InvestingPro is your one-stop shop for analyzing a stock

The unique tool provides access to a sea of data

You can start using this tool today, just sign up here and start your free trial today!

Since the expansion of the Internet, investing in the stock market is no longer reserved for the elite.

Anyone with a smartphone or a computer connected to the Internet can invest in stocks or assets worldwide.

Undoubtedly, this new era of finance has democratized stock market investment to a great extent, but it has also ‘trapped’ many people without adequate financial knowledge due to bad investment decisions.

To avoid these bad decisions as much as possible, we can use certain tools that help optimize investment decision-making.

Thus, when it comes to fundamental analysis, one of the best tools currently available is InvestingPro: a platform that provides retail investors worldwide access to the same data that the world’s largest investment banks and money managers rely on.

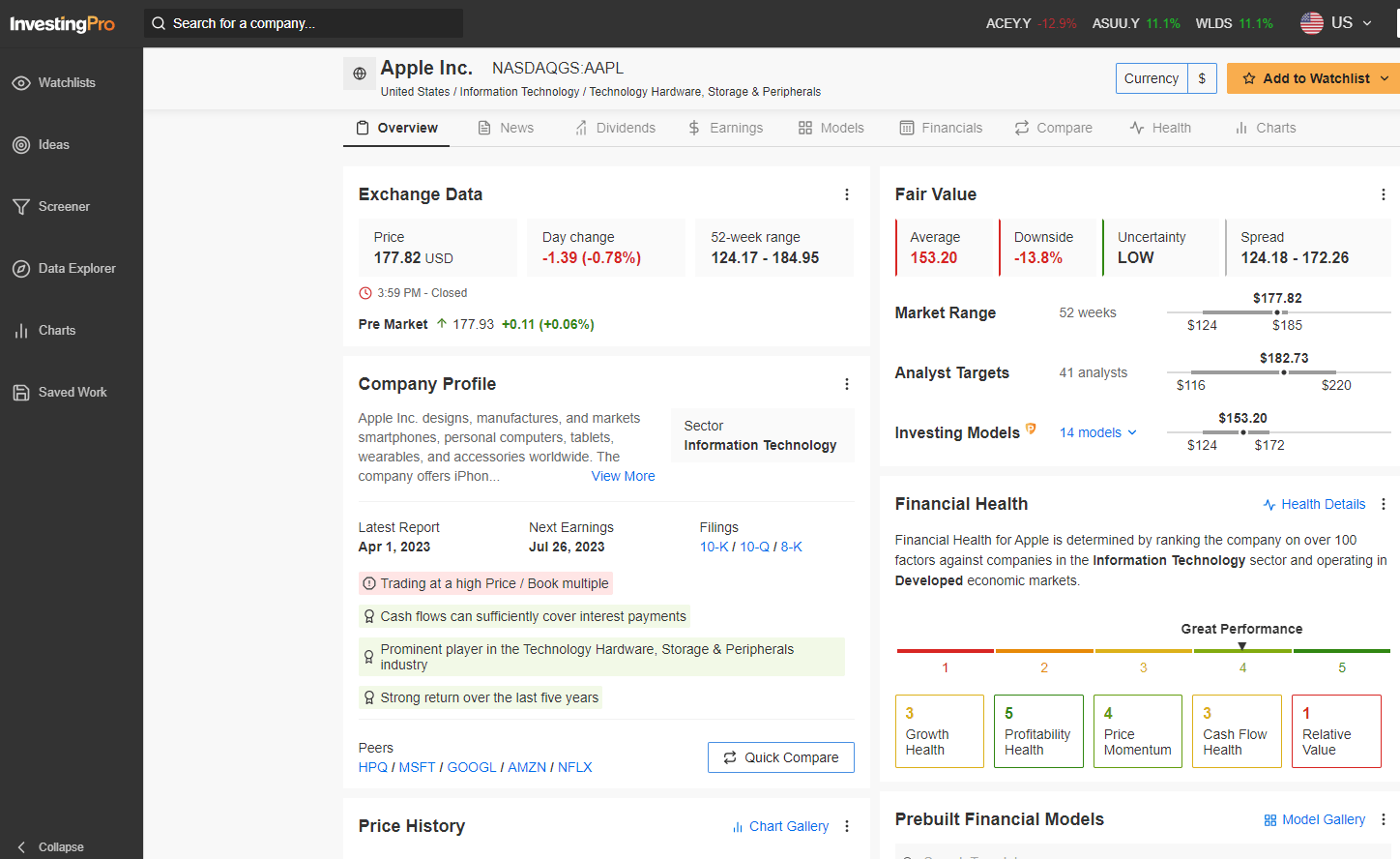

InvestingPro Tool

InvestingPro Tool

Source: InvestingPro

What’s So Special About InvestingPro?

InvestingPro’s greatest strength lies in its extensive coverage of over 60,000 financial instruments worldwide. However, its most valuable feature is the assistance it provides in analyzing stocks through fully customizable professional data.

To accurately assess its value, InvestingPro provides a comprehensive analysis of a company’s financial health, including the past 10 years of balance sheets and over 1,000 metrics.

All this without forgetting exclusive data such as the fair value of a stock, a company’s financial health, predefined stock search strategies, or investment ideas from the most successful investors in the world, such as Warren Buffett or Carl Icahn.

And all of this can be customized down to the last comma.

Key Points for Analyzing a Stock

Having seen some of the main features of InvestingPro, let’s focus on what to look for when analyzing a stock using this tool:

