US500

+0.93%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

IXIC

+1.53%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

SPXEW1

-0.16%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

VIX

+8.53%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

DXY

+0.05%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

Markets face a decisive week, with the Fed and the ECB likely to put an end to their rate hike cycles

Markets will now focus on how long rates will stay high—as well as the Fed’s balance sheet

Inflation, particularly Core CPI, should keep driving Central Banks’ decisions throughout the year

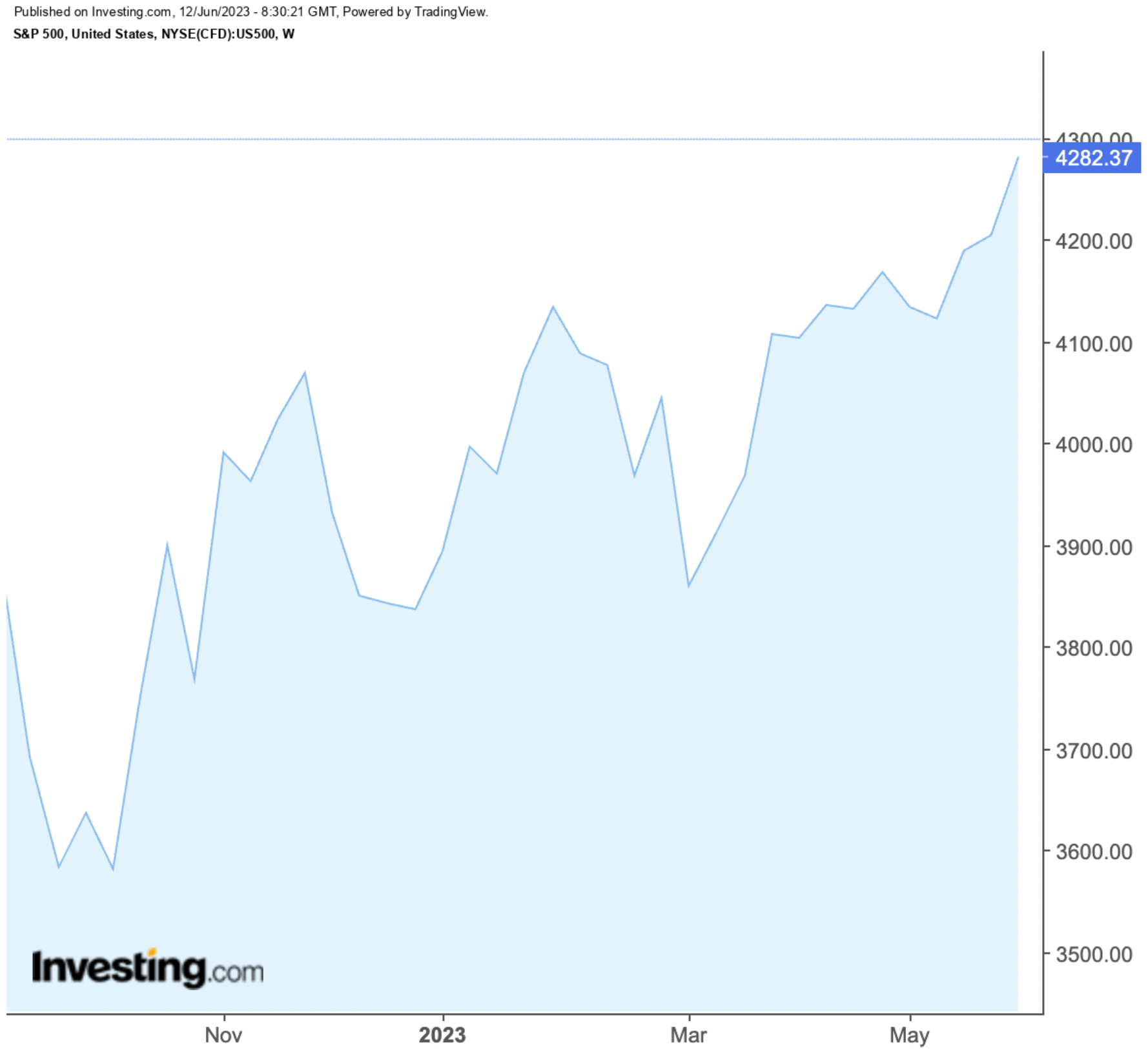

After more than a year of relentless pain, we’re finally here: The likely end of the Fed’s rate-hike cycle. And, along with it, the potential dawn of a new bull market, with the S&P 500 rising 20% from the lows as of Friday last week.

S&P 500 Weekly Chart

S&P 500 Weekly Chart

To wit, the VIX has reached its lowest level since 2020.

