JNJ

+0.09%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

RWM

+0.64%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

XLV

+0.13%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

XLE

-0.03%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

ABBV

+0.49%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

PSQ

+1.05%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

META

-1.99%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

BRKa

-0.11%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

CL

-0.09%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

UNH

+1.12%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

GE

+0.03%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

NDX

-0.98%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

XOM

-0.12%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

DIA

-0.09%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

DE

+0.73%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

CSCO

-0.14%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

CAT

-0.89%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

CVX

+0.57%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

US2000

-0.46%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

DJI

-0.08%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

US500

-0.48%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

After raising rates in July, the Federal Reserve is all but certain to skip tightening at its policy meeting next week.

Fed Chair Powell will likely hint that a rate hike in November is very much a possibility amid the recent uptick in inflation.

As such, I used the InvestingPro stock screener to search for high-quality companies showing strong relative strength amid the current market environment.

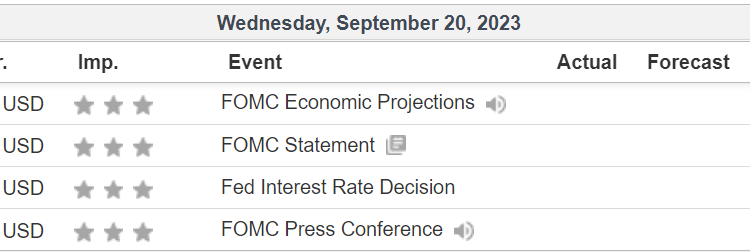

The upcoming week will play a pivotal role in shaping the Federal Reserve’s outlook for interest rates. In what is expected to be one of the most important Fed policy decisions of the year, the U.S. central bank is widely expected to pause its rate hiking campaign at the conclusion of its FOMC meeting on Wednesday at 2:00 PM ET.

Investing.com Economic CalendarSource: Investing.com

Investing.com Economic CalendarSource: Investing.com

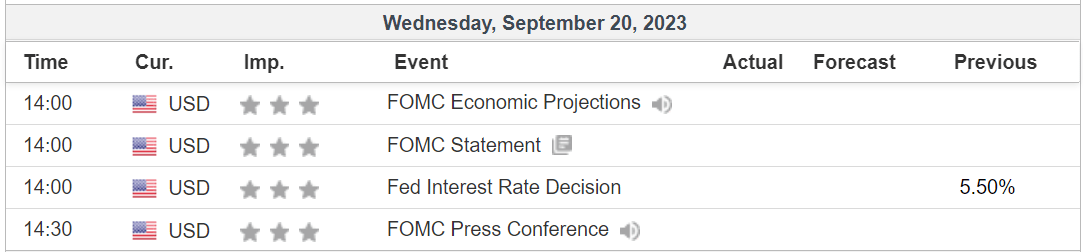

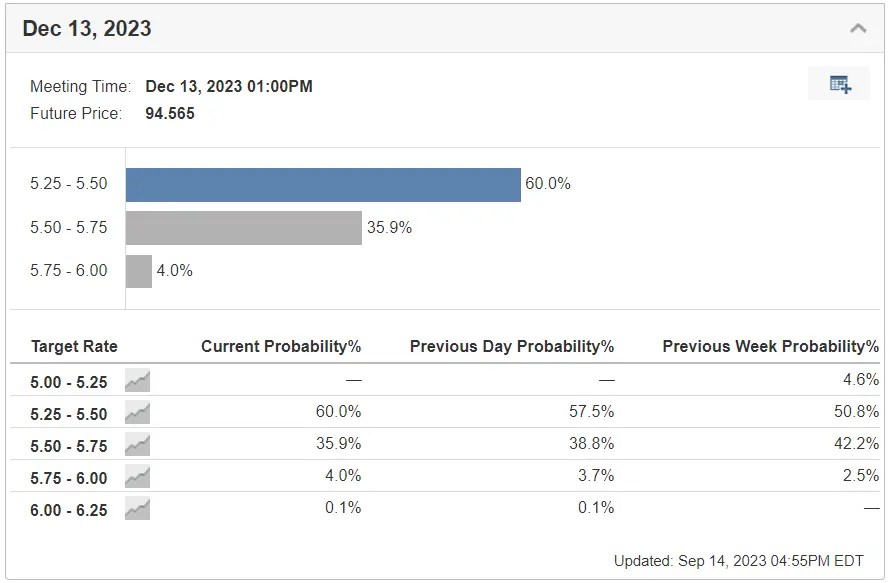

Financial markets are currently pricing in a 98% chance of the Fed holding interest rates at current levels, according to Investing.com’s Fed Rate Monitor Tool.

If the Fed does, in fact, skip further tightening next week, it will leave the benchmark Fed funds target range in a range between 5.25% and 5.50%, which is the highest level since January 2001.

Fed Funds Rate Source: Investing.com

Fed Funds Rate Source: Investing.com

Beyond the expected rate decision, all eyes will be on Fed Chair Jerome Powell, who will speak shortly after the release of the FOMC statement, as investors look for fresh clues on how he views inflation trends and the economy.