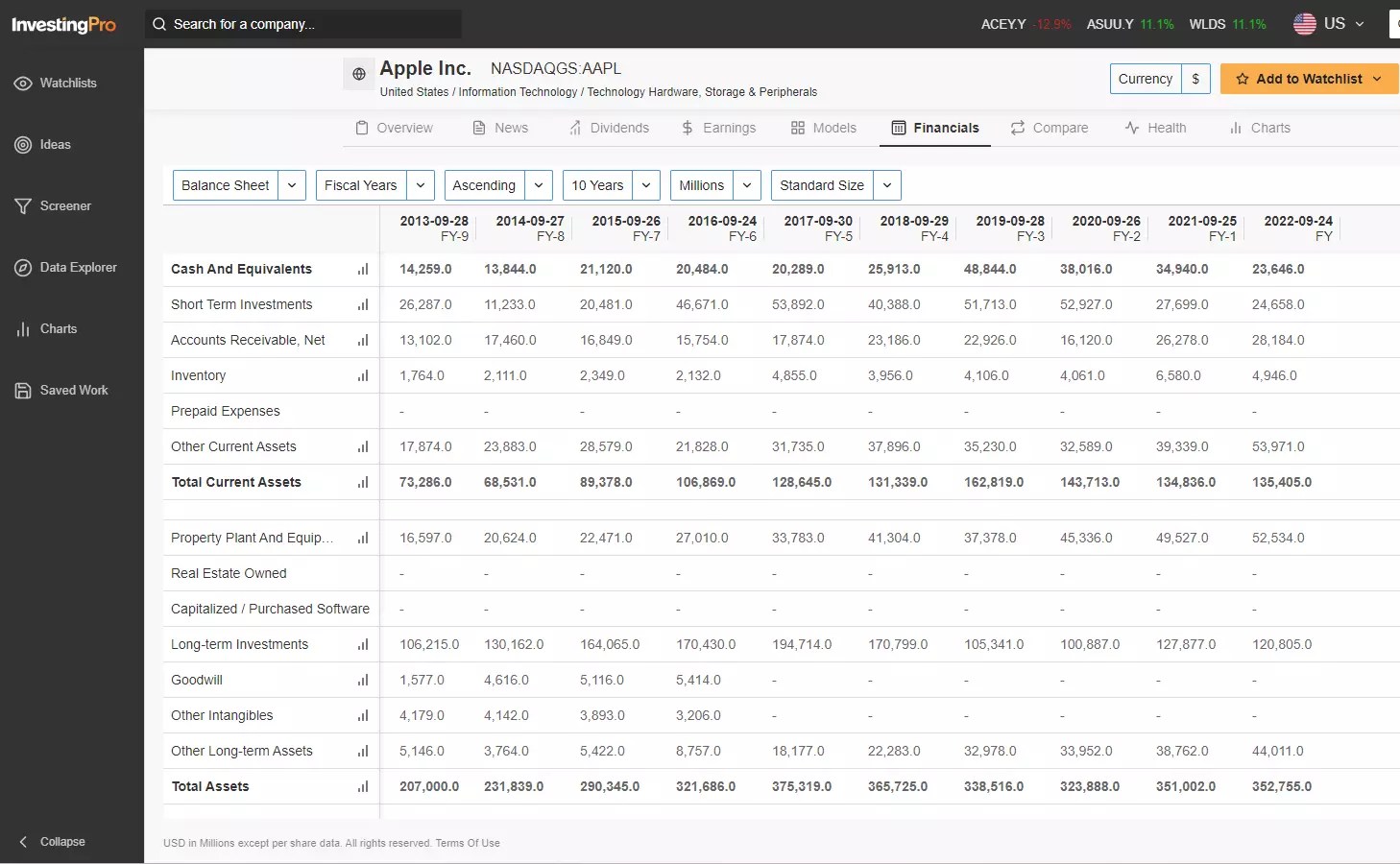

1. Balance sheet, cash flow, and income statement

These 3 documents are fundamental for an investor and are vital when evaluating a company.

It is the picture or the true image of the company at a given time. It shows us the difference between assets and liabilities, in addition to its capital or equity.

Balance Sheet

Balance Sheet

Source: InvestingPro

PRO TIPS:

The income statement, like the cash flow statement, is a flow, so it doesn’t make much sense to analyze it only over the last year as it gives us little information.

It is much better to compare it with other historical periods, such as, for example, the last 3 or 4 years. The more historical data we have, the better (with InvestingPro, you can analyze up to the last 10 years).

