PFE

+1.04%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

Despite a long-term downtrend since December 2021, Pfizer’s stock may still be undervalued

The company is now aiming to establish a stable, growth-oriented model following a year of stagnation

Pfizer’s overall financial health has remained solid and the stock could be on the verge of bottoming out

After experiencing a surge during the pandemic, Pfizer (NYSE:PFE) entered a long-term downtrend in December 2021. The stock showed signs of a potential recovery in the October-December period last year. However, it struggled to fend off the persistent selling pressure, ultimately resulting in the price returning close to pre-pandemic levels.

The company reaped substantial cash flow from the COVID-19 vaccine and Paxlovid sales. However, instead of resting on its laurels, the New York-based company chose to invest in its non-COVID-19 product portfolio and pursued growth through various mergers and acquisitions.

While the pharmaceutical giant faced some challenges in this process, it’s clear that it still maintains significant potential, even though the expected returns from these investments haven’t materialized yet.

A hiccup in Pfizer’s journey occurred when it had to halt production of a drug used in the treatment of type 2 diabetes and obesity due to elevated liver enzyme levels. Nevertheless, the company has another drug in the pipeline for these conditions, which is considered a promising alternative.

So far, trials of this alternative drug, named Danuglipron, have not encountered any issues. The results of these studies are expected to be available towards the end of the year, and it will be interesting to see how much of the market it can capture.

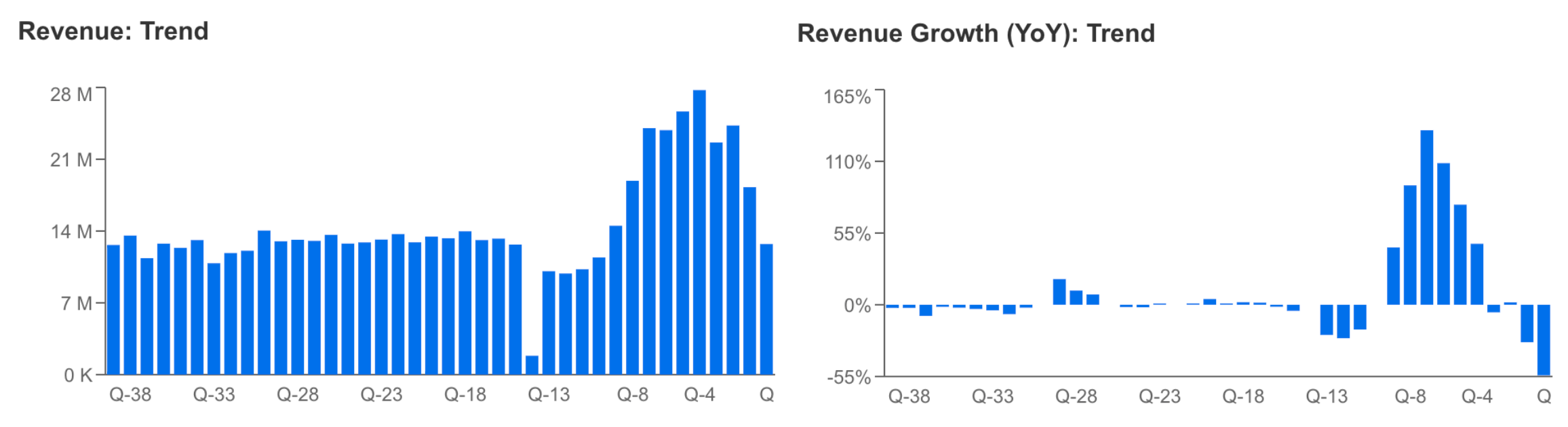

Pfizer’s stock took another hit in August when the company reported negative second-quarter earnings. The report revealed a 54% decline in total revenue for the last quarter, primarily due to reduced sales of non-COVID-19 products. This followed a 28% revenue decline in the previous quarter, further exacerbating concerns about pricing and performance.

Revenue Trend and Growth YoYSource: InvestingPro

Revenue Trend and Growth YoYSource: InvestingPro

In addition, it announced its earnings per share (EPS) as 0.64 dollars in the last quarter, 15% above expectations. However, last quarter’s revenue came in at $12.73 billion, 5% below InvestingPro expectations, creating negativity. The company also lowered its revenue forecast for 2023 from $67 – $71 billion to $67 – $70 billion following the latest quarterly data.

