Wednesday, 01 July 2015 18:27

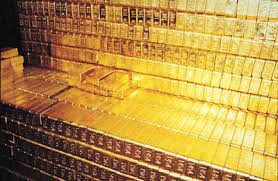

LONDON: Gold hovered above a near-four-week low on Wednesday, in reaction to a stronger dollar and hopes of progress in the Greek debt crisis after the country said it is willing to accept a deal on offer from its international creditors with some amendments.

LONDON: Gold hovered above a near-four-week low on Wednesday, in reaction to a stronger dollar and hopes of progress in the Greek debt crisis after the country said it is willing to accept a deal on offer from its international creditors with some amendments.

The Greek situation has failed to spark robust safe-haven bids for gold, with bullion investors still focused on an expected increase in US interest rates after more strong economic data.

“It’s not clear whether it’s good for gold because people think the dollar might rally and institutional investors are less interested in the gold market,” Macquarie analyst Matthew Turner said.

“Everyone says this crisis should be good for gold, but no one has made a convincing case on who should be buying gold … Greeks are going to hold euros.”

Spot gold was unchanged at $ 1,172.15 an ounce at 1155 GMT.

It had touched its lowest since June 5, at $ 1,166.35, in the previous session.

US gold futures for August delivery were flat on the day at $ 1,171.40 an ounce.

Greece made last-minute overtures to its international creditors on Tuesday, but it was not enough to save the country from becoming the first developed economy to default on an IMF loan.

There is still scope for the crisis to drive more risk-averse money into gold if it worsens to the point where Greece leaves the euro zone, or if there is contagion into other economies in the bloc, such as Italy, Portugal or Spain, traders said.

The dollar rose 0.4 percent against a basket of currencies, mostly because of euro weakness.

The US Federal Reserve is on track to raise interest rates this year, with September still “in play”, a top central bank official said on Tuesday, despite growing market volatility and anxiety in the wake of Greece’s debt default.

Data on Tuesday showed that US consumer confidence increased in June, supporting expectations that the Fed is on track to increase rates this year.

Higher interest rates would dent demand for non-yielding gold.

Among other precious metals, silver fell 1 percent to $ 15.59 an ounce. Palladium rose 4 percent to a session high of $ 700 and platinum was up 0.7 percent at $ 1,082.45.