META

-0.45%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

NVDA

-0.40%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

FLRA

-0.16%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

FMET

-0.32%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

METV

+0.20%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

VCAR

-0.10%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

WUGI

-0.19%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

USD

-2.58%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

SMH

-1.25%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

Nvidia and Meta’s stocks have skyrocketed this year

Investors looking to gain from Meta and Nvidia’s rallies have plenty of ways to do so

And low-cost ETFs are one of the best options out there

S&P 500’s surge can be largely attributed to the dominance of technology companies, with 70% of the top 10 companies belonging to this sector. This dominance is fueled by two key factors:

The rapid expansion of artificial intelligence.

The potential peaking of interest rates.

In a striking resemblance to the 1970s, the top 10 companies in the S&P 500 now command an impressive 29% of the index’s weight.

Among the top-weighted companies in the S&P 500, Exxon Mobil Corp (NYSE:XOM) and UnitedHealth Group Incorporated (NYSE:UNH) have experienced declines of -2.6% and -4% respectively this year.

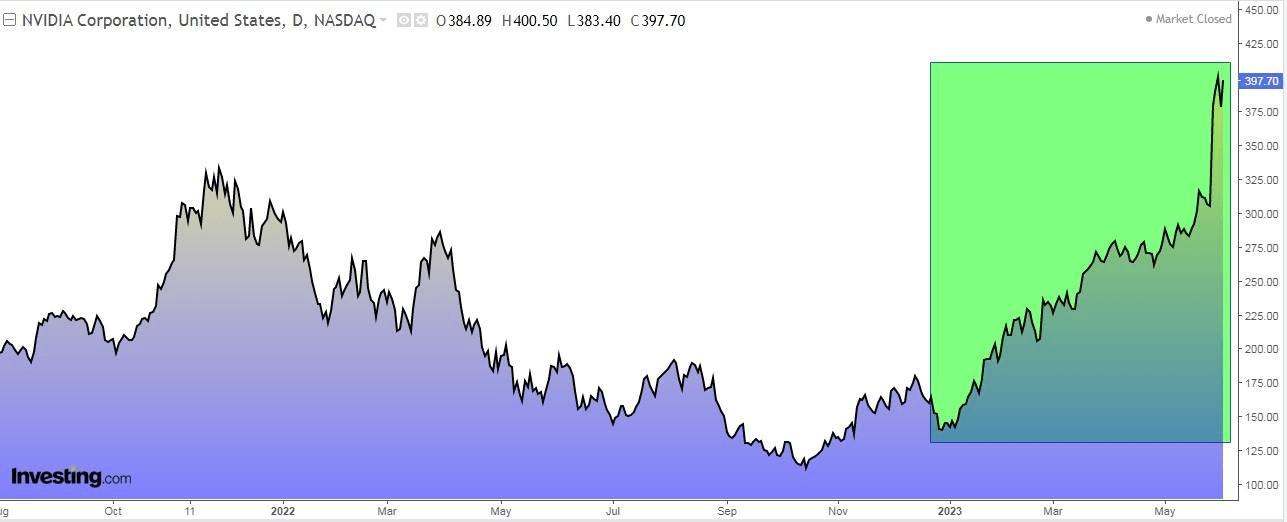

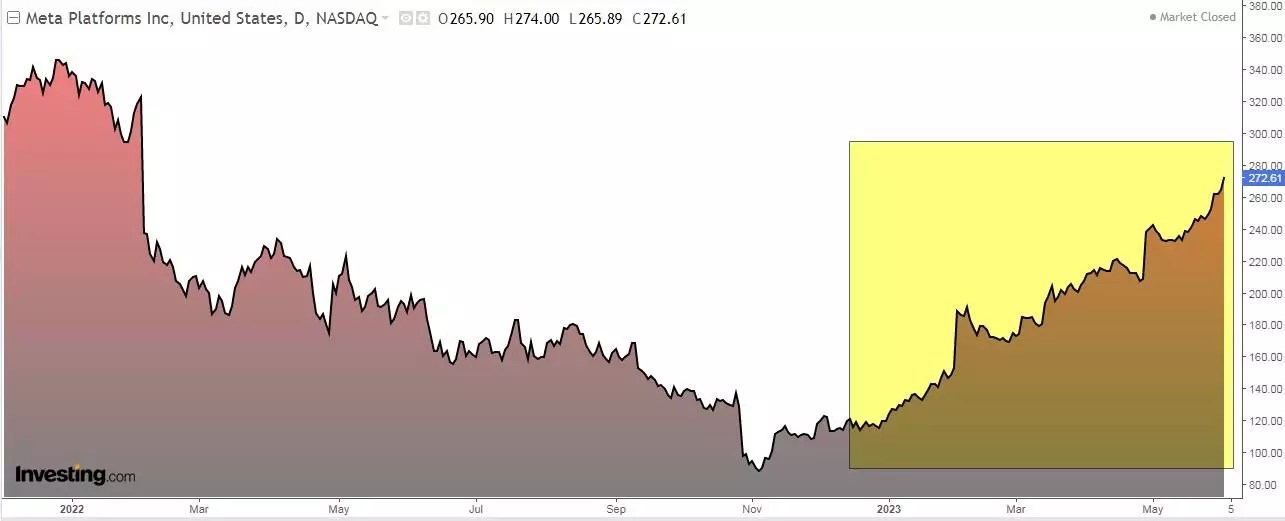

However, two stocks stand out with remarkable growth: Nvidia (NASDAQ:NVDA), which has skyrocketed by +169% in 2023, and Meta (NASDAQ:META), which has surged by +126.5% after facing a -64% decline last year.

Time will tell if it is too late to invest in these stocks, but there are multiple ways to do so if you want to capitalize on the AI and metaverse frenzy.

4 ETFs With High Exposure to Nvidia

Nvidia stock is feeding off the AI boom, as the company specializes in designing chips and software that power AI applications.