What Lies Ahead for Pfizer?

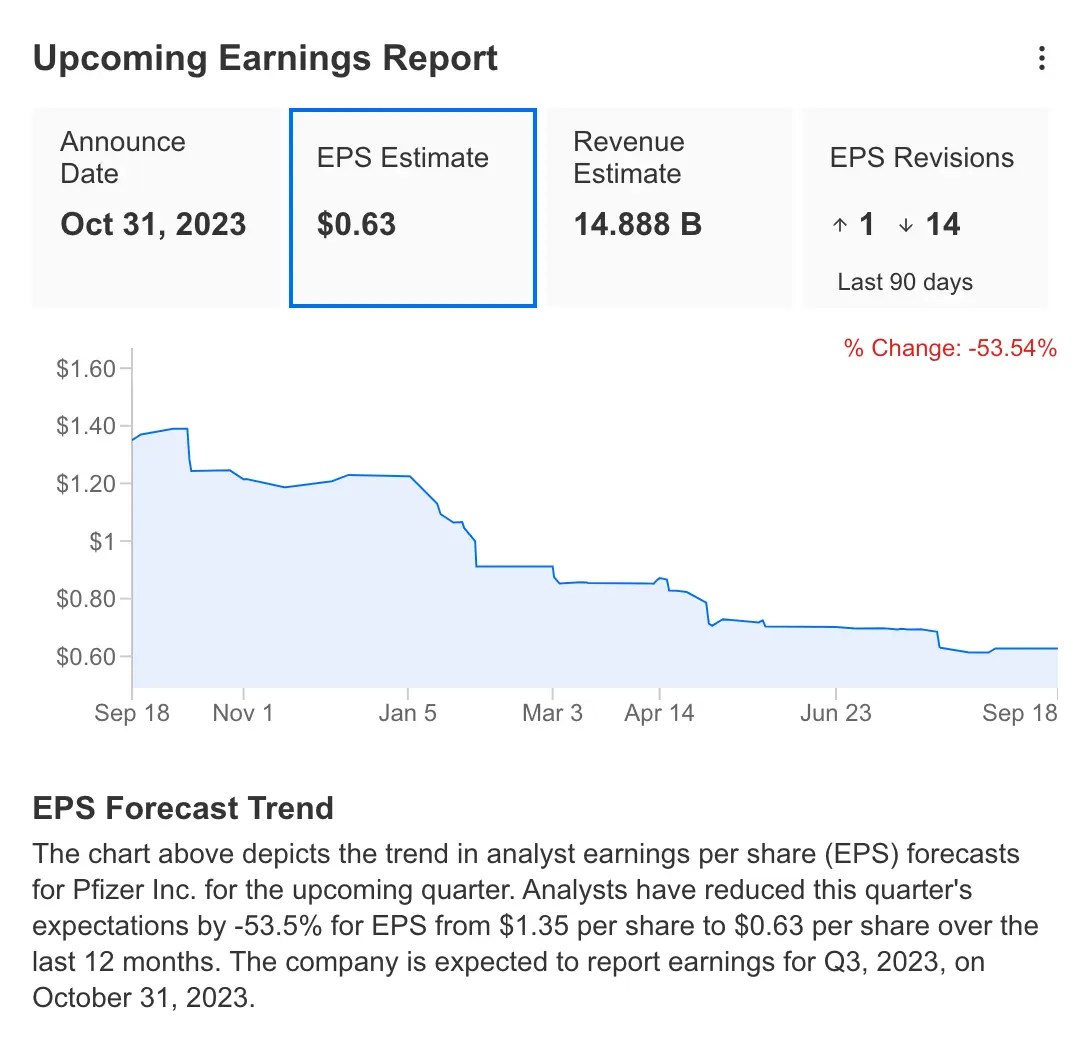

When we take a look at analyst forecasts through the InvestingPro platform, it is seen that 14 analysts have revised their estimates downwards for the Q3 report, which is expected to be announced on October 31. Accordingly, the consensus estimate for the current quarter is $4.88 billion, down 26% year-on-year. Analysts also lowered the EPS forecast by 53% to $0.63.

