Copper

+0.64%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

MCU

+0.86%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

Chinese inflation remains weak, raising concerns about the economic rebound

Price stagnation and falling prices in China indicate deflation

Copper could continue to head lower as demand in China hits a low point

Copper has a “China problem”: The world’s second-largest economy isn’t rebounding as fast as many thought it would after abandoning all caution over COVID.

And that is a problem for a metal that sees nearly half of its global demand out of China alone.

The numbers are telling. Data out of Beijing on Thursday showed Chinese consumer inflation barely grew in April, while producer inflation sank to its weakest level since the peak of the pandemic in 2020.

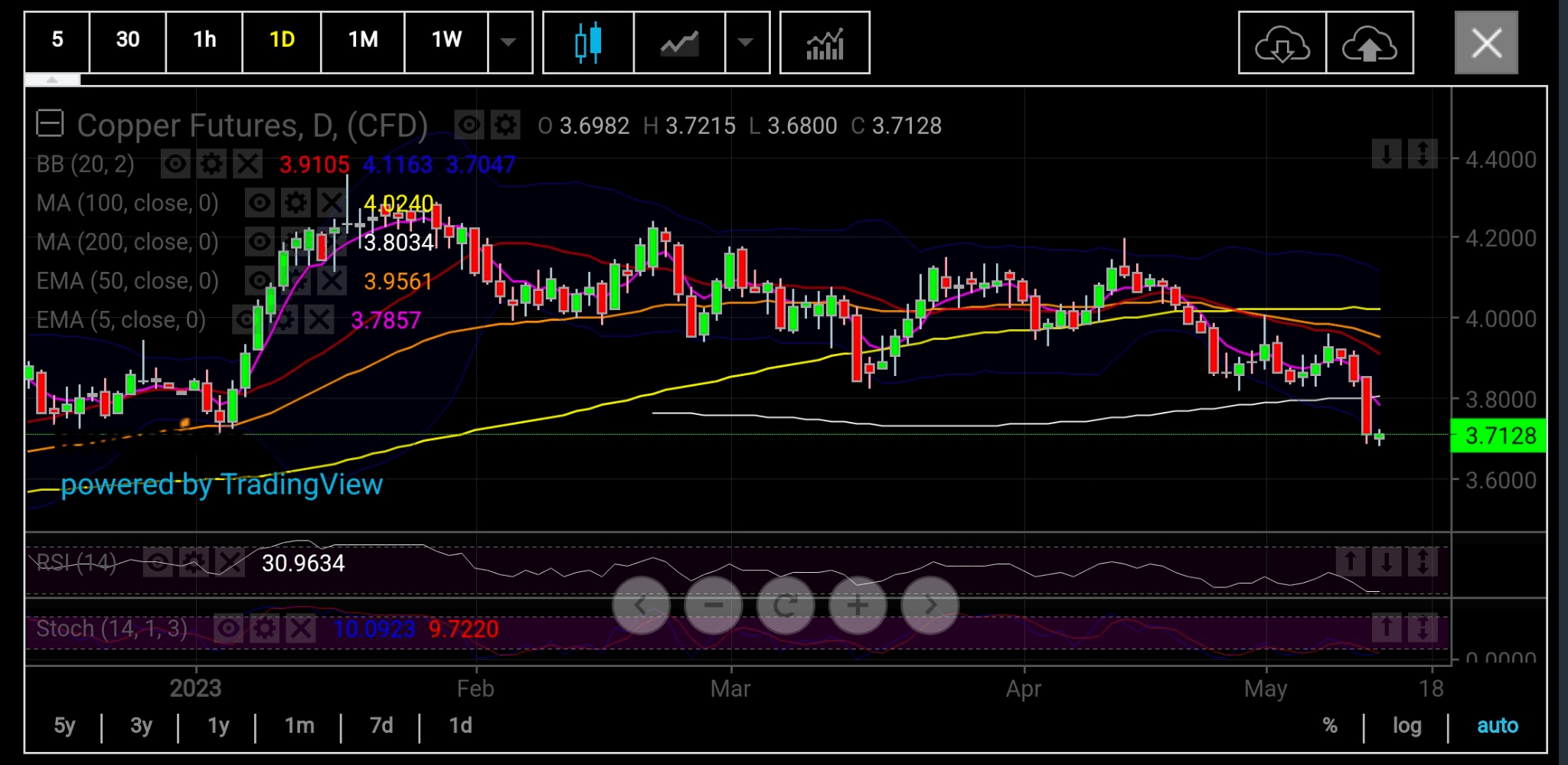

US Copper Daily Chart

US Copper Daily Chart

Charts by SKCharting.com, with data powered by Investing.com

Chinese trade data earlier this week was also disappointing, showing an economy struggling to pick up despite various stimuli put into place since the country turned its back on COVID lockdowns early this year.