VIX Weekly Chart

VIX Weekly Chart

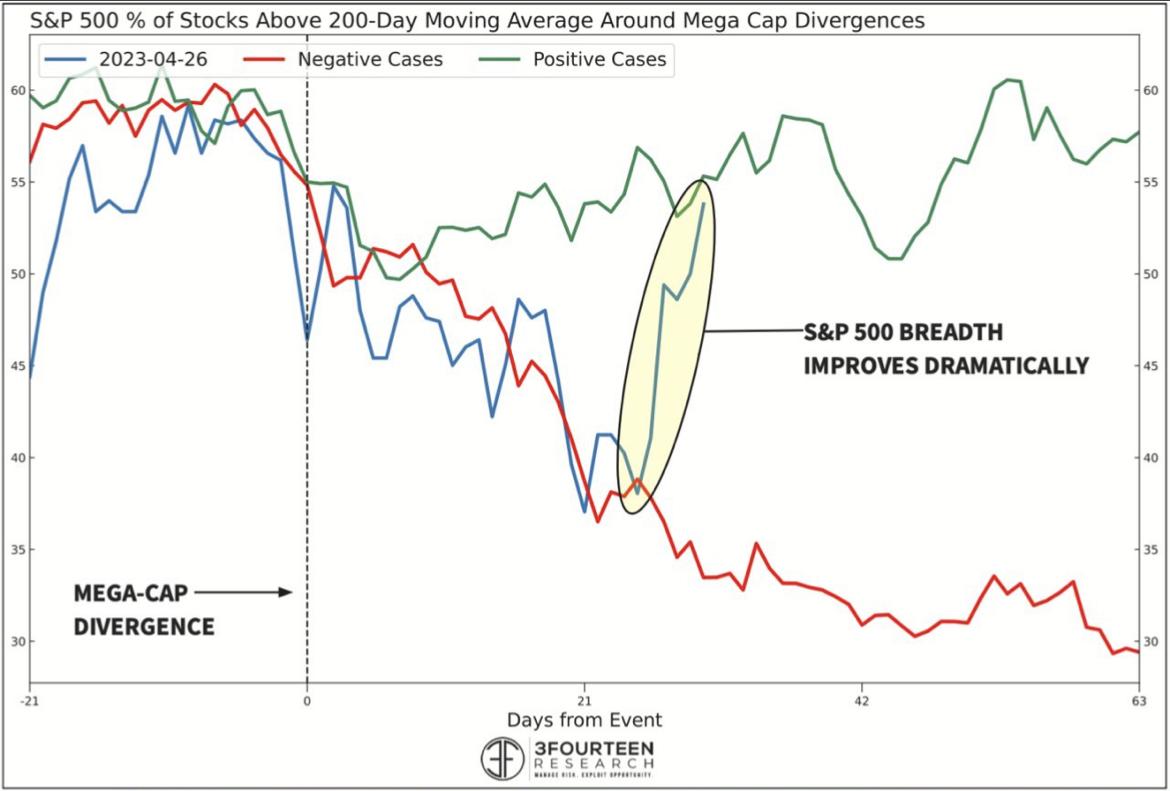

And market breadth has also started to improve. In fact, in just four sessions last week, the percentage of S&P 500 stocks trading above its 200-day moving average jumped from 38% to 53%, indicating that the bull market might be finally starting to spread across sectors other than technology.

