmed their gilt holdings on the view that buying momentum is over, dealers said. On the other hand, foreign banks stepped up purchases of the 10-year benchmark 7.26%, 2033 bond, dealers said. Dealers expect the yield on the 10-year paper to remain above 7.00%.

Additionally, dealers speculated that a few traders stocked up on the 7.14%, 2036 paper at lucrative yield level as the spread between the 10-year and 14-year papers widened to 12 basis points.

According to data on the RBI’s Negotiated Dealing System–Order Matching platform, the turnover was 366.00 bln rupees, compared with 308.25 bln rupees on Wednesday. Meanwhile, no trades were settled with the digital rupee today compared with two trades aggregating to 100 mln rupees on Wednesday.

OUTLOOK

On Friday, bond prices are seen opening steady on caution ahead of the release of domestic April CPI data after market hours, dealers said.

Traders may also track overnight movement in US Treasury yields and crude oil prices.

The yield on the 10-year benchmark 7.26%, 2033 bond is seen at 6.95-7.10%.

India Gilts: Most bonds up as US ylds fall; traders eye India CPI

NEW DELHI – Most on-the-run gilts rose today as US CPI for April was slightly lower than expected, dealers said. Shorter-tenure papers continued to trade in thin band due to lack of clarity on rate cuts in near term.

According to dealers, repo rate cuts by the end of the calendar year are likely only if domestic economic growth remains resilient, in line with Reserve Bank of India’s projections, and headline inflation remains well within the tolerance band of 2-6%.

Dealers speculated that a few traders covered short bets after the release of the US CPI data, which kept the gilts afloat. Meanwhile, state-owned banks trimmed their gilt holdings on the view that buying momentum is over, dealers said.

“PSU banks (state-owned banks) are on the selling side today,” a dealer at a state-owned bank said. “Those who bought at the auction, this is a good level (yield on the benchmark 7.26%,2033 bond) to sell.”

Additionally, traders eyed the release of the domestic inflation data. The consumer inflation data is scheduled to be released after market hours on Friday. According to an Informist poll, April CPI inflation is seen at 18-month low of 4.8%.

According to data on the Reserve Bank of India’s Negotiated Dealing System–Order Matching platform–the marketwide turnover was 241.25 bln rupees at 1440 IST, compared with 247.50 bln rupees at 1535 IST on Wednesday.

For the rest of the day, the yield on the 10-year benchmark 7.26%, 2033 bond is seen at 6.95-7.08%. (Anjali)

India Gilts: In thin band after initial rise as traders eye India CPI

NEW DELHI–1230 IST–Government bond prices traded in a thin band after rising initially as traders eyed the domestic inflation data, due on Friday, dealers said. Traders covered short bets, which kept the gilts afloat, dealers said.

The domestic consumer inflation data is scheduled to be released after market hours on Friday. According to an Informist poll, Apr CPI inflation is seen at 18-month low of 4.8%.

Meanwhile, dealers speculated that state-owned banks sold the benchmark 10-year 7.26%,2033 bond at a profit. On the other hand, foreign banks stepped up purchases of the 10-year benchmark 7.26%,2033 bond, dealers said.

Additionally, dealers speculated that state-owned banks and private banks stocked up on 7.14%, 2036 paper at lucrative yield level as the spread between 10-year paper and 14-year paper widened to 12 basis points. Meanwhile, dealers expect the yield on the 10-year paper to remain above 7.00% on the view that the buying momentum is behind us.

“People are betting on the yield curve steepening, but the curve will flatten soon,” a dealer at a state-owned bank said. “The yield on 14-year paper will not go beyond 7.14% level, but right now a spread of 12-14% is lucrative.” Yield curve steepens when the yield on long-term bonds rises faster than short-term bonds.

According to data on the Reserve Bank of India’s Negotiated Dealing System–Order Matching platform–the marketwide turnover was 197.60 bln rupees at 01230 IST, compared with 87.50 bln rupees at 0930 IST on Wednesday.

For the rest of the day, the yield on the 10-year benchmark 7.26%, 2033 bond is seen at 6.95-7.08%. (Anjali)

India Gilts: Rise as US yields slump; short term bonds in thin band

NEW DELHI–0930 IST–Prices of government bond were up tracking a fall in US Treasury yields after slightly lower than expected US April inflation data, dealers said.

