WMT

+0.18%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

KR

-3.25%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

CAG

+0.32%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

C1AG34

0.00%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

US10Y…

-1.35%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

US3MT=X

-0.37%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

HRL

+0.60%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

K

-0.38%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

US500

+1.30%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

JNJ

-0.04%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

GWW

+0.70%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

SHW

+1.16%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

CPB

+0.10%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

ADI

+2.40%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

GIS

-0.39%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

The US economy’s chances of entering a recession are on the rise

While the economy may or may not enter a recession, investors would be wise to add recession-resistant stocks to their portfolios

In this piece, we will discuss stocks that posted double-digit gains in the last 5 economic recessions

According to Factset, about 95% of the companies listed on S&P 500 have reported their results, and 78% of them have exceeded market expectations.

Profits are down 2.2% compared to the first quarter of last year, but this is much better than the 6.6% drop that was expected. Moreover, all 11 sectors performed better than expected, with Tech dominating.

This is good news, but we have to address the elephant in the room: a real recession.

A recession is a negative change in gross domestic product for two consecutive quarters. The causes are linked to the fluctuation in inflation, which restricts households’ purchasing power.

However, it is not the same as an economic crisis. It refers to a prolonged period of instability that has long-term consequences.

The economy goes through a significant downturn, which can be considered the intermediate point between a recession and an economic depression.

And why am I saying there is a high probability of economic recession in the US?

Because one of the most reliable tools used by the Federal Reserve Bank of New York, which analyzes the spread between 3-month and 10-year Treasury bond yields to predict the probability of a recession in the United States in the next 12 months, indicates so.

Just recently, the 3-month and 10-year bonds experienced the largest yield curve inversion in more than 40 years. In the last 57 years, there have been 8 occasions in which the New York Federal Reserve recession indicator exceeded 40%.

In that time, it has never been wrong, and at this time, it suggests a recession probability of 68.22%, the highest level in 42 years.

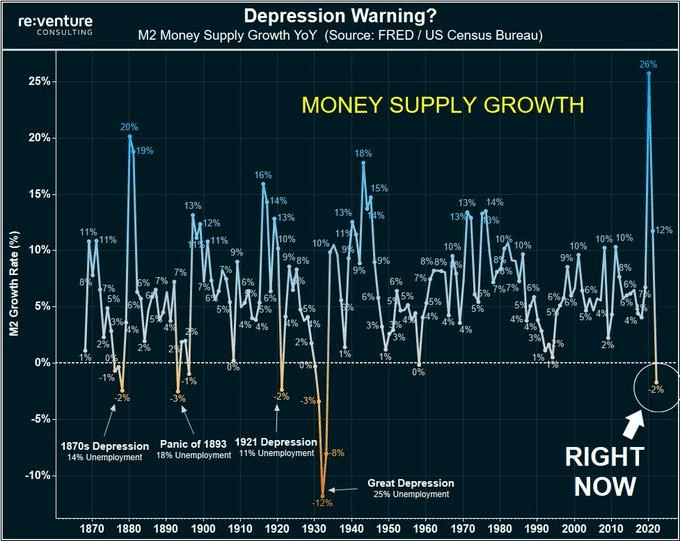

Money Supply Growth

Money Supply Growth

Source: Venture Consulting

So, investors are looking to ride out the recession with stocks that generally do well during recessions. This article will discuss stocks that have performed much better than the S&P 500 during the last 5 recessions.

We are going to use the InvestingPro tool to analyze these stocks.

Walmart

Walmart (NYSE:WMT) performs well during recessions. When times are bad, people flock to establishments where they can buy almost anything at a lower price.

Its shares have risen by +39.5% on average in the last 5 recessions (in 2007, they rose +1.12% when the S&P 500 plunged -38%).

The company will distribute dividends on January 2.

Walmart Dividend Payouts

Walmart Dividend Payouts

Source: InvestingPro

The retailer reports earnings on August 17, which are expected to be better than the previous ones.

Walmart Upcoming Earnings

Walmart Upcoming Earnings

Source: InvestingPro

According to InvestingPro, the average analyst target for the stock is $165.71.

Walmart Analyst Targets

Walmart Analyst Targets

Source: InvestingPro

Walmart has 31 Buy ratings, 10 Hold, and 0 Sell.

Walmart Pro News

Walmart Pro News

Source: InvestingPro

Barclays maintains Walmart at ‘overweight’ with a price target of $162.

Walmart Daily Chart

Walmart Daily Chart

Technically speaking, the stock could not break through the strong resistance at $153.69.

Kroger

Headquartered in Cincinnati, Kroger (NYSE:KR) has performed very well during the last 5 recessions, rising by 22.7% on average.

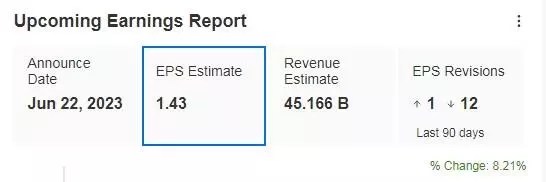

Kroger Upcoming Earnings

Kroger Upcoming Earnings

Source: InvestingPro

On June 22, the retail giant will report earnings and is expected to report earnings per share (EPS) of $1.43.

Kroger

Kroger

Source: InvestingPro

InvestingPro models give it a potential target of $66.12.

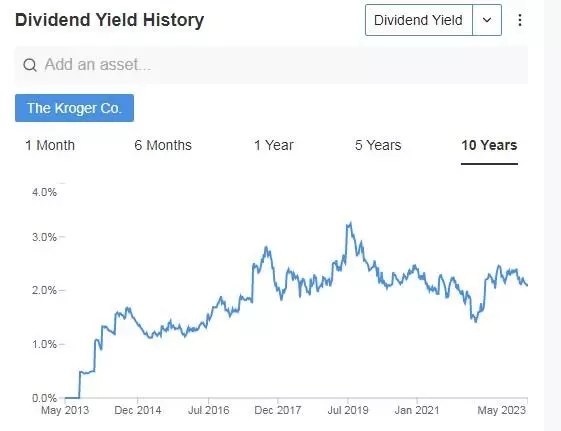

You can see the dividend yield history here:

Kroger Dividend Yield History

Kroger Dividend Yield History

Source: InvestingPro

Technically speaking, it has tried to overcome its resistance at $50.35 several times, but without any success.

Kroger Daily Chart

Kroger Daily Chart

Other Stocks Doing Well During Recessions

Here’s a list of stocks that performed well during the past five recessions and their average yields. Check it out.

Analog Devices (NASDAQ:ADI) +21.8%.

Sherwin-Williams (NYSE:SHW) +20.1%

General Mills (NYSE:GIS) +16.8%

Hormel Foods (NYSE:HRL) +16,1%

Johnson & Johnson (NYSE:JNJ) +15.8%

Conagra Brands (NYSE:CAG) +15.6%

Campbell Soup (NYSE:CPB) +13%

W.W. Grainger Inc (NYSE:GWW) +11,7%

Kellogg (NYSE:K) +11.4%

With InvestingPro, you can conveniently access comprehensive information and outlook on a company in one place, eliminating the need to gather data from multiple sources such as SEC filings, company websites, and market reports.

In addition to analyst targets, InvestingPro provides a single-page view of complete information, saving you time and effort.

Start your InvestingPro free 7-day trial now!

Find All the Info you Need on InvestingPro!

Disclaimer: This article was written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel, or recommendation to invest, nor is it intended to encourage the purchase of assets in any way.

Source: Investing.com