Thursday, 30 July 2015 00:40

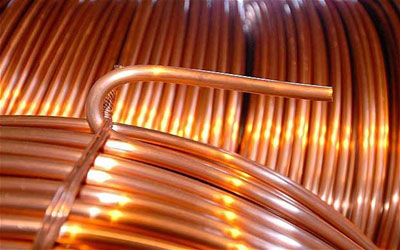

LONDON: Copper rose on Wednesday after the Chinese stock market rebounded, though investors were nervous ahead of a statement from the Federal Reserve, which could set the stage for a US interest rate hike in September and a potentially firmer dollar.

LONDON: Copper rose on Wednesday after the Chinese stock market rebounded, though investors were nervous ahead of a statement from the Federal Reserve, which could set the stage for a US interest rate hike in September and a potentially firmer dollar.

Copper’s rise was also fuelled by hopes of more stimulus in China, the world’s top consumer of industrial metals.

Benchmark copper on the London Metal Exchange closed up 0.6 percent at $ 5,330 a tonne after a volatile session that saw it touching an intraday high of $ 5,398 and also slump into negative territory.

The metal used in power and construction, down about 15 percent so far this year, hit a six-year low of $ 5,164 on Monday when Chinese equities tumbled 8 percent.

Chinese shares bounced back by more than 3 percent on Wednesday, but the positive impact on metals faded later in the session as investors turned attention to a policy statement from the US Federal Reserve due at 1800 GMT.

“We should see dollar strength and possible pressure on the commodities once the statement is out, as this would be the last communication from the central bank until the key September meeting,” said analyst Edward Meir at brokerage INTL FCStone.

A stronger US currency makes commodities more expensive for holders of other currencies.

One factor supporting copper was the expectation by many investors that Beijing will step up its stimulus programmes.

“China is struggling, but it’s not imploding. The equity selloff will have a negative impact on the economy in the third quarter,” said Leon Westgate, analyst at ICBC Standard Bank.

“China’s economy is going to need a helping hand to achieve growth targets.

Copper is probably now reasonable value.” Beijing is targeting 7 percent economic growth this year. Other analysts cite stronger demand growth for the fourth quarter in China and tighter supplies as a reason to be optimistic for copper’s prices prospects.

“We reiterate our view that a significant proportion of copper mine output is struggling at these price levels,” Macquarie said in a note.

On Wednesday, Antofagasta cut its full-year copper production guidance.

In other metals, soldering metal tin jumped to $ 16,340, its highest since May 6 on short position covering. Tin failed to trade in closing open outcry activity and was last bid unchanged at $ 16,150 a tonne.

Aluminium also failed to trade in closing rings and was bid up 0.4 percent at $ 1,662 a tonne. Nickel closed down 0.7 percent at $ 11,250 a tonne after LME inventories rose 5,310 tonnes, highlighting oversupply in the market.

Zinc ended down 0.7 percent at $ 1,966 a tonne, while lead added 0.2 percent to $ 1,725.