Market BreadthSource: 3Fourteen Research

Market BreadthSource: 3Fourteen Research

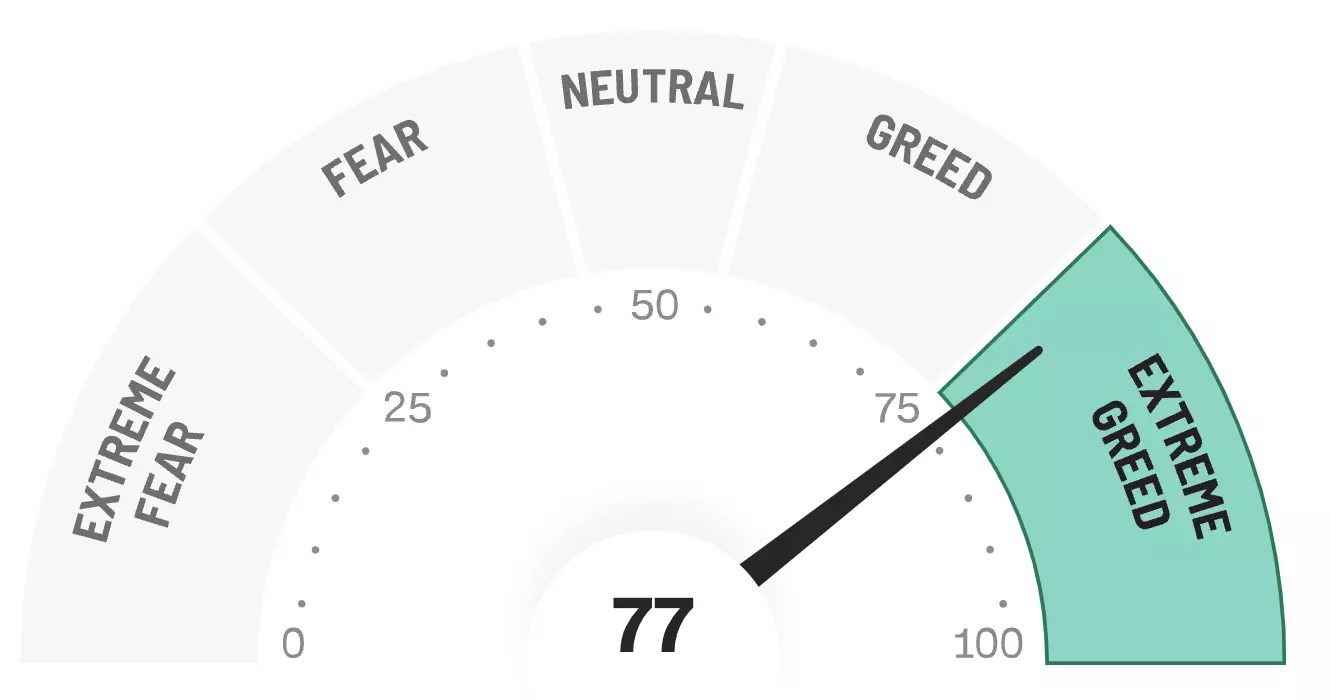

But as the famous adage from Warren Buffett goes: “Be fearful when others are greedy.” To wit, the market has reached “Extreme Greed” levels, according to CNN’s index.

Fear and Greed IndexSource: CNN

Fear and Greed IndexSource: CNN

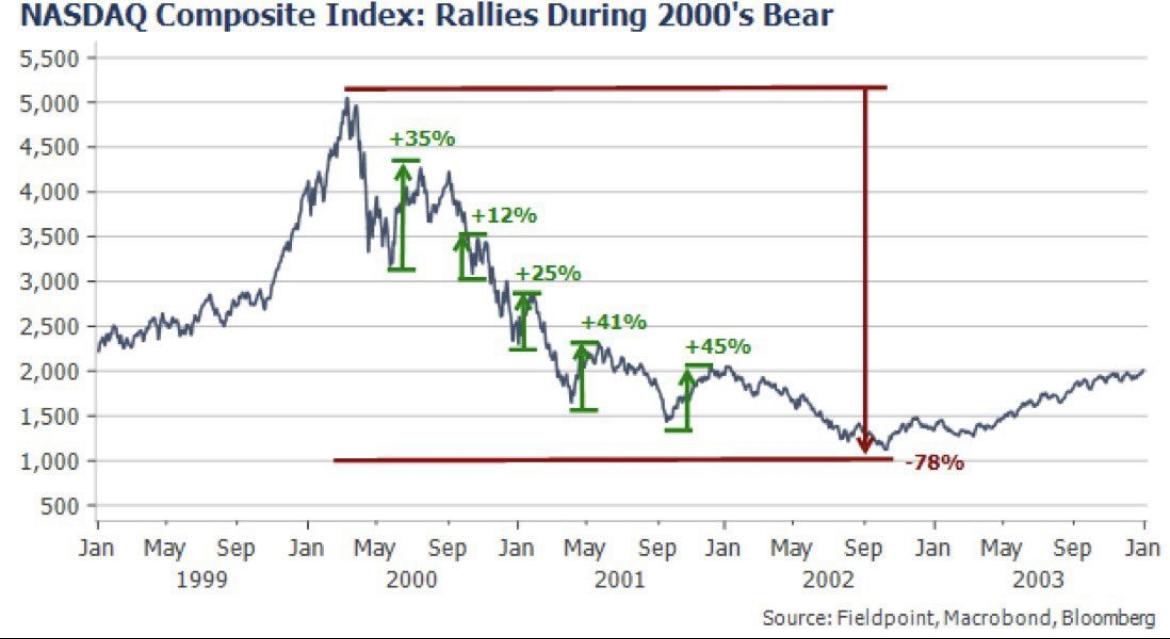

While it remains too early to tell whether the bear market is over for good or if we’re just experiencing a prolonged bear market rally, the fact is the overly optimistic market behavior against a rather tricky macroeconomic backdrop should be raising flags to savvy investors out there.