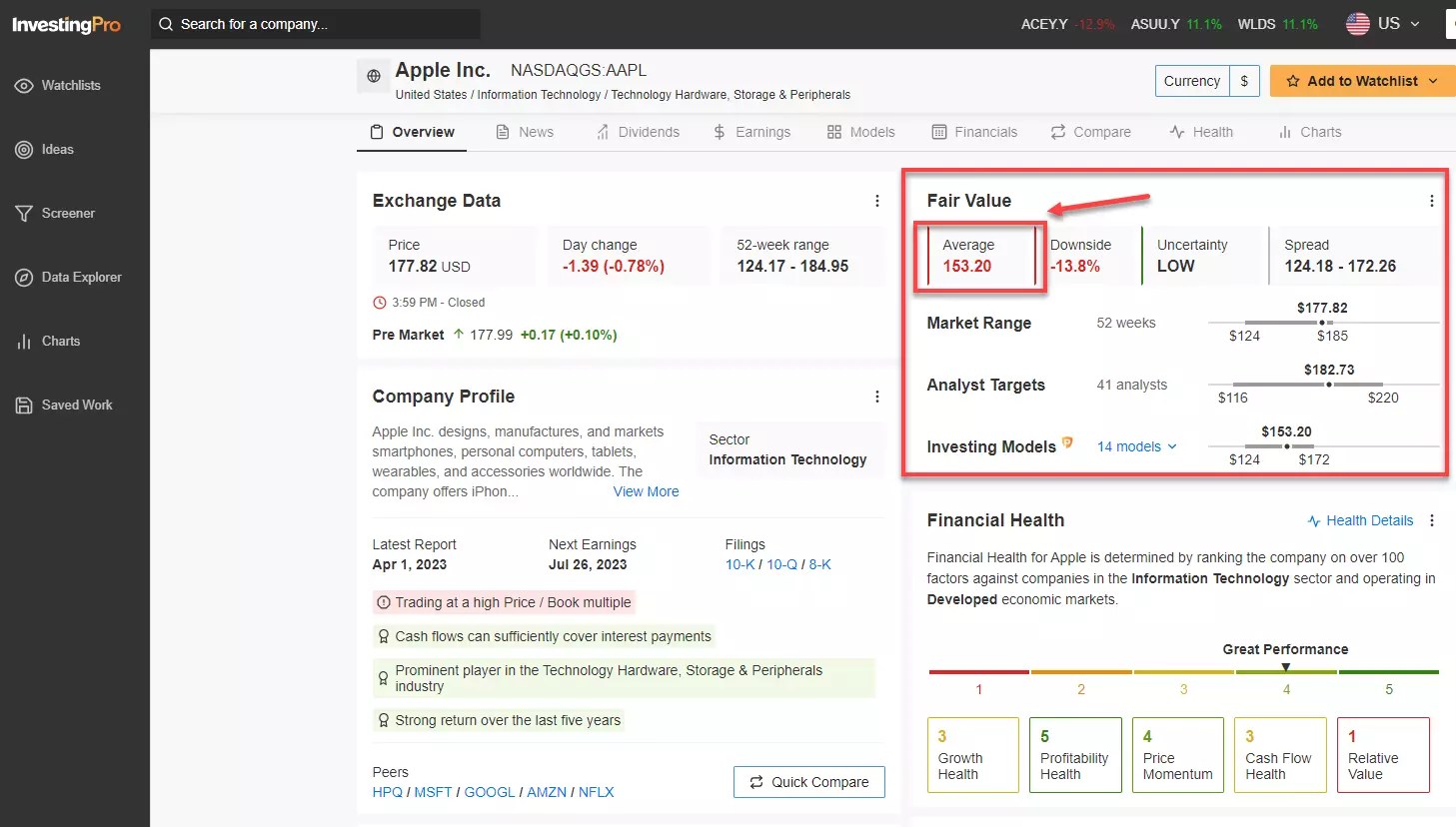

2. Fair value: Know what the company is worth

The fair value is an essential indicator that shows us the overvaluation or undervaluation in relation to the market price.

In this sense, the fair value of a share is its real or underlying intrinsic value. It is an unbiased estimate of the potential market price and is useful in fundamental analysis to estimate the value of a company based on future cash flows.

OK but… How is it calculated?

InvestingPro’s fair value uses financial modeling techniques to determine the value of stocks worldwide and estimate their fair value.

These models are similar to what an analyst at an investment bank or equity research firm would spend their day building.

InvestingPro’s technology also allows you to identify companies that investors might overlook (undervalue) or overvalue because of fads (overvalue) based on these fair value estimates.

With fair value, you can easily and quickly check that particular stock’s average target price, potential upside, and uncertainty.

Apple Fair Value Example

Apple Fair Value Example

Source: InvestingPro

PRO TIP:

Add your portfolio or tracked stocks into a custom list and sort your stocks by fair value. You can see the stock’s appreciation options and its ability to generate income with diversified portfolios.

