(AP/Mark J. Terrill) The Canadian economy contracted in May for the fifth consecutive month.

(AP/Mark J. Terrill) The Canadian economy contracted in May for the fifth consecutive month.

Canada’s in rough shape.

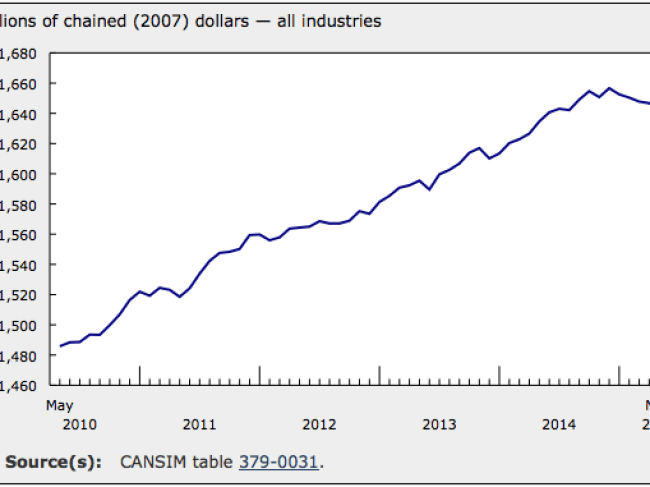

The country’s statistics agency released GDP data on Friday that showed the Canadian economy shrank by 0.2% in May.

That’s worse than expectations of 0.0% growth, and it’s the fifth consecutive month the economy contracted.

Weighing on the economy were the manufacturing and mining, oil, and gas extraction sectors. Wholesale trade was also down.

Manufacturing output contracted 1.7% in May to its lowest level in a year, following no growth in April, according to the report. Mining, quarrying, and oil and gas extraction fell 0.7%, down for the seventh consecutive month.

The oil crash, and a smoked loonie

The drop in oil prices that began more than a year ago has been hard on the net oil-exporting nation.

Major oil producers like Schlumberger are now cutting jobs, and Alberta, Canada’s main oil-producing province, saw its unemployment rate jump from 5.5% to 5.8% in May.

It looks like the effect of falling commodities prices on the Canadian economy is not going to let up any time soon. That’s according to a note from BNP Paribas’ Derek Lindsey.

The Bank of Canada cut interest rates last month and now it’s likely to continue easing, Lindsey noted.

Bank of Canada governor Stephen Poloz has yet to use the word “recession,” preferring to describe the economic situation as a “complex and significant adjustment.”

The Canadian dollar — aka the loonie — is weak. Here’s what’s happened with the currency over the past year: (Yahoo! Finance) The Canadian dollar, aka the loonie, is weak.

(Yahoo! Finance) The Canadian dollar, aka the loonie, is weak.

One bubbly bright spot

Not all economic sectors contracted in May. Construction was up slightly, and Canadians continued to spend money on their homes. An increase in retail trade was driven by spending on building material, garden equipment, and supplies, according to the report.

Meanwhile, housing markets in Toronto and Vancouver are still super hot. Canadian home prices did not drop nearly as much as home prices in the US during the housing-market crash, and they’ve soared ever since.

(Statistics Canada) Real gross domestic product in Canada fell in May.

(Statistics Canada) Real gross domestic product in Canada fell in May.

In Toronto, home prices are reportedly 42% higher than they were in 2008. Home prices in Vancouver are the second-most expensive in the world.

Economist Robert Shiller suggested back in 2012 that Canada could experience a slow-motion version of the US housing bust.

According to BNP’s Lindsey, “investment and exports remain in contractionary territory and the economy remains vulnerable to a correction in housing and a pull-back in spending due to high levels of household debt.”

Looking forward

So what’s to come for Canada? The country is due for a general election this year.

Prime Minister Stephen Harper and his Conservative Party have been in power since 2006, and have consistently campaigned on the economy. He’s expected to formally launch his campaign as early as Sunday.

A strong economic record leading up to and after the financial crisis meant political success for the fiscally conservative party. No banks had to be rescued after the crisis and housing prices didn’t plunge. Exports were weak, but overall, the recession was much less painful in Canada than in the US.

By 2010, the economy had fully recovered.

(REUTERS/Andy Clark) Canadian Prime Minister Stephen Harper is a fan of cowboy hats.

(REUTERS/Andy Clark) Canadian Prime Minister Stephen Harper is a fan of cowboy hats.

Now things could change for Harper’s conservatives. After nine and a half years of conservative leadership, it’s hard to gauge what economic policies the rival Liberal Party would pursue.

A statement on the Liberal Party website reads: “The world has changed in the last 10 years … Now and in the future, the path to economic growth and good middle class jobs is through strong environmental policy.”

The New Democratic Party, the official opposition party in parliament, recently released “5 signs that Stephen Harper’s economic plan just isn’t working.” No alternative solutions were offered.

The upcoming election, expected to be held in mid-October, will be worth watching.

NOW WATCH: 11 Surprising Facts About Canada

More From Business Insider

- Canada is in recession

- Canada’s Achilles’ heel is showing

- The US and Canada are on the brink of a potentially deadly fight over lobsters