As many analysts have been pointing out, both the S&P 500 and the Nasdaq Composite have had stronger rallies amid secular bear markets. Take the dot-com bubble as an example:

Nasdaq Bear Market RalliesSource: Fieldpoint, Macrobond, Bloomberg

Nasdaq Bear Market RalliesSource: Fieldpoint, Macrobond, Bloomberg

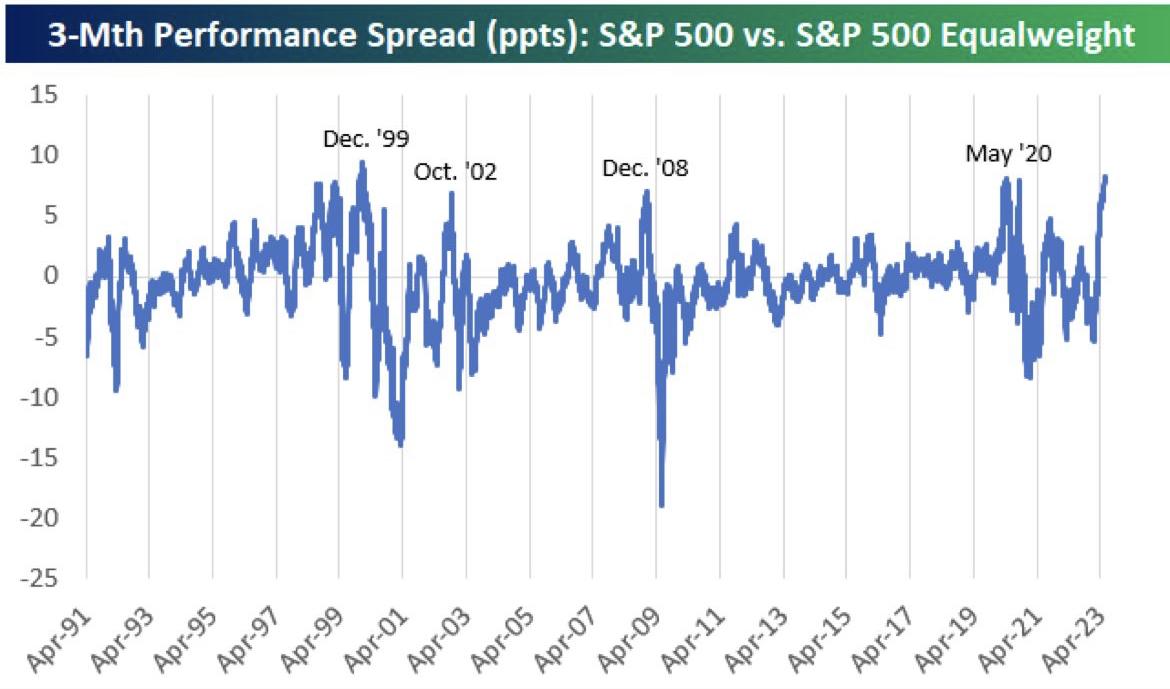

Moreover, on a broader frame, the spread between S&P 500 and the S&P 500 Equal Weighted is sitting at historically high levels, indicating that breadth remains weak. S&P 500/S&P 500 Equal Weighted

S&P 500/S&P 500 Equal Weighted

Source: Bespoke

This combination of factors tells me we’re still looking at a market better suited for range trading than for the unidirectional play upward in terms of indexes, as I’d opined in this piece earlier this year. Stock-picking should remain the way to beat the market, and InvestingPro’s stock scanner is the top tool in the market for retail investors that wish to find solid companies to bet on.

Claim your free week here!

Financial Conditions Should Remain Relatively Tight, Regardless of the Fed’s Decision

The market should keep paying close attention to inflation and the Fed’s moves, even if the topic loses importance in financial media. Only instead of focusing on how much the Fed will raise, investors will start worrying about how long the Fed will keep rates high.

Moreover, financial conditions should remain relatively tight, regardless of the Fed’s decision this week. That’s why I suspect the Fed’s balance sheet will become a bigger topic of discussion in mainstream financial media. Currently, conditions are still relatively tight from a historical perspective, as seen in the chart below.

U.S. Financial ConditionsSource: Thomas Willie, Bloomberg

U.S. Financial ConditionsSource: Thomas Willie, Bloomberg

In fact, after an uptick on its balance sheet due to the banking crisis, the Fed has returned to QT (quantitative tightening) for the last couple of months (a period in which markets were rallying like there was no tomorrow).