Upcoming EarningsSource: InvestingPro

Upcoming EarningsSource: InvestingPro

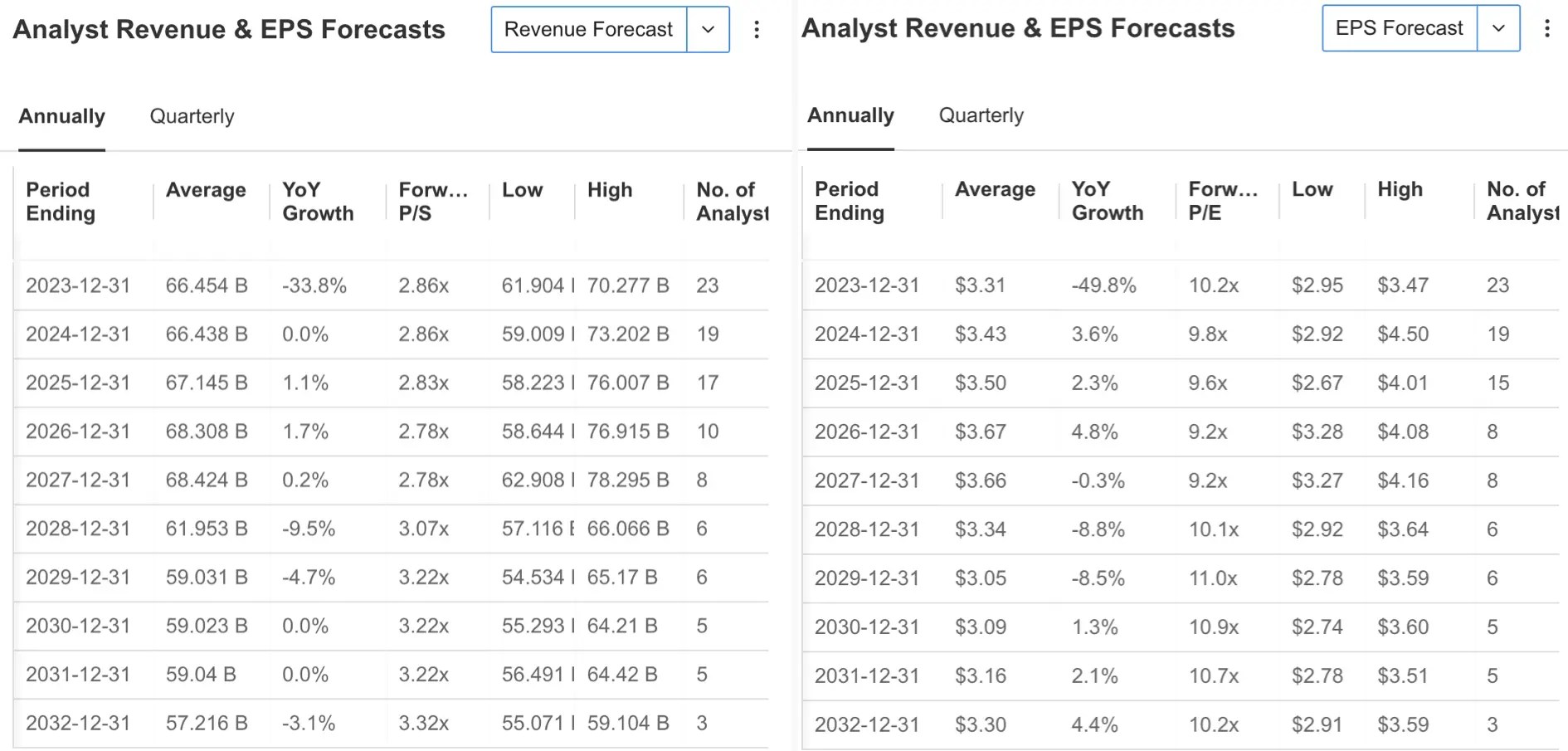

Looking at longer-term forecasts, EPS for the year-end is estimated at $3.31, down nearly 50%. There is a moderate upward view for the coming years. The revenue forecast for the year-end is $66.45 billion, down close to 34%. While Pfizer’s revenue is expected to increase modestly in the next 3 years, a weak outlook is predicted.

