VWAGY

-1.25%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

BMWYY

-0.28%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

STLA

-1.75%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

Volkswagen reported earnings on May 4, beating expectations

In this piece, we will take a closer look at the German automaker’s financials

Using InvestingPro tools, we will also see whether the stock is worth buying at current valuations

German automakers have been omnipresent in the global automotive industry for several decades. Among them is Volkswagen (OTC:VWAGY), which released its quarterly earnings on May 4, surpassing analyst expectations.

Let’s take a deep dive into the company’s financials, analyzing its performance and key factors to consider when assessing its future growth potential.

From sales trends to balanced current assets, we will examine the company’s financials, ratings, and valuations to shed light on the German automaker’s standing among its peers.

InvestingPro tools make this process a breeze. You can do the same for virtually any stock, just click on this link and start your free trial today!

What Does the Company Do?

To get started, we need to know exactly what the Germany-based automaker does to make money. Well, it manufactures and sells vehicles across four segments: Passenger Cars, Commercial Vehicles, Power Engineering, and Financial Services.

The company’s operations encompass vehicle and engine development, production and sales of passenger cars, original parts business, as well as light commercial vehicles, trucks, and buses.

Additionally, Volkswagen is involved in the development and production of large diesel engines, turbochargers, industrial turbines, chemical reactor systems, gearboxes, propulsion components, and testing systems.

Their brand portfolio includes Volkswagen, Audi, SEAT, SKODA, Bentley, Bugatti, Lamborghini, Porsche, Ducati, Volkswagen Commercial Vehicles, Scania, and MAN.

Financials at a Glance

Let’s start with the historical financial statements, which provide several useful insights.

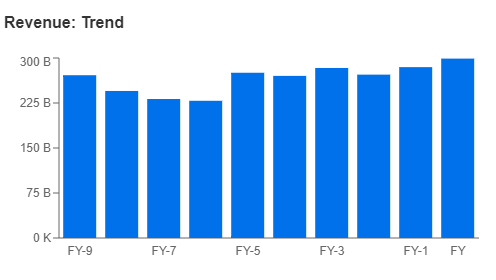

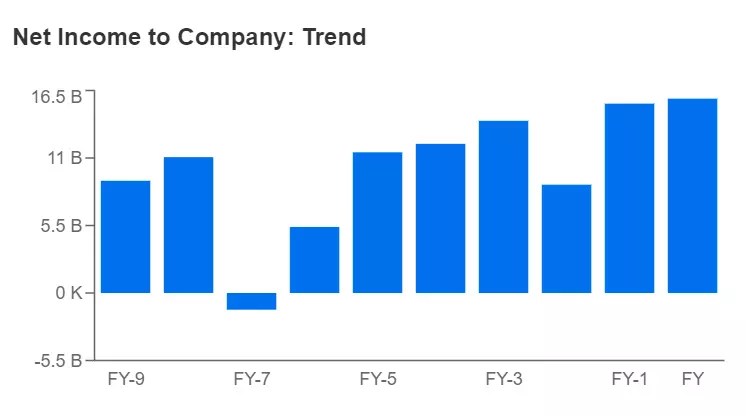

The automaker’s sales have trended up over time, with profits showing a similar but more volatile trend. Nevertheless, margins have been consistent even in the pandemic and post-pandemic periods, between 15 and 18%, which is typical for automakers, which have lower margins compared to technology companies.

Revenue Trend

Revenue Trend

Source: InvestingPro

Net Income to Company Trend

Net Income to Company Trend

Source: InvestingPro

Gross Profit Margins Trend

Gross Profit Margins Trend

Source: InvestingPro

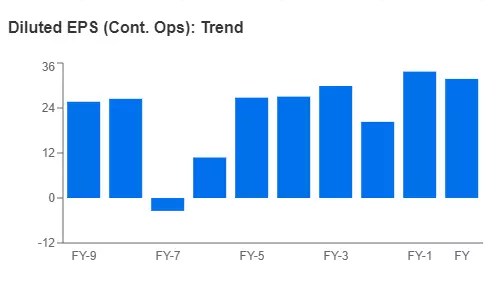

The company has achieved a positive annual growth rate of 5% in diluted earnings per share (EPSd) over the last 10 years. This indicates a positive trend, although there have been ups and downs in some years, including the pandemic year.

It is crucial to assess whether the company can continue to increase this growth at an attractive pace. It remains to be seen how Volkswagen will improve its standing among its peers and handle potential fluctuations in profit growth.

