Maintain buy with a higher target price of RM8.35 from RM7.13 previously: Despite Top Glove shares’ strong performance in the past month, gaining 13% versus the overall sector, its forward price-earnings ratio (PER) multiple still trails that of its peers, Kossan Rubber Industries Bhd (Financial Dashboard) and Hartalega Holdings Bhd (Financial Dashboard), by 8% and 18%, respectively.

This is unjustified, in our view, given the group’s continuous improvement in product mix and margins.

In light of the favourable operating environment, and with Top Glove arguably being best placed in the sector to benefit from the ringgit-US dollar exchange rate, we see its valuations as more likely to catch up and trade closer to its peers.

Shares in Top Glove have historically traded at a premium to peers. Any sharp appreciation of the US dollar could also cause valuations to overshoot in the near term.

Meanwhile, the group plans to add an additional production capacity of 6.4 billion pieces per annum by December 2016, raising its total lightweight nitrile (NBR) production capacity to 16.4 billion pieces per annum.

Also, while we understand that the group’s peers are not adding any additional capacity in the natural rubber (NR) glove segment, the group has plans to expand its existing plant in Phuket, Thailand, by 1.2 billion pieces per annum.

This will bring its total product mix to 40 NBR to 60 NR.

The group has targeted an equal product mix of NBR and NR in the longer term.

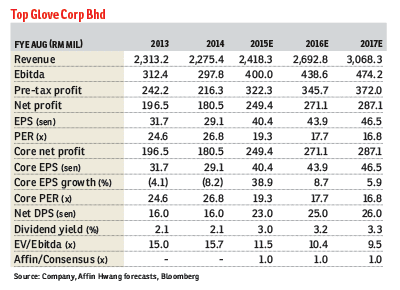

We leave our financial year 2015 (FY15) to FY17 forecasts unchanged.

Nevertheless, we raise our target PER multiple to 18.6 times from 16 times, given the group’s improving product mix and being a key beneficiary of the stronger US dollar.

We forecast Top Glove’s earnings to grow at a three-year compound annual growth rate of 18%. — Affin Hwang Capital Research, July 22