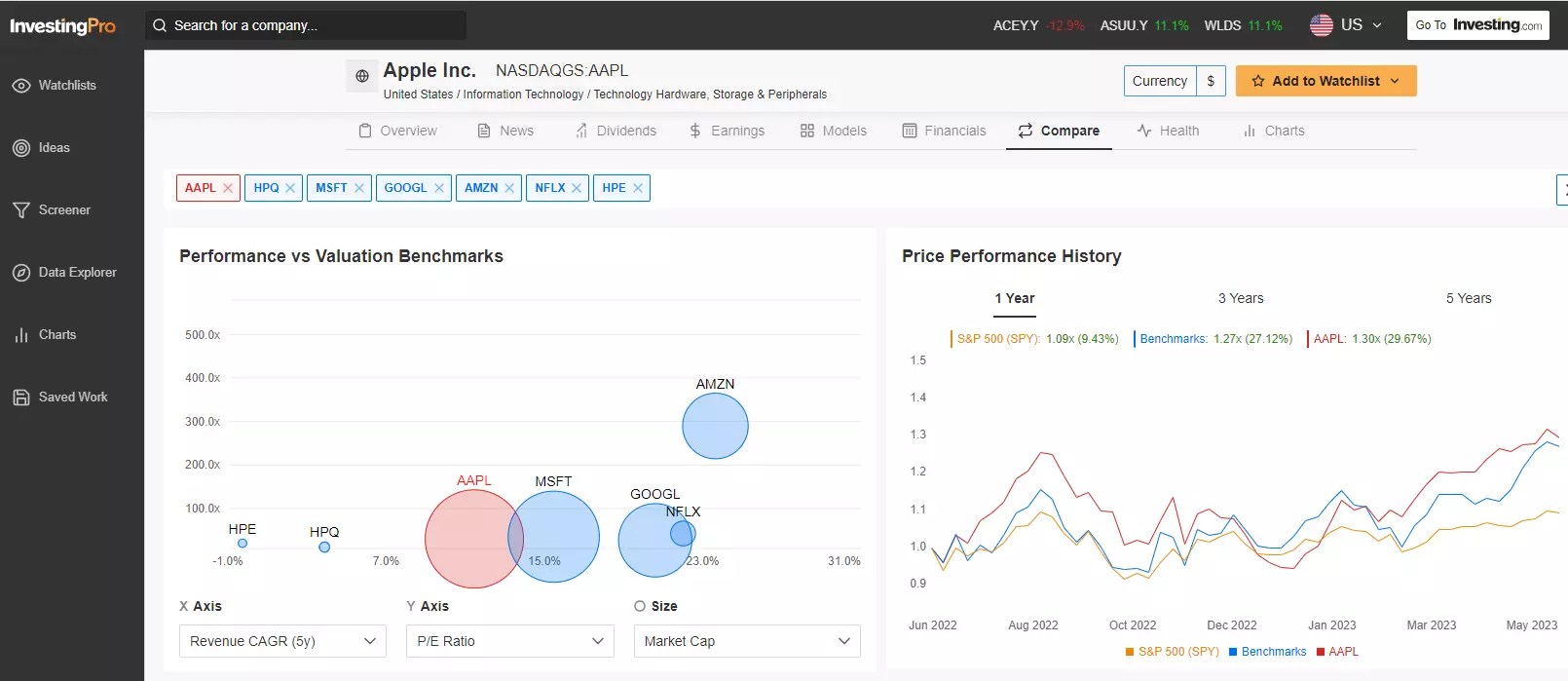

3. Competitor analysis

When you have already performed the two previous steps on a series of stocks under surveillance, you can be more or less clear about the options to invest or not in a particular company.

However, conducting a peer comparison of a stock with companies in the same sector is always advisable.

Apple Peer Comparison

Apple Peer Comparison

Source: InvestingPro

Let’s see how InvestingPro can help us compare several companies under the same parameters with just one click.

PRO TIP: Steps to follow to analyze the competition:

Choose the stock to analyze.

Go to the “Compare” section of InvestingPro

In the chart on the left, choose on the “X-axis” Income CAGR 5Y

In the chart on the left, choose the “Y-Axis” P/E Ratio

Under the “size” label on the left chart, choose Market Cap.

These are just a few items to get an immediate visual comparison of competitor analysis, but it is possible to include many budget variables to compare stocks.

So what are you waiting for? Sign up and start your InvestingPro trial today!

Find All the Info you Need on InvestingPro!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such and is in no way intended to encourage the purchase of assets. It must be remembered that any asset class is evaluated from multiple points of view and is highly risky, and, therefore, any investment decision and associated risk remains the decision of the investor.

Source: Investing.com