The unusual combination of price declines and unprecedented money supply in the Chinese economy has fueled talk of deflation.

As the United States and many other countries desperately try to bring down inflation which is chipping away at living standards, China is doing the opposite in trying to grow its economy through higher prices.

The seemingly paradoxical situation is logical to anyone who understands Chinese economic peculiarities.

Economic uncertainty is prompting Chinese households to stash money into savings rather than go out to spend, and companies remain wary of making new investments.

That’s raising the specter of a tailspin of falling prices and wages from which the economy may struggle to recover.

In a recent commentary, Raymond Yeung, chief economist for Greater China at ANZ Research, said:

“Our core view is that China’s economy is deflationary.”

Yu Yongding, a former director of the Institute of World Economics and Politics at the CASS, concurs somewhat. Yu said in an article posted on the Chinese news site NetEase,

“In my opinion, although the statement ‘deflation has begun’ is not necessarily accurate, it is not a big mistake. Calling attention to deflation is entirely correct. Insufficient aggregate demand is a prominent problem facing the economy.”

Prices are stagnating or falling in China despite the People’s Bank of China, or PBOC, cutting interest rates and pumping cash into the financial system to bolster the economy, and despite the removal of strict COVID control measures late last year.

Although China’s gross domestic product expanded by 4.5% in the first quarter, that growth largely reflected the impact of pent-up demand among shoppers following three years of pandemic restrictions, Yeung added. Stripping that out, GDP growth would have been only 2.6%.

There’s plenty of money in the economy. The broad money supply, as measured by M2, increased by a record high of $5.6 trillion in the past 15 months. And the PBOC has been trying to encourage people to spend by boosting banking liquidity via multiple policy tools, such as open market operations and lowering reserve requirement ratios.

But consumers appear to have barely reacted. Instead of spending money, people are hoarding cash at a record rate. According to analysts, much of the new bank lending has gone to local governments, which were used to repay their high levels of debt.

Copper: COVID or Not, It Wasn’t Always Like This for China

China’s manufacturing and construction sectors initially posted a strong recovery from the COVID-19 crisis some six months after the pandemic broke out in the world’s second-largest economy.

Chinese factory activity in August 2020 reached its highest level in nine years, triggering a powerful comeback rally in copper, which sees nearly half of its global demand in China alone.

Futures of copper, which fell to an 11-year low of beneath $2 per pound in March 2020 during the height of the COVID outbreak in China, experienced one of their longest winning streaks after that, reaching a record high of $5.04 by March 2021 despite some intermittent losses.

But from there, relapses in the pandemic’s outbreak in China and Beijing’s return to heightened caution over the virus took both copper demand and prices steadily lower. In Friday’s session on New York’s Comex, benchmark US copper futures fell to a five-month low of $3.68 per pound.

In terms of actual purchases, China’s purchase of copper has dropped to its lowest since October. Imports in the first four months are lagging 13% behind the pace set in 2022, a year that saw copper purchases boom despite generally weaker demand for other commodities.

Despite the gloom for the metal, Asia’s copper industry gathers in Hong Kong next week for the first London Metal Exchange in person-meeting in that part of the world since the pandemic struck three years ago.

According to a Bloomberg report, more than a thousand executives, traders, bankers, and analysts will be attending to chew over the latest industry news and wine and dine old friends in the city’s bars and restaurants.

Copper: Where to From Here?

US Copper Weekly Chart

US Copper Weekly Chart

US copper futures are approaching the 50-month Exponential Moving Average, or EMA, of $3.65, as well as the 200-week Simple Moving Average, or SMA, of $3.59, where some minor support may be witnessed, causing a rebound, said Sunil Kumar Dixit, chief technical strategist at SKCharting.com.

“On the way to any small recovery from this support zone, the 200-day SMA of $3.80 will be initial resistance,” said Dixit. “If this is cleared with a day close above the zone, the next challenge will be the 50-day EMA of $3.95, followed by the 100-day SMA of $4.02.”

US Copper Monthly Chart

US Copper Monthly Chart

On the flip side, if copper continues its tumble, sustaining below the 200-week SMA of $3.59 with a weekly close below that zone, a further drop can be witnessed, as support at the 200-month SMA of $3.18 beckons, followed by the 100-month SMA of $3.08, Dixit said.

He said the weekly Relative Strength Index, or RSI, at 41 was below neutrality, while Stochastics at 5/12 indicated oversold conditions.

“Whatever the case, copper’s technical bias suggests it will continue its downward march, so as long as prices sustain below $3.80 and do not cross $4.10.”

***

Disclaimer: The content of this article is purely to educate and inform and does not in any way represent an inducement or recommendation to buy or sell any commodity or its related securities. The author Barani Krishnan does not hold a position in the commodities and securities he writes about. He typically uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables.

Source: Investing.com