Fed’s Balance SheetSource: Bloomberg

Fed’s Balance SheetSource: Bloomberg

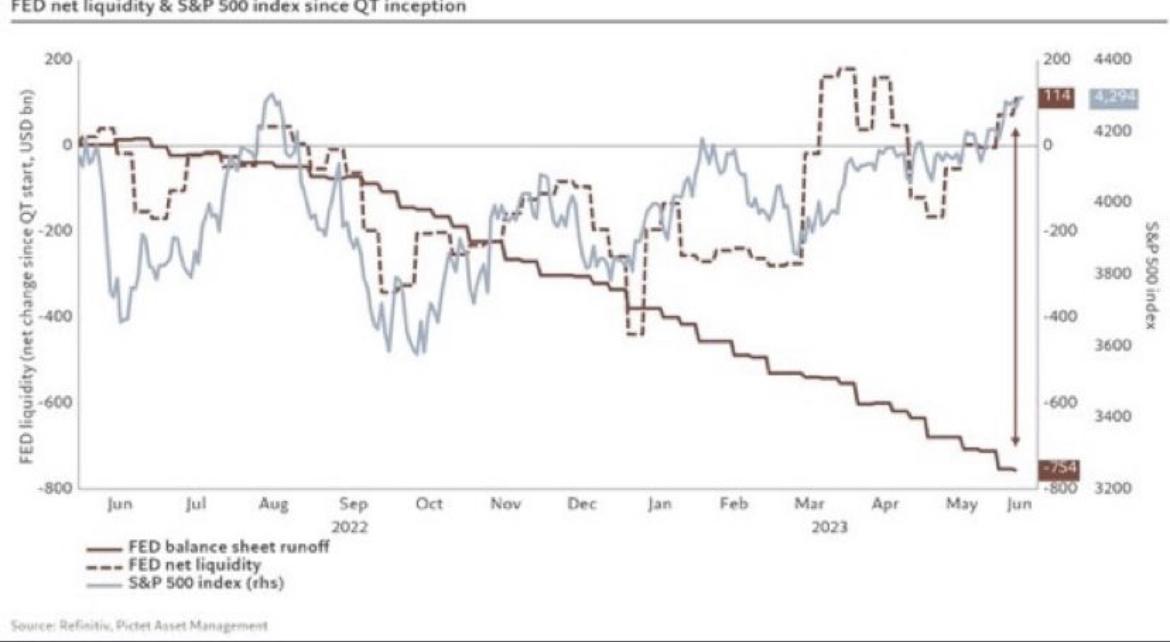

And why does this matter? Mainly because the correlation between the Fed’s balance sheet runoff and the S&P 500 is extremely high. However, with the Fed’s net liquidity diverging from its balance sheet runoff (see chart below), there’s a high likelihood that something will break for one side or for another (meaning the Fed will either return to QEing, or the balance sheet runoff will start lowering).

Fed Net Liquidity vs. S&P 500Source: Refinitiv, Pictet Asset Management

Fed Net Liquidity vs. S&P 500Source: Refinitiv, Pictet Asset Management

There are two main factors traders should be looking at in order to anticipate a break in either one of the directions:

Economic stress forces the Fed to pivot.

Core CPI gets very close to the Fed’s target.

For the former, corporate bankruptcies have hit a 13-year high in 2023, up roughly 115% from the same period last year, according to data from S&P Global. However, as many would argue, numbers are coming off from a weak base, so they aren’t as bad from a historical perspective as they seem.

Furthermore, the labor market’s resilience keeps pointing to a ‘no-recession recession’ scenario—as well explained by Francesco Casarella in this story.