Moreover, Nvidia’s growth projections are impressive, with market estimates of earnings of $7.76 per share for the fiscal year. This represents a remarkable increase of +132% compared to the previous fiscal year.

NVIDIA Daily Chart

NVIDIA Daily Chart

There are two options for those who wish to have exposure to Nvidia. The first one is obvious, by buying shares of the company.

The second choice is ETFs. There is a wide range of these investment vehicles with good exposure to the company. I will leave you 4 examples, along with their commission and their profitability so far in 2023:

ProShares Ultra Semiconductors (NYSE:USD): +122% (fee 0.95%, exposure 25%).

VanEck Semiconductor (NASDAQ:SMH): +42% (fee 0.35%, exposure 17%).

AXS Esoterica NextG Economy (NYSE:WUGI): +40.5% (commission 0.75%, exposure 17%).

Simplify Volt RoboCar Disruption and Tech (NYSE:VCAR): +40% (commission 0.95%, exposure 13%).

3 Ways to Take Advantage of the Metaverse Craze

Meta, formerly known as Facebook, represents the forefront of the metaverse sector, reflecting its recent name change. The stock’s rally so far indicates investors’ faith in the metaverse sector.

Meta Daily Chart

Meta Daily Chart

But, buying Meta stock is not the only way you can invest in the metaverse. Here are 3 ETFs you can consider instead:

Roundhill Ball Metaverse ETF (NYSE:METV): This ETF, launched in 2021, tracks the Ball Metaverse Index. It comprises 40 companies, providing exposure to the metaverse sector. Around 80% of its holdings are based in the United States, with the remaining 20% in Asia.

Franklin Metaverse (ETR:FLRA): This ETF follows the Solactive Global Metaverse Innovation Net Return index, which includes companies with significant involvement in the metaverse and technology. It is listed on the German, Italian, and London stock exchanges. Notably, it boasts a low expense ratio of only 0.3%, which is half the industry average for this sector.

Fidelity® Metaverse ETF (NASDAQ:FMET): This ETF focuses on companies involved in the development, manufacturing, distribution, and sale of products or services related to the metaverse. It offers a reasonable fee of 0.5% for investors.

How Will U.S. Stocks Fare This June?

