2/2

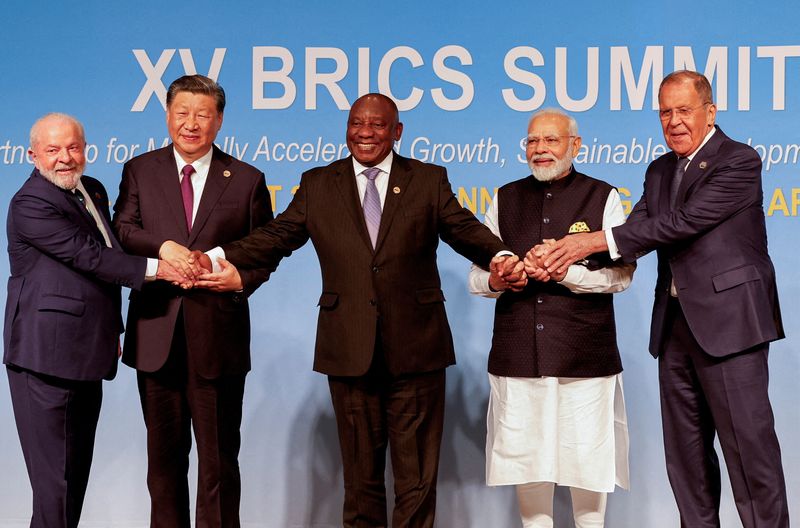

© Reuters. FILE PHOTO: President of Brazil Luiz Inacio Lula da Silva, President of China Xi Jinping, South African President Cyril Ramaphosa, Prime Minister of India Narendra Modi and Russia’s Foreign Minister Sergei Lavrov pose for a BRICS family photo during the 2

2/2

BBAS3

-1.30%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

2628

+0.18%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

LCO

+1.82%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

CL

+1.27%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

8200

-0.52%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

AIRA

+0.34%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

ETEL

+0.46%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

INBK

-1.94%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

GOLD

-1.68%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

By Rachel Savage and Karin Strohecker

JOHANNESBURG/LONDON (Reuters) – The expansion of the BRICS group of developing countries could provide a lifeline to capital-starved new entrants Iran and Argentina, but investors and analysts say a broader economic boon for the bloc’s members is far from certain.

Leaders of the BRICS – Brazil, Russia, India, China and South Africa – invited the two as well as Saudi Arabia, the United Arab Emirates (UAE), Ethiopia and Egypt into the club at a summit this week in Johannesburg.

The move is aimed at increasing the BRICS’ clout as a champion of “Global South” nations, many of which feel unfairly treated by international institutions dominated by the United States and other wealthy nations.

The additions are a mixed bunch: Saudi Arabia and the UAE are wealthy oil producers, inflation-wracked Argentina is desperate for foreign investment, Iran is isolated by Western sanctions, Ethiopia is recovering from a civil war and Egypt’s economy is in crisis.

Some investors and economic analysts are sceptical that expansion will lead to increased foreign direct investment (FDI) within the bloc.

“Egypt has already been expecting a lot of FDI from Saudi… and the Gulf money is not coming – and it is not because they are not in the BRICS organisation, it is because the proposition is not attractive,” said Viktor Szabo, a portfolio manager at abrdn in London.

Still, BRICS leaders and other investors touted the increased economic heft from the expansion. The new members would grow the bloc’s share of global GDP to 29% from 26% and trade in goods to 21% from 18%, Li Kexin, a senior Chinese foreign ministry official, told a press briefing on Thursday.

“I don’t know if I would say it’s a game changer, but in terms of opening up consumer markets there is scale there,” said Ola El-Shawarby, deputy portfolio manager for the Emerging Markets Equity Strategy at Van Eck in New York.

Increasing trade links between existing and prospective members of the bloc have garnered attention.

“The growing trade interconnectedness seems to be providing some fundamental ground for political announcements,” said Chris Turner, global head of markets at ING.

ING calculates that since 2015, the share of core BRICS in the new candidates’ imports increased from 23% to 30%, replacing the euro area, the United States, and other developed economies.

Other analysts and investors say Iran, which is under Western sanctions, as well as the bloc’s heavyweight member China – which has long-pushed for enlargement – are among the main beneficiaries of expansion.

“China and Brazil, India will benefit in terms of easy access to oil, and Argentina and notably Iran will benefit in terms of access to markets and FDI,” said Jakob Ekholdt Christensen, senior emerging markets fixed income strategist at BankInvest in Copenhagen.

“At most, the enlargement is a benefit for the new entrants that are hungry for capital,” said Hasnain Malik, a Dubai-based managing director at Tellimer, an emerging markets research firm.

“But this assumes they would not have seen capital inflow anyway from the richer BRICS countries and that any capital provided via a BRICS institution does not jeopardise that from other multi and bilateral sources.”

A BRICS loan to Argentina could conflict with the bailouts it has received from the International Monetary Fund, which has deeper pockets, said abrdn’s Szabo.

Increasing use of national currencies to reduce U.S. dollar dependence was another goal BRICS leaders discussed at the summit in Johannesburg. They said this could help lessen their economies’ vulnerability to a strong dollar and foreign exchange fluctuations.

And with oil producer heavyweights among the newcomers, investors said this would feed speculation that Saudi Arabia might increasingly switch to non-dollar-denominated currencies for oil trade.

“The short-term consequences could be seen in oil,” said Kaan Nazli, a portfolio manager at asset manager Neuberger Berman in London.

“If oil gets priced in a currency other than the dollar for example, or at least partly… that’s a big change.”

Source: Investing.com