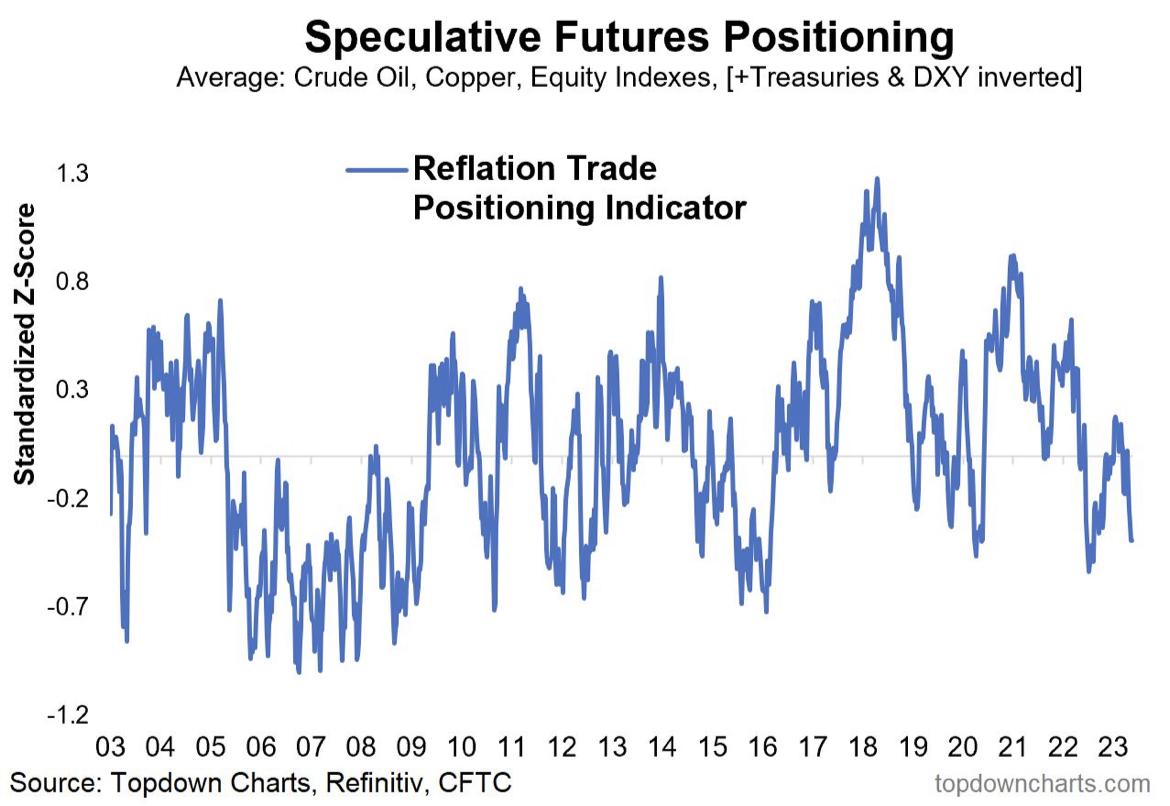

Speculative futures positioning (i.e., futures positioning across commodities, currencies, fixed income, and equities) is also indicating that investors are largely betting on a deflationary/recessionary scenario.

Speculative Future PositioningSource: Topdown Charts

Speculative Future PositioningSource: Topdown Charts

Now, let’s talk about the elephant in the room: CPI and Core CPI, both due tomorrow.

CPI Still Matters

With this week’s CPI report just around the corner, investors are advised to take caution before buying into the FOMO.