However, the yield on the benchmark 10-year 7.26%,2033 bond is expected to remain above 7% due to large supply, and caution ahead of domestic inflation data release, dealers said. The domestic consumer inflation data is scheduled to be released after market hours on Friday.

“The market opened with a gap, but the prices are capped now,” a dealer at a state-owned bank said. “There is supply pressure also, I don’t think the yield (on the 10-year paper) will fall below 7% for now.”

Traders refrained from betting on shorter tenure papers due to lack of clarity on any rate cuts in the near future, dealers said. According to dealers, repo rate cuts by the end of the calendar year are likely only if domestic economic growth remains resilient, in line with Reserve Bank of India’s projections, and headline inflation remains well within the tolerance band of 2-6%.

The domestic consumer inflation data is scheduled to be released after market hours on Friday. According to an Informist poll, Apr CPI inflation is seen at 18-month low of 4.8%.

A majority of the government’s 8.88-trln-rupee gross bond issuance in Apr-Sep is by way of bonds maturing over 14 years, with the 10-year gilt accounting for 20.5% of supply. In contrast, the three-year gilt and the five-year gilt make up for merely 18.0% of the supply in the first half.

According to data on the RBI’s Negotiated Dealing System–Order Matching platform–the marketwide turnover was 65.15 bln rupees at 0930 IST compared with 11.60 bln rupees at 0930 IST on Wednesday.

During the day, the yield on the 10-year benchmark 7.26%, 2033 bond is seen at 6.95-7.08%. (Anjali)

India Gilts: Seen higher as US ylds slump on softer US inflation data

MUMBAI – Prices of government bonds are seen opening higher, tracking a fall in US Treasury yields, dealers said. US yields slumped after slightly lower-than-expected US April inflation data.

Today, the yield on the 10-year benchmark 7.26%, 2033 bond is seen at 7.00-7.07% as against 7.04% on Wednesday.

Yields on the benchmark 10-year US Treasury note slumped 10 basis points to 3.43% on Wednesday against the previous day close. A fall in US Treasury yields widens the interest rate differential between the safe-haven asset and emerging market debt, making the latter more appealing to foreign investors.

US inflation print for April was at 4.9%, which is slightly lower than the estimates of economists surveyed by Dow Jones of 5%. The inflation increased 0.4% on the month, in line with the estimates. However, the inflation still remains well above the US Federal Reserve’s target of 2%.

April CPI data cemented investors’ bets on the US rate-setting panel leaving the rates unchanged in its June policy review meeting, dealers said. According to the CME FedWatch tool, about 90% of Fed fund futures traders are expecting the Fed to keep the rates unchanged in its upcoming policy meeting, while the rest see a 25 bps hike in June.

During the day, traders may place short bets ahead of the 390-bln-rupees gilt auction on Friday, dealers said. The central government will sell 80 bln rupees of the 6.99%, 2026 bond, 70 bln rupees of the 7.17%, 2030 bond, 120 bln rupees of the 7.41%, 2036 bond, and 120 bln rupees of the 7.40%, 2062 bond.

The market also awaits the India CPI data for April, which is scheduled to be released on Friday, dealers said. Preliminary estimates show April CPI around 4.8%. India’s consumer price inflation fell to a 15-month low of 5.66% in March. (Nishat Anjum)

End

IST, or Indian Standard Time, is five-and-a-half hours ahead of GMT

Edited by Tanima Banerjee

For users of real-time market data terminals, Informist news is available exclusively on the NSE Cogencis WorkStation.

Cogencis news is now Informist news. This follows the acquisition of Cogencis Information Services Ltd by NSE Data & Analytics Ltd, a 100% subsidiary of the National Stock Exchange of India Ltd. As a part of the transaction, the news department of Cogencis has been sold to Informist Media Pvt Ltd.

Informist Media Tel +91 (11) 4220-1000

Send comments to [email protected]

© Informist Media Pvt. Ltd. 2023. All rights reserved.

Source: Cogencis

![[Geojit Comtrade] Daily report on Natural Rubber: December 4, 2012](https://img.globalrubbermarkets.com/2024/08/geojit-comtrade-daily-report-on-natural-rubber-december-4-2012.jpg?resize=120%2C86&ssl=1)