Diluted EPS Trend

Diluted EPS Trend

Source: InvestingPro

Balance Sheet and Cash Flows

Volkswagen holds over $59 billion in cash and short-term investments, contributing to total current assets of around $240 billion. This indicates a favorable short-term balance when compared to current liabilities, which amount to around $195 billion.

However, it’s worth noting that the company’s debt-to-equity ratio is unbalanced at 1.14. This is a cause for concern, as excessive debt can impact corporate balance sheets.

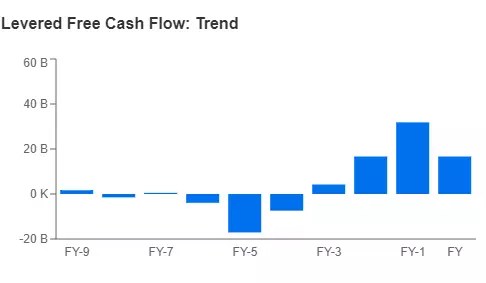

In terms of cash flow, both operating cash flow and free cash flow exhibit fluctuating trends, often influenced by diluted EPS, sometimes leading toward negative.

Levered Free Cash Flow

Levered Free Cash Flow

Source: InvestingPro

The company’s Free Cash Flow (FCF) stands at around $16.6 billion (latest available), resulting in a commendable return of about 20%. This is considered excellent, as the average level of profitability typically ranges between 8-10%. Therefore, Volkswagen has demonstrated strength in this metric.

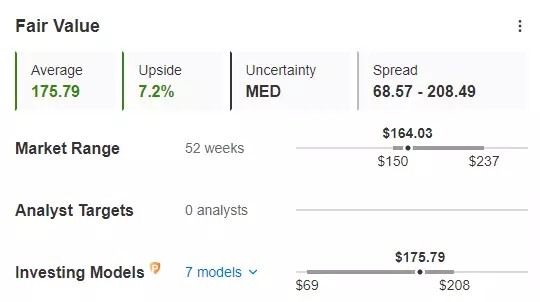

Fair Value

Moving on to valuations, the current stock price of 164 reflects a mere 7.2% discount to its fair value, which is estimated to be around 175.79 per share based on the average of 7 different mathematical models, according to InvestingPro. Thus, the room for stock price growth is relatively low.

However, it’s important to keep a close eye on the company’s fundamentals. The automotive industry is highly competitive, and I don’t see significant signs of diversification that could improve the company’s position.

Fair Value Estimate

Fair Value Estimate

Source: InvestingPro

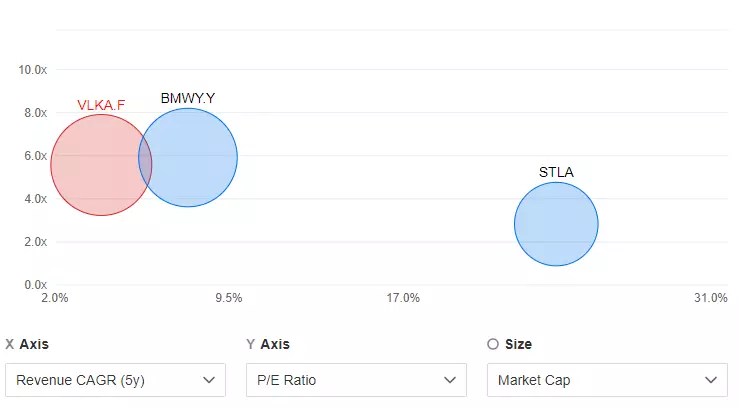

Here is a comparison with its fellow competitors. Volkswagen is priced similarly to other automakers in terms of valuations. However, it has lower growth rates compared to the likes of Stellantis NV (NYSE:STLA) or Bayerische Motoren Werke (OTC:BMWYY).

Peer Comparison

Peer Comparison

Source: InvestingPro

As we look ahead to the future, I believe investors who intend to buy it for the medium- to long-term should seek a greater discount on these valuations.

As you saw in this article, with InvestingPro, you can conveniently access comprehensive information and outlook on a company in one place, eliminating the need to gather data from multiple sources such as SEC filings, company websites, and market reports.

In addition to analyst targets, InvestingPro provides a single-page view of complete information, saving you time and effort.

You can use InvestingPro tools to analyze the companies you are investing in or considering investing in and benefit from analyst opinions and up-to-date forecasts calculated using dozens of models.

Start your InvestingPro free 7-day trial now!

Find All the Info you Need on InvestingPro!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remain with the investor.

Source: Investing.com