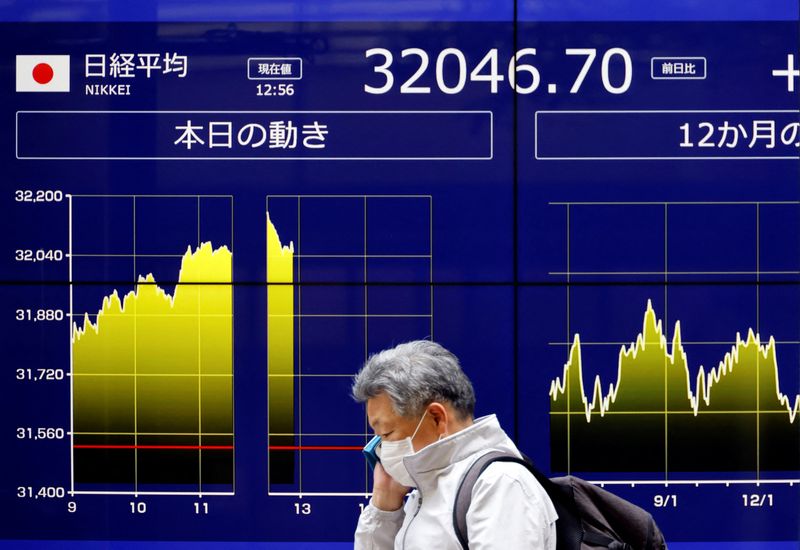

© Reuters. FILE PHOTO: A man walks past an electric monitor displaying Japan’s Nikkei share average and recent movements, outside a bank in Tokyo, Japan, June 5, 2023. REUTERS/Issei Kato

XAU/USD

+0.30%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

US500

+0.93%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

DJI

+0.56%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

JP225

+1.80%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

HK50

+0.80%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

AAPL

+1.56%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

AMZN

+2.54%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

DX

-0.32%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

Gold

+0.39%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

LCO

+0.95%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

ESM3

+0.34%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

CL

+0.70%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

TSLA

+2.22%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

US10Y…

-0.62%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

By Julie Zhu

HONG KONG (Reuters) -Asian shares rose on Tuesday following an upbeat session on Wall Street, while investors turned their attention to key U.S. inflation data and the Federal Reserve’s interest rate decision this week.

Investors will be closely monitoring U.S. consumer and producer inflation data on Tuesday and Wednesday respectively for a reading of how well the Fed’s tightening cycle has managed to curb rising prices.

The equity index’s gains partly reflected expectations for the Fed to pause rate hikes for the first time since January 2022, and for both gauges of inflation to come in lower than the prior month, investors and strategists said.

“Overall equity markets reacted positively to expectations the monetary policy cycle may be nearing its peak,” ANZ analysts said in a note. “U.S. markets are now pricing a 72% probability that the Federal Reserve Monetary Policy Committee (FOMC) will hold rates at this week’s meeting.”

European markets were set for a higher open, with pan-region Euro Stoxx 50 futures up 0.69%, German DAX futures rising 0.68% and FTSE futures advancing 0.41%.

In Asia, MSCI’s broadest index of Asia-Pacific shares outside Japan was up 0.8% while U.S. stock futures – the S&P 500 e-minis – rose 0.22%.

Japan’s benchmark Nikkei index surged to a fresh three-decade peak, led higher by technology shares on expectations of a flood of investment in chip-related companies. The Nikkei climbed for a third-straight session, up 1.89% in afternoon trade and set for the highest close since July 1990.

Australian shares were up 0.18%.

China’s stocks regained some lost ground after the central bank on Tuesday lowered a short-term policy lending rate in a bid to restore market confidence. But economic worries and geopolitical risks limited gains as recent Chinese economic data has shown subdued demand, weakening investor sentiment.

“I am afraid China’s monetary policy may become increasingly ineffective, due to low confidence and weak loan demand,” said Wang Qi, CEO of asset manager MegaTrust Investments. “While it’s good to see more liquidity being pumped into the system, whether the private sector will leverage up remains to be seen.”

China’s blue-chip CSI300 index edged up 0.11% in afternoon trade. Hong Kong’s Hang Seng index added 0.23%.

On Monday, the S&P 500 and the Nasdaq rallied to their highest closing levels since April 2022.

Lifted by gains in market heavyweights Amazon (NASDAQ:AMZN), Apple (NASDAQ:AAPL) and Tesla (NASDAQ:TSLA), the S&P 500 has recovered 21% from its October 2022 lows, heralding the start of a new bull market as defined by some market participants.

The S&P 500 climbed 0.93% to end the session at 4,338.93 points. The Nasdaq gained 1.53%, while the Dow Jones Industrial Average rose 0.56%.

While the Fed is expected to keep rates steady, surprise rate hikes by the Reserve Bank of Australia and the Bank of Canada last week have kept investors alert to the idea of prolonged tightening cycles.

The European Central Bank will deliver its rate decision on Thursday with analysts expecting it to raise rates by 25 basis points (bps) and to signal that there is more ground to cover. But the Bank of Japan, which will announce its plan on Friday, is expected to maintain its ultra-loose policy.

In U.S. Treasuries, the yield on benchmark 10-year Treasury notes reached 3.7299%, compared with the U.S. close of 3.765% on Monday. The two-year yield, which rises with traders’ expectations of higher Fed fund rates, touched 4.5605% compared with a U.S. close of 4.592%.

In currencies, the U.S. dollar index, which measures the greenback against a basket of major currencies, fell 0.21% to 103.36, while the euro was up 0.3% on the day at $1.0792.

The dollar dropped 0.1% against the yen to 139.46.

U.S. crude ticked up 0.33% to $67.34 a barrel. Brent crude rose to $72.2 per barrel.

Gold was slightly higher. Spot gold was traded at $1960.29 per ounce. [GOL/]

Source: Investing.com