Policymakers will also release new forecasts for interest rates and economic growth, known as the ‘dot-plot,’ as investors grow increasingly uncertain over the Fed’s monetary policy plans through the end of the year and beyond.

Prediction: Hawkish Pause

While I expect the Fed to remain on hold next week, the accompanying policy statement will make sure to let everyone know that November could very well bring about another rate hike.

In addition, Powell will likely signal that further tightening will be necessary while stressing that the decision will remain data-dependent and that the U.S. central bank remains strongly committed to bringing inflation back down to its 2% goal.

As such, I would not be surprised to see most officials continue to project at least one more rate hike by year-end in their updated ‘dot plot’ projections.

That being the case, there is a growing risk that the Fed could raise rates to levels above where markets currently anticipate and keep them there for longer as there is still more work for them to do to slow the economy and cool inflation.

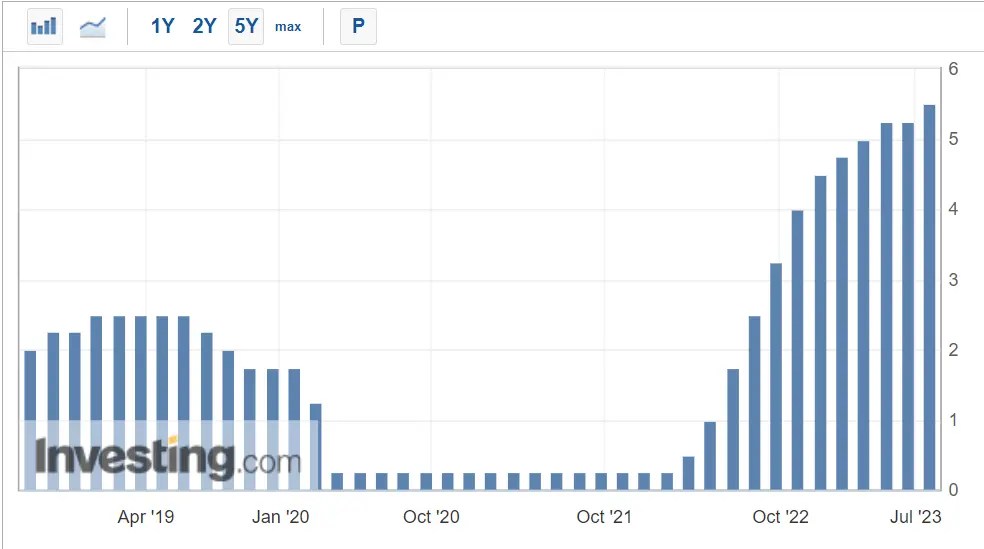

Indeed, U.S. consumer price data released this week showed inflation increased by 0.6% last month, the largest gain since June 2022, amid surging energy prices. In the 12 months through August, the CPI rate rose 3.7%, picking up from 3.2% in July.

CPI Data

CPI Data

Source: Investing.com

Excluding the volatile food and energy items, the core CPI measure edged up 0.3%, moderated by a decline in prices for used cars and trucks. Annually, core CPI slowed from 4.7% to 4.3%, the smallest year-on-year gain since September 2021.

Considering the recent spike in oil and gas prices, inflationary pressures will likely reaccelerate further in the months ahead, resulting in another wave of hot inflation.

Moreover, the economy continues to hold up much better than expected in the face of higher rates. Despite widespread expectations of a potential U.S. recession this year, the economy has proven considerably more resilient than anticipated by many on Wall Street amid a solid labor market and robust consumer spending.

Taking that into account, I remain hesitant to bet on an end to Fed tightening just yet. Indeed, futures tied to the Fed’s funds rate now show a roughly 40% chance of another rate hike by December, up from a 30% chance seen a month ago.

Fed Monitor Tool

Fed Monitor Tool

Source: Investing.com

At the same time, markets have pushed back the timing of the first rate cut next year to July 2024, compared with expectations a month ago that rates would begin falling by March, as inflation remains well above historical standards.

What To Do Now

Investors may want to exercise caution in the near term as the current environment is far from ideal to be adding to your exposure to equities. So long as inflation continues to be sticky and the Fed leaves the door open to another rate hike, I believe the stock market will struggle to make headway for the rest of 2023, and equities will face more volatility.

S&P 500 Daily Chart

S&P 500 Daily Chart

At the time of writing, I am short on the S&P 500, Nasdaq 100, and Russell 2000 via the ProShares Short S&P500 (NYSE:SH), ProShares Short QQQ (NYSE:PSQ), and ProShares Short Russell2000 (NYSE:RWM).

Additionally, I am long on the Dow Jones Industrial Average via the Dow Jones Industrial Average ETF (NYSE:DIA). I also have a long position on the Energy Select Sector SPDR ETF (NYSE:XLE) and the Health Care Select Sector SPDR ETF (NYSE:XLV).

