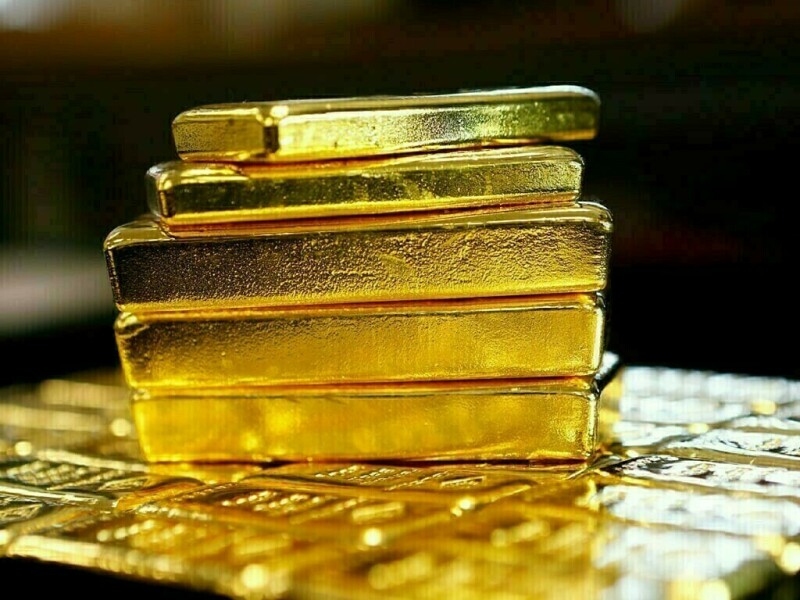

Gold slipped to a one-week low on Tuesday on rising bond yields and as investors opted for the U.S. dollar to hedge against global growth concerns.

Spot gold declined 0.6% to $1,926.49 per ounce by 10:18 a.m. ET (1418 GMT). U.S. gold futures fell 0.8% to $1,952.00.

Jitters about global growth, particularly in China and the Euro zone, caused rival safe-haven dollar to hit multi-month highs against a basket of currencies, making gold more expensive for overseas buyers.

“Global bond yields are up sharply across the board and it appears that there are concerns that global growth concerns could get even uglier and that’s sending everyone back to the dollar,” said Edward Moya, senior market analyst at OANDA.

Gold prices tread water as markets weigh Fed policy path

“The global growth slowdown story will eventually prove to be a positive for gold and that would only come once the market becomes more skeptical about the US recession risks.”

Limiting gold’s downside, were trader’s expectations of a 95% chance of the Federal Reserve leaving interest rates unchanged at its Sept. 19-20 policy meeting, and a 60% chance that rates would remain at current levels for the rest of the year, according to the CME FedWatch tool.

Non-yielding gold loses its appeal when rates rise.

Focus was also on comments by Fed officials expected to speak during the week.

Fed Governor Christopher Waller said on Tuesday the latest round of economic data is giving the central bank space to see if it needs to raise rates again.

“In the meantime, the precious metal is showing signs of exhaustion on the daily charts with weakness below the 50-day SMA opening a path back toward $1,920,” Lukman Otunuga, senior research analyst at FXTM, said in a note.

Silver shed 1.1% to $23.70 per ounce, logging its biggest daily drop in a month.

Platinum dipped 1.9% to $936.17 and palladium eased 1% to $1,209.09.

Source: Brecorder