US500

+0.67%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

DJI

+0.73%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

QQQ

+0.78%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

DX

+0.03%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

ESU3

+0.30%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

US2YT=X

+0.70%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

META

-0.44%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

BKX

-0.46%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

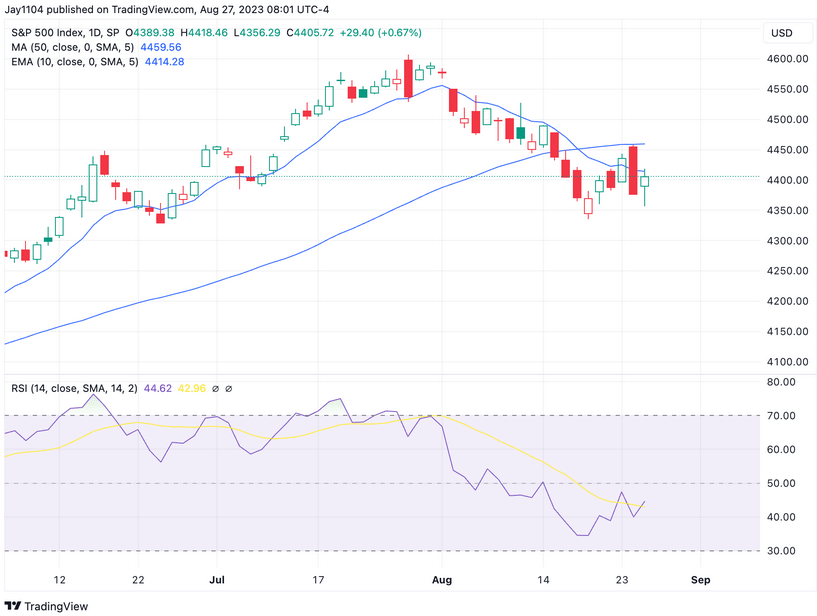

It’s a significant week for the markets, as a plethora of economic data is poised to determine the trajectory for the upcoming month. Yields have demonstrated a steady advance, the US dollar has exhibited strength, and equities have undergone a downturn. Notably, the S&P 500 is currently displaying a series of cautionary signals.

This was further underscored by the emergence of another bearish engulfing pattern this past Thursday. Moreover, the accompanying chart illustrates that the S&P 500 encountered difficulties in surpassing the 50-day moving average and sustaining a position above the 10-day exponential moving average.

S&P 500 Index Daily Chart

S&P 500 Index Daily Chart

These three factors, in isolation, already indicate a bearish sentiment. However, the situation is compounded by the emergence and validation of a bump-and-run reversal pattern on the S&P 500 chart. This particular pattern, recognized for its bearish implications, has breached both preceding uptrends.

Furthermore, an emerging head and shoulders pattern is discernible within the index, featuring a neckline approximately at the 4,330 mark. Should both of these patterns unfold as anticipated, there’s a conceivable scenario wherein the index might experience a descent to around 4,200 initially, with the potential for a more extensive drop to as low as 3,800. This retracement could essentially retrace back to the origin of the initial bump and run pattern.

SPY Daily Chart

SPY Daily Chart

Furthermore, the hourly chart of S&P 500 Futures reveals a megaphone pattern that has already experienced a downside break. This implies the presence of additional room for decline, indicating the possibility for the futures contracts to descend further, potentially reaching approximately 4,250.

S&P 500 Futures Hourly Chart

S&P 500 Futures Hourly Chart

Similar characteristics are observable in the QQQ as well. Notably, there’s a substantial gap in the chart around the $330 mark that remains unfilled, adding to the existing set of features.

QQQ Hourly Chart

QQQ Hourly Chart

The Dow Jones Industrial Average index shares a similar scenario, as it currently trades below both the 10-day exponential and 50-day simple moving averages. Moreover, a crucial support/resistance zone of around 34,600, previously breached, has seen a subsequent retest and regain earlier this week. This development hints at the potential for a decline toward the 33,600 level.

DJIA Daily Chart

DJIA Daily Chart

A significant portion of the equity market’s vulnerability can be attributed to the prevailing strength of the dollar, a trend that appears poised to persist. Presently, the dollar is exhibiting overbought indications, potentially prompting a retracement to retest the breakout level around 103.50 in the near term. Nevertheless, my assessment is that the dollar index will likely maintain its upward trajectory and progress toward the 106 mark.

US Dollar Index Daily Chart

US Dollar Index Daily Chart

In the interim, the release of strong data this week has the potential to trigger a breakout in the 2-year rate, propelling it above the earlier peaks situated around 5.1%. This surge could result in the 2-year rate advancing to approximately 5.3%, marking a level not witnessed since 2006

US 2-Yr Yields Weekly Chart

US 2-Yr Yields Weekly Chart

Meanwhile, Meta (NASDAQ:META) has essentially filled the price gap around $325 and has been on a downward trajectory since then. The chart depicts a consistent pattern of breaking through successive trend lines and dipping below a couple of moving averages.

Additionally, there are multiple unfilled gaps at lower price levels, with the initial gap anticipated to be filled at $210. Remarkably, the stock’s current state isn’t even classified as oversold, as indicated by its Relative Strength Index (RSI) at a mere 40.

Meta Inc Daily Chart

Meta Inc Daily Chart

Finally, the KBW Bank Index, subsequent to its upward movement stemming from the inverted head and shoulders formation, has encountered an inability to sustain its progress and has retraced to find support at the $80 level.

A breach below this support at $80 would likely initiate a reexamination of the previous lows situated around $73. In instances where head and shoulder patterns falter, they often transition into continuation patterns reflective of the preexisting trend.

In this specific scenario, the prevailing trend was one of decline.

KBW NASDAQ BANK Index Daily Chart

KBW NASDAQ BANK Index Daily Chart

My latest Free YouTube Video:

Anyway, have a good week.

Original Post

Source: Investing.com