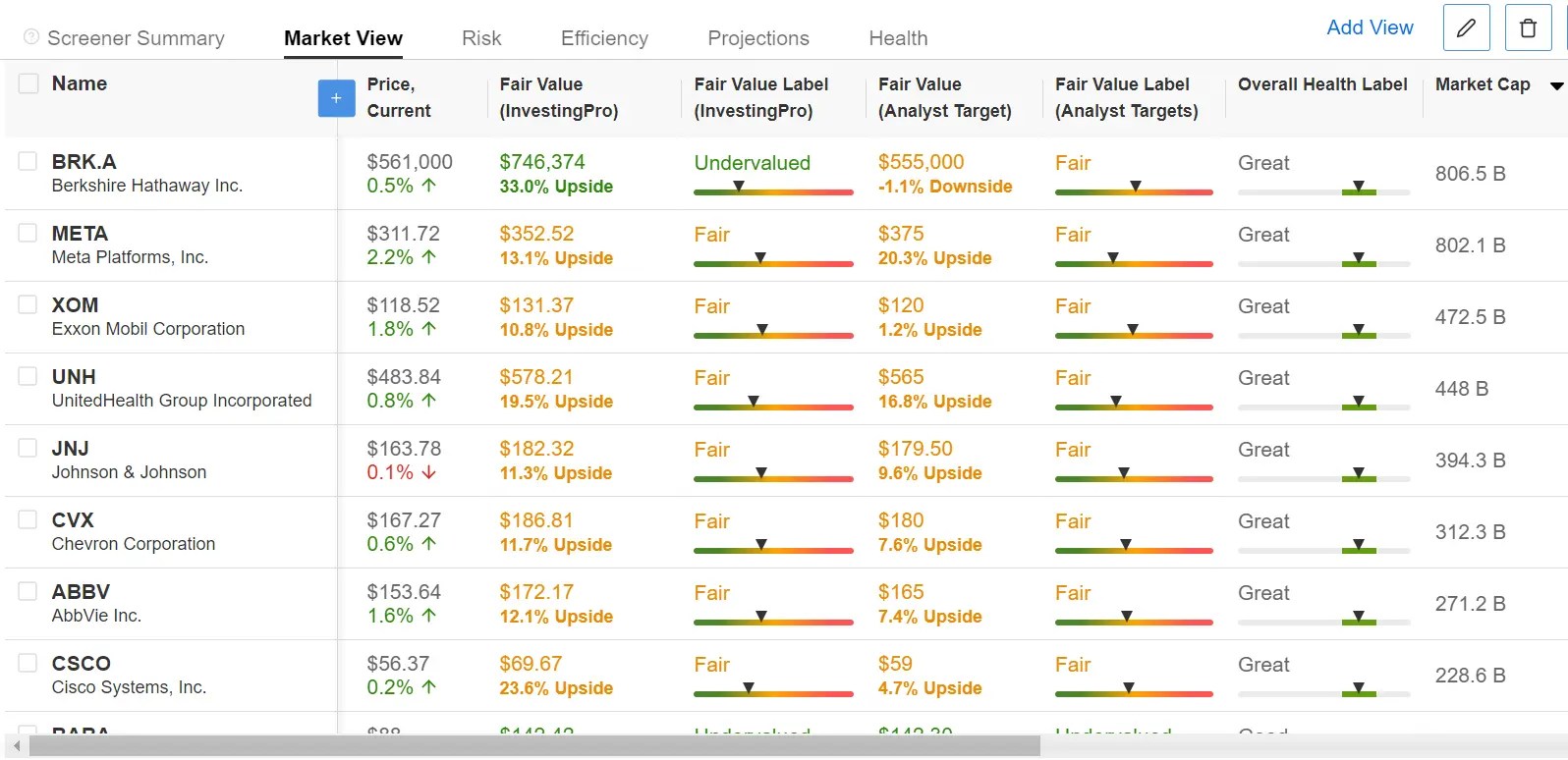

Taking that into consideration, I used the InvestingPro stock screener to build a watchlist of high-quality companies best placed to ride out the Fed-induced turmoil in the weeks and months ahead.

Not surprisingly, some of the most notable names to make the cut include Berkshire Hathaway (NYSE:BRKa), Meta Platforms (NASDAQ:META), ExxonMobil (NYSE:XOM), UnitedHealth Group (NYSE:UNH), Johnson & Johnson (NYSE:JNJ), Chevron (NYSE:CVX), AbbVie (NYSE:ABBV), Cisco (NASDAQ:CSCO), Caterpillar (NYSE:CAT), General Electric (NYSE:GE), and Deere (NYSE:DE).

InvestingPro ScreenerSource: InvestingPro

InvestingPro ScreenerSource: InvestingPro

For the full list of stocks that made my watchlist, start your 7-day free trial with InvestingPro. If you’re already an InvestingPro subscriber, you can view my selections here.

***

Find All the Info you Need on InvestingPro!

Disclosure: I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Source: Investing.com