Analyst Revenue and EPS ForecastsSource: InvestingPro

Analyst Revenue and EPS ForecastsSource: InvestingPro

To reverse the pessimistic outlook, the company appears to be focused on establishing a stable and potentially growth-oriented model for the future after a year of stagnation. While the initial results of these efforts, such as a 5% increase in non-COVID-19 revenues, are not yet deemed sufficient, it is crucial for the company’s existing investments to evolve in a direction that will bolster its revenue in the upcoming periods.

In the most recent quarterly report, the company acknowledged the lingering uncertainty related to COVID. However, it anticipates that the increase in vaccination rates during the fall and winter months will have a positive impact on its earnings until year-end. Furthermore, the combination of the flu and COVID vaccines is expected to provide ongoing positive contributions in the medium and long term.

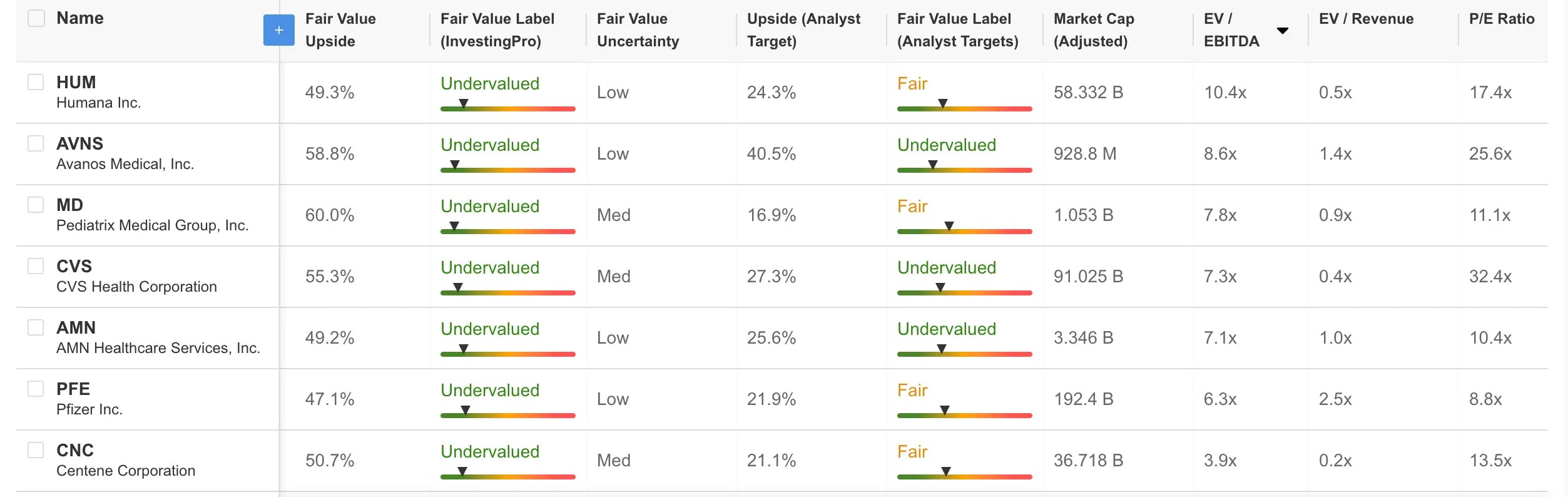

PFE Stock Is Significantly Undervalued

Despite the uncertainty surrounding Pfizer’s revenue margins, PFE’s stock exhibits a significant upside potential. When evaluating the company’s stock based on factors such as fair value analysis, analyst opinions, and price/earnings ratio, it becomes evident that PFE is currently undervalued by 47% in terms of fair value potential.

Analysts’ assessments suggest that the stock is trading at a discount of 22%. Moreover, Pfizer boasts a lower EV/EBITDA ratio compared to its peers and a reduced enterprise value relative to revenue. Additionally, with a price/earnings ratio of 8.8X, the company’s stock price appears quite low, signaling that PFE may have reached its bottom prices and possesses substantial potential for growth.

