MCFT

+1.36%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

HCC

+0.28%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

DVAX

+5.97%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

GBUSS

+1.50%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

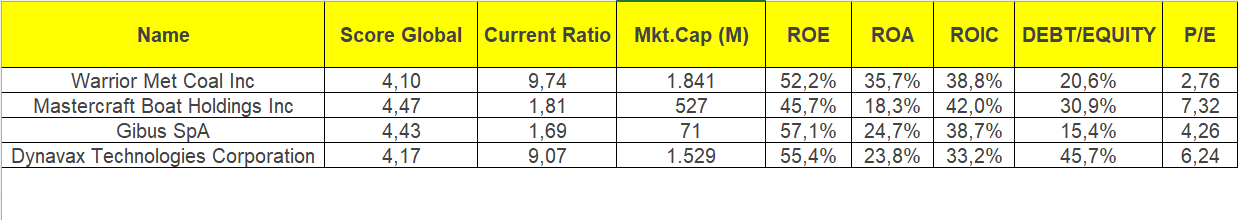

Mega-cap stocks have led market rally, while small-caps have lagged behind

Some see this as a risk, I see it as a buying opportunity

Here are 2 undervalued small-cap stocks found by our InvestingPro stock scanner

In the uptrend from the mid-October low, we have seen a market recovery driven mainly by the mega-cap stocks, including Apple (NASDAQ:AAPL), NVIDIA Corporation (NASDAQ:NVDA), Meta Platforms (NASDAQ:META), Alphabet (NASDAQ:GOOGL).

Many see this as a risk, but one must also see the other side of the story, which is the possibility that small-caps could rally too. I recently bought an ETF on small caps because of the discounted valuations.

So, let’s see if we can identify small-cap plays using the InvestingPro stock scanner.

The filters used are as follows:

Return on Asset > 12%

Return on Equity > 15%

Return on Invested Capital > 15%

Current Ratio > 1

P/E less than 15

Market Cap less than 2 Billion

InvestingPro Overall Score > 4

Debt/Equity ratio less than 0.6

And here are the results:

InvestingPro Stock Screener Results

InvestingPro Stock Screener Results

Source: InvestingPro

Only four companies meet these stringent requirements. However, it is crucial not to stop here. Instead, we should delve into the details of each stock.

We should consider factors such as profit and revenue growth trends, free cash flow returns, potential upside relative to fair value, competitive advantage within the industry, quality of management, and more.

And excessively positive values in these metrics should raise caution, as they prompt the question of whether such numbers can be sustained in the future.

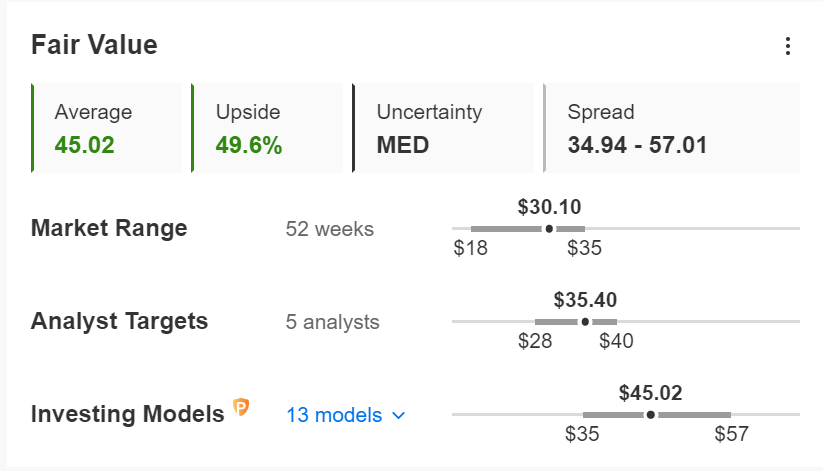

Out of the 4 selected companies, only 2 show a discount to InvestingPro Fair Value exceeding 30%:

MasterCraft Boat Holdings (NASDAQ:MCFT) presents a discount of 49.6%.

Warrior Met Coal (NYSE:HCC) shows a discount of 35.8%.

MasterCraft Fair Value

MasterCraft Fair Value

Source: InvestingPro

Warrior Met Coal Fair Value

Warrior Met Coal Fair Value

Source: InvestingPro

A deeper analysis is always recommended after shortlisting stocks. You can subscribe and try out the InvestingPro premium tool, which provides comprehensive tools for conducting in-depth analyses.

The InvestingPro tools assist savvy investors in analyzing stocks. By combining Wall Street analyst insights with comprehensive valuation models, investors can make informed decisions while maximizing their returns.

You can conveniently access a single-page view of complete and comprehensive information about different companies all in one place, saving you time and effort.

Start your InvestingPro free 7-day trial now!

Find All the Info you Need on InvestingPro!

Find All the Info you Need on InvestingPro!

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling, or investment recommendation. As such, it is not intended to incentivize the purchase of assets in any way. As a reminder, any type of asset is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remain with the investor. The author does not own the stocks mentioned in the analysis.

Source: Investing.com