Wednesday, 29 July 2015 00:27

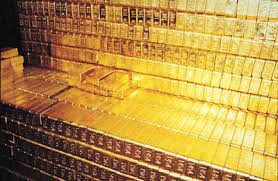

LONDON: Gold firmed on Tuesday but remained near 5-1/2-year lows as markets braced for this week’s Federal Reserve meeting, at which policymakers are expected to give further clues on the timing of a US rate increase.

LONDON: Gold firmed on Tuesday but remained near 5-1/2-year lows as markets braced for this week’s Federal Reserve meeting, at which policymakers are expected to give further clues on the timing of a US rate increase.

The Fed suggested earlier this year that a near-term rate rise was on the cards if economic data supported such a move, but slowing growth in China and a drop in commodity prices have led some to question whether it will be pushed back.

Spot gold was up 0.3 percent at $ 1,096.71 an ounce at 1355 GMT, while US gold futures for August delivery were down 30 cents an ounce at $ 1,096.10. Gold hit a low of $ 1,077 on Friday, its weakest since early 2010. “Until the Fed provides some clarity on Wednesday, it’s difficult to say that we’ve hit a floor,” ING analyst Hamza Khan said.

“The volumes we’re seeing suggest that this could just be short covering in case the Fed announces some firmer vocabulary.” Rising interest rates pressure gold by lifting the opportunity cost of holding bullion, while boosting the dollar.

Expectations a near-term hike may be possible are making investors hesitant to bid up gold despite a price slide, with its failure to benefit from jitters over Greece this year undermining its appeal as a haven from risk.

The dollar rose 0.5 percent against the euro on Tuesday as investors focused on the Fed meeting.

“Gold is treading water despite a slight improvement in the dollar and US Treasury yields,” Mitsubishi analyst Jonathan Butler said.

“That would seem to indicate some pricing in of the Fed pushing out interest rate rises further into the future.”

GFMS researchers at Thomson Reuters said in a report on Tuesday that global gold demand hit its lowest since 2009 in the second quarter as China poured funds into equities, which had promised better returns.

Also weighing on sentiment, China’s net gold imports from main conduit Hong Kong fell to a 10-month low in June, reflecting weak demand from the major consuming nation.

China’s gold imports could fall as much as 40 percent this year as demand for bullion used to back domestic financing deals decreases, said Michael Mesaric, head of the world’s biggest refiner Valcambi.

Silver was up 0.6 percent at $ 14.63 an ounce, platinum was down 0.5 percent at $ 974.50 an ounce, and palladium was up 0.8 percent at $ 616.50 an ounce.