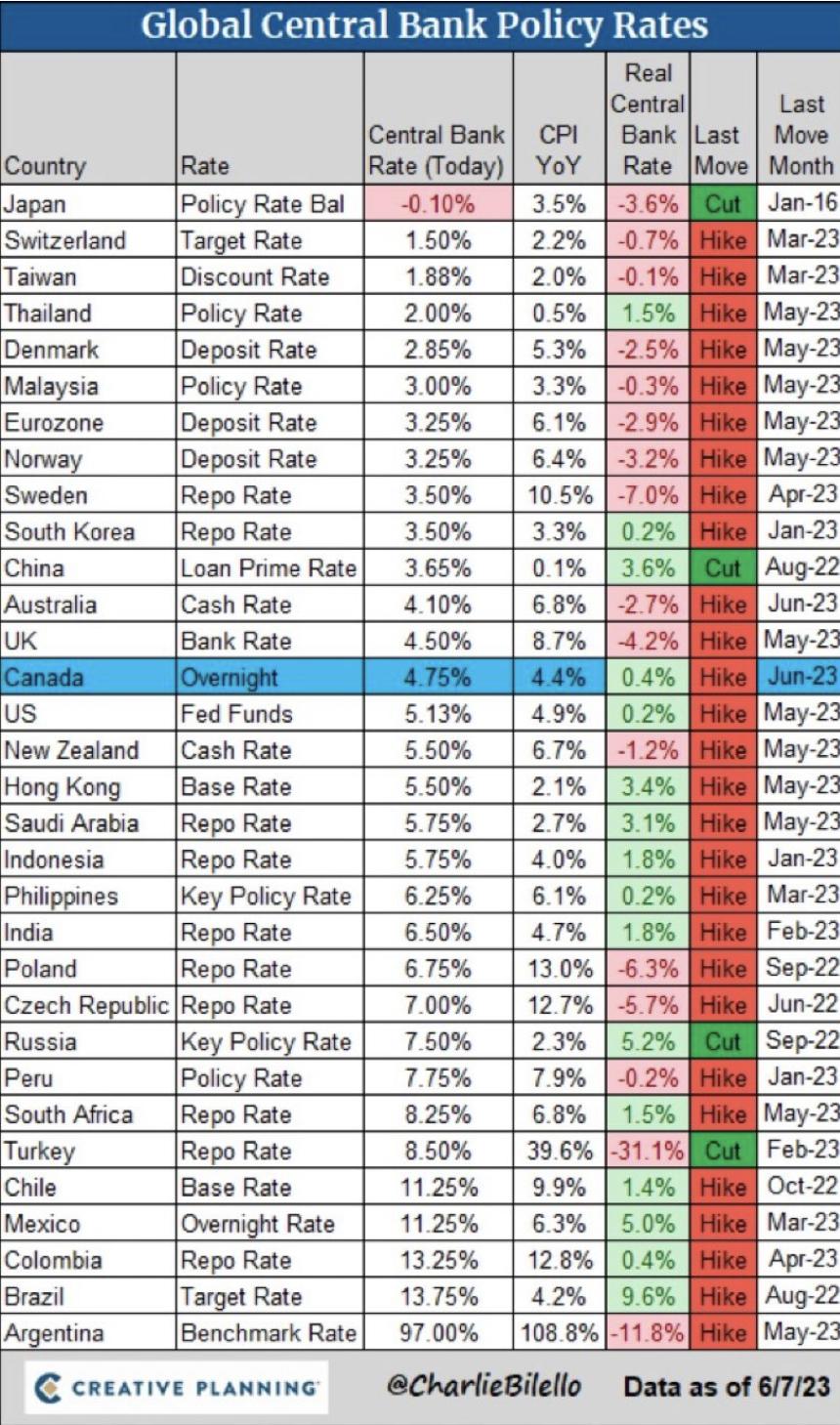

While the topic seems to have disappeared from the news since the highly-positive readings of last month, Central Banks worldwide are still focused on the matter—as indicated by the surprising hikes by the Bank of Canada and Reserve Bank of Australia last week. Likewise, the likelihood that the ECB will also raise rates this week by 25bps remains high.

In the US, the situation appears more dovish, with Investing.com’s Fed Monitor Tool pricing a nearly 80% chance of rates remaining stable this week. However, I believe a final 25bps this week to close the cycle is not completely out of the cards.

As inflation trends lower and Central Banks refuse to pivot, real rates will become progressively more positive worldwide, making bonds more attractive.

Real Rates Around the WorldSource: @CarlieBilello

Real Rates Around the WorldSource: @CarlieBilello

The chart above also hints that the US dollar should remain strong going forward due to the positive real yield in the US in comparison to other developed economies. This could be a headwind for corporate earnings but positive for inflation.

Moreover, with no pivot in sight, inflation stickiness, particularly in the Core part of the CPI should keep driving the Fed’s economic policy throughout the year.

Core CPI

Core inflation rose in winter due to pent-up demand for cars, travel, and persistent shelter inflation. Signs indicate stabilizing and decreasing car prices as supply shortages improve. The auto sector’s supply-demand imbalance contributed to overall inflation, despite global supply chain improvements.

US auto sales declined, but prices are expected to stabilize and decrease as pent-up demand meets improved supply. Used car auctions show evidence of disinflation with recent price decreases.

Pent-up demand in the travel sector caused a surge in airfare and hotel prices, although travel inflation has since declined. Housing inflation may have peaked, with shelter inflation converging towards historical norms. Private rent inflation for new leases returned to historical norms and is tracking below them. Inflation models suggest a decline in shelter inflation by year-end, impacting overall inflation.

Recent reports align with expectations, with high core CPI inflation primarily driven by used car prices. Monthly shelter inflation rates have declined, while travel-related inflation has been below expectations. Wage-sensitive non-shelter core services face risks of disinflation due to the tight labor market, but wage inflation is expected to decrease in the coming months.