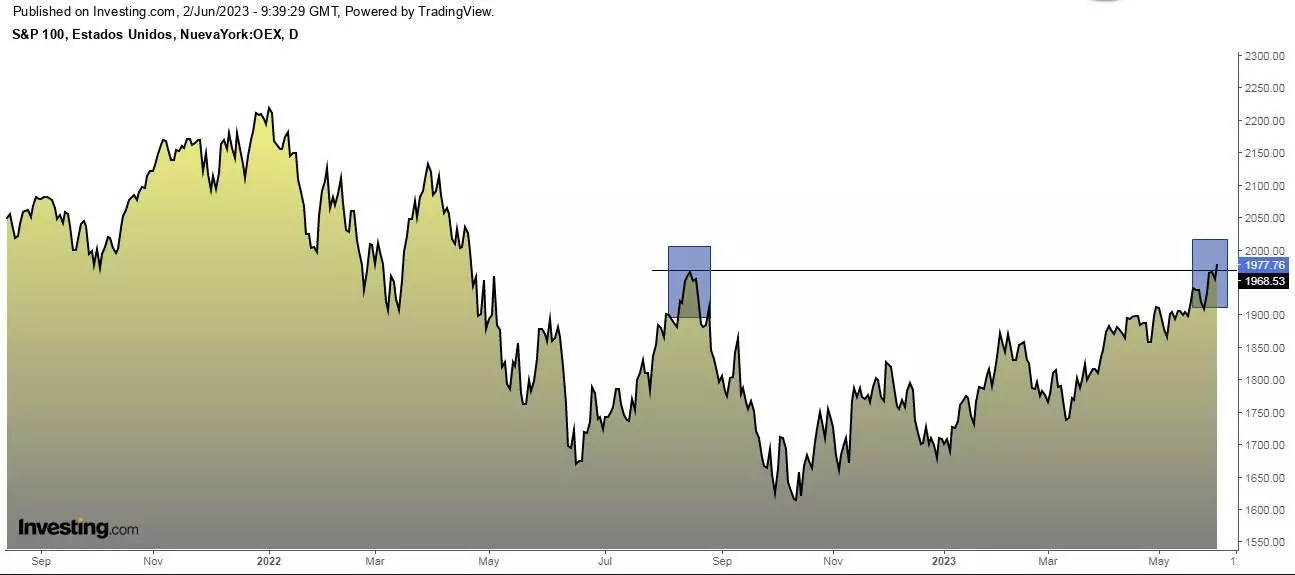

The S&P 500 rose +0.25% in May. The index has risen in 10 out of the past 11 Mays, but gains have been minimal in the past two years, with only a +0.01% increase in May 2022 and +0.25% this year.

Nvidia powered a 9% rally in the technology sector, while the communication and consumer sectors also showed strong performance. However, other sectors experienced declines.

As we enter June, historical data reveals an average rise of +0.03% over the past 72 years, positioning it as the 4th weakest month in terms of profitability, consistent with the trend observed in the last 10 years.

When examining the past 20 years, June ranks as the 3rd worst month, trailing only January and September.

Nevertheless, there is some consolation in the fact that during pre-election years, June has recorded an average increase of +1.5%, outperforming most other months.

S&P 100 Daily Chart

S&P 100 Daily Chart

While the S&P 100 reached a new 52-week high last week, the Russell 2000 remains 12% below its 52-week high.

But, there’s another development. There is a historic divergence forming between Nasdaq 100 and Dow Jones Industrial Average.

The Nasdaq 100 continues to outperform the Dow Jones by a considerable margin this year. In May alone, the Nasdaq surged by +5.8%, whereas the Dow Jones declined by -3.5%.

This represents a substantial gap of 9.29 percentage points, ranking as the 9th largest disparity in history between these two indexes.

The following chart visually depicts the comparison between the Nasdaq 100 and Dow Jones indexes, illustrating their contrasting trajectories.

Nasdaq 100 Vs. DJIA

Nasdaq 100 Vs. DJIA

It is worth noting that the previous eight instances occurred within a span of 35 months, specifically from December 1998 to October 2001.

In contrast, the three sectors that performed the worst in 2022, namely communications, consumer, and technology, have emerged as the top performers in 2023. Conversely, the energy sector, which was the leading sector in 2022, has experienced a decline of -9% this year.

Investor sentiment (AAII)

Bullish sentiment, i.e., expectations that stock prices will rise over the next six months, increased by 1.7 percentage points to 29.1%. However, bullish sentiment remains below its historical average of 37.5%.

Bearish sentiment, i.e., expectations that stock prices will fall over the next six months, decreased 2.9 percentage points to 36.8%. Bearish sentiment remains above its historical average of 31%.

Here’s how the major U.S. and European stock markets are doing so far in 2023:

NASDAQ Composite +26.51%

Japanese Nikkei +23.46%

German Dax +15.46%

FTSE MIB Italian +14.18%

Euro Stoxx 50 +13.97%.

Ibex 35 +13.22% +13.22

French Cac +12.31%

S&P 500 +11.53%

British FTSE 100 +2.095

Dow Jones +1.86%

InvestingPro tools assist savvy investors in analyzing stocks. By combining Wall Street analyst insights with comprehensive valuation models, investors can make informed decisions while maximizing their returns.

Start your InvestingPro free 7-day trial now!

Find All the Info you Need on InvestingPro!

Disclaimer: This article was written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel, or recommendation to invest, nor is it intended to encourage the purchase of assets in any way.

Source: Investing.com