Friday, 10 July 2015 17:44

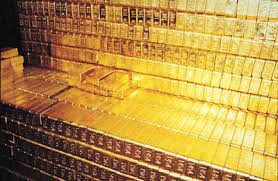

LONDON: Gold scaled higher on Friday, further off a four-month low, as the dollar tumbled against the euro on signs of progress in Greece’s efforts to secure fresh funding.

LONDON: Gold scaled higher on Friday, further off a four-month low, as the dollar tumbled against the euro on signs of progress in Greece’s efforts to secure fresh funding.

Spot gold was up 0.2 percent at $ 1,161.11 an ounce by 1219 GMT. Prices touched $ 1,146.75 on Wednesday, their lowest since March 18, when the dollar was boosted by weakness in the euro on Greece and the tumble in Chinese stock markets.

US gold for August delivery was unchanged at $ 1,159.60 an ounce.

The euro climbed 1.5 percent against the dollar, making dollar-denominated assets such as gold cheaper for buyers using other currencies.

“Gold is getting some support from the stronger euro but if we get a deal with Greece on Sunday, it should be bearish for gold because it removes any risk,” Societe Generale analyst Robin Bhar said.

“The major driver is the US because we have Yellen speaking today and markets will be watching that for any clues about the rate hike.”

Federal Reserve Chair Janet Yellen will speak on Friday on the US economic outlook at 1630 GMT.

“No doubt, gold has been a profound disappointment for the bulls over the past few months to see repeated rallies fizzle,” INTL FCStone analyst Edward Meir wrote.

Physical demand remained tepid this week as prospective investors in China chased bargains in equities after a market rout, while those in India delayed purchases.

The metal in India was still sold at a discount to the global benchmark.

Chinese stocks rose sharply for a second day on Friday after Beijing moved to arrest a rout that pulled down key indexes by around 30 percent from mid-June, banning shareholders with large stakes in listed firms from selling. Also aiding gold, the International Monetary Fund trimmed its forecast for global economic growth this year to 3.3 percent from a previous estimate of 3.5 percent, citing recent weakness in the United States.

Silver was up 0.2 percent at $ 15.39 an ounce, palladium rose 1.2 percent to $ 645 an ounce and platinum gained 0.6 percent to $ 1,027 an ounce, slightly rebounding from a 6-1/2 year low near $ 1,000 hit on Wednesday.