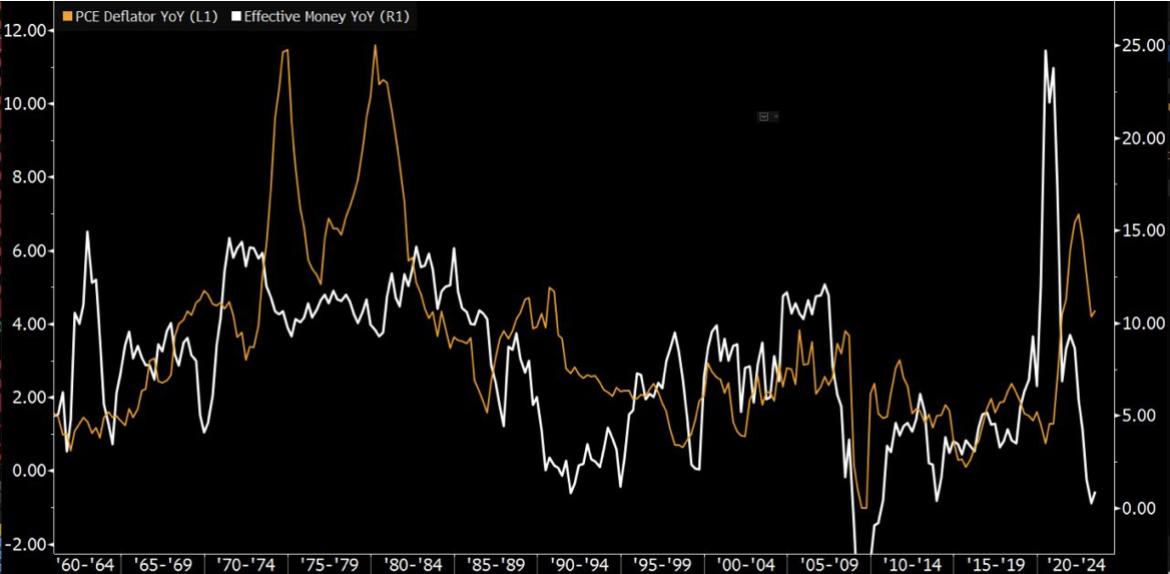

Furthermore, the PCE deflator/effective money supply correlation has been diverging (as seen in the chart below). Since the latter usually heads the former, it is likely that PCE prices will also start dropping sharply should the Fed maintain its tight-ish stance.

PCE Deflator/Effective Money (R1)

PCE Deflator/Effective Money (R1)

Source: Bloomberg

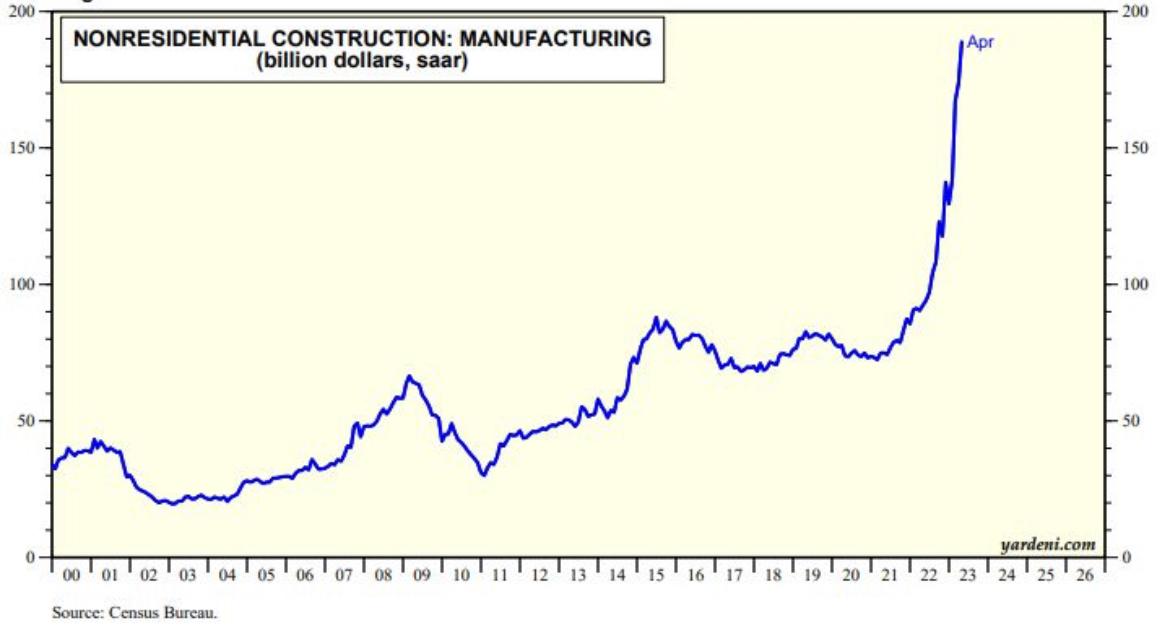

However, should the Fed pivot soon, conditions could start to reverse. The chart below shows that non-residential construction manufacturing costs are skyrocketing, and the only reason that hasn’t pushed inflation higher is that high borrowing costs are still keeping the market in range.

Non-Residential Construction ManufacturingSource: Yardeni Research, US Census Bureau

Non-Residential Construction ManufacturingSource: Yardeni Research, US Census Bureau

Bottom Line

Financial conditions have certainly improved globally this year, and markets have responded quite euphorically. However, we remain far from a net-zero interest rate, high money supply scenario.

Considering all the aforementioned factors, I believe we are still looking at a market that moves within range for quite some time. Against this backdrop, traders are advised to remain patient and take measured risks considering the development of the macroeconomic picture.

Finally, financially-resilient companies are still a better play than high-flying innovative stocks at this point. In order to find such companies, check out InvestingPro, the market’s leading research tool for retail investors. Sign Up for a Free Week Now!

Sign Up for a Free Week Now!

***

Disclosure: The author believes in long-term investing and, thus, is long on stocks that compose both the S&P 500 and the Nasdaq Composite.

Source: Investing.com