InvestingPro WatchlistSource: InvestingPro

InvestingPro WatchlistSource: InvestingPro

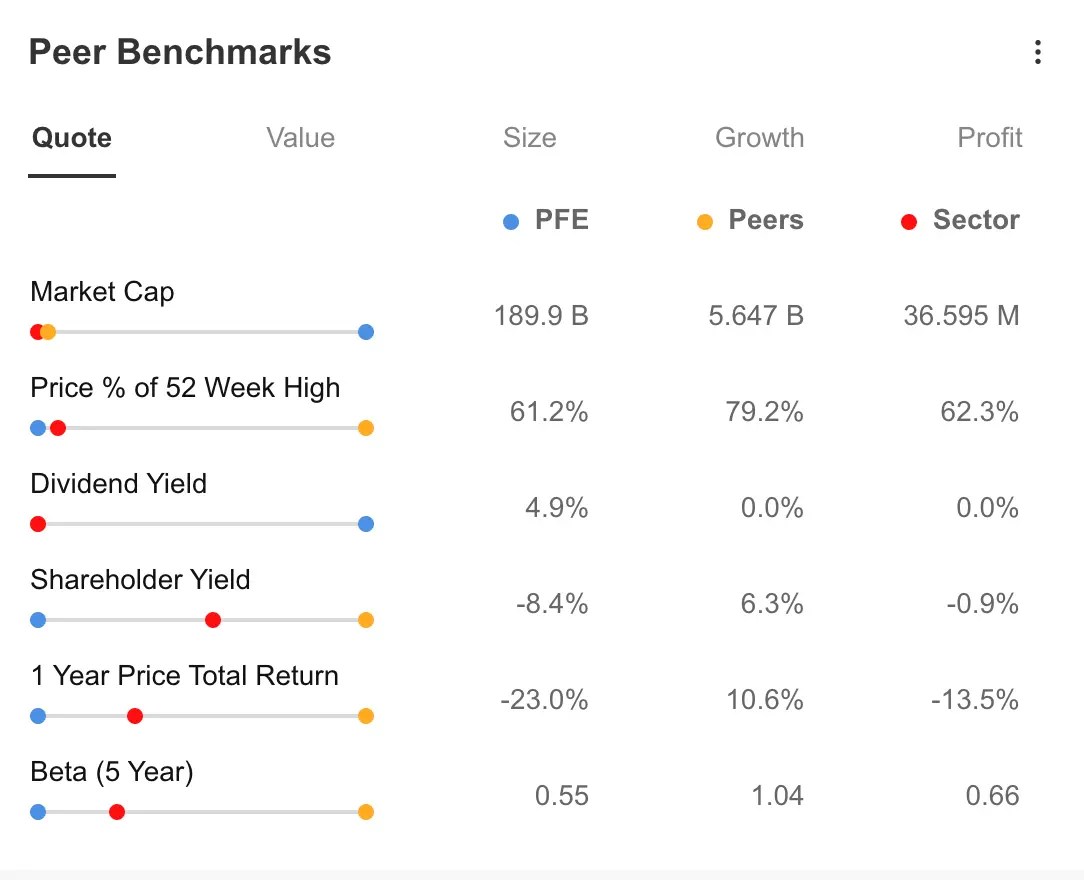

Continuing with the comparison of Pfizer with its peers and the industry, the company stands out with its market capitalization and dividend yield, while its shareholder return and total return over the last 1 year reflect negativity. While PFE is currently 61% away from its 1-year high, the fact that this ratio is close to the peers and the sector average gives an important clue that the problem is caused by sectoral difficulties.

Another noteworthy detail here is that PFE’s 5-year beta is at 0.55. According to the current beta, PFE stock is a defensive asset for the investment portfolio with the potential to reflect price movements that diverge from stock market movements.

Peer BenchmarksSource: InvestingPro

Peer BenchmarksSource: InvestingPro

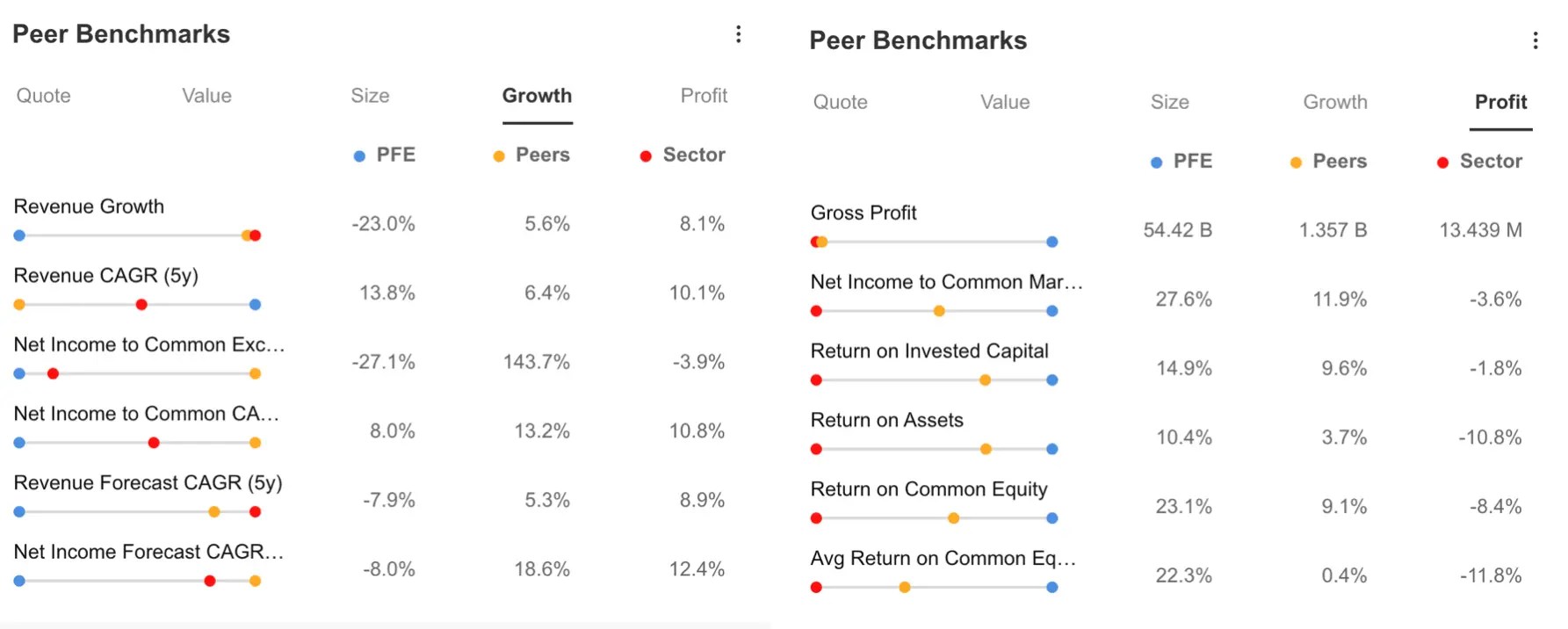

Let’s delve into a comparison focusing on growth and profitability. Pfizer’s growth indicators appear to be more challenging than those of its peers based on current results. While peers are experiencing a partial upturn in revenue growth, Pfizer is facing a negative trend in this regard.

Furthermore, revenue and net profit forecasts for the next 5 years don’t look particularly promising at the moment. However, it’s important to note that Pfizer’s profitability metrics continue to outperform those of its sector and peer companies. The company might encounter challenges in expanding its revenue given its current size, and its ability to generate rapid profits from its operations in comparison to peer companies should not be underestimated.

Peer Benchmarks – Growth and ProfitSource: InvestingPro

Peer Benchmarks – Growth and ProfitSource: InvestingPro

This is because the long-term perspective shows that investments made through mergers and acquisitions continue to reflect a significant income potential. In addition, in recent developments, the FDA has approved the vaccine, which has been harmonized with the latest COVID variants with Eris, for people aged 12 years and older. This is another factor that has the potential to boost the company’s revenue by the end of the year, depending on demand.

The company’s good financial health is summarized by the following points:

12 years of consecutive dividend increases, making it an attractive stock for long-term investors

High return on invested capital

Low volatility of the share price

Health of cash flow

Pfizer’s overall financial health is solid. The company’s profitability and relative value are the highlights, while its cash position, growth, and price momentum have also performed well.

src=

src=

Source: InvestingPro

As a result, the fair value analysis suggests that the stock is moving at a 45% discount to its current level of $33.6, reflecting the potential for the stock to reach close to $50 with low uncertainty. The consensus view of 23 analysts is that PFE could rise as high as $44 in the short term.

***

Find All the Info you Need on InvestingPro!

Disclaimer: The author does not own any of these shares. This content, which is prepared for purely educational purposes, cannot be considered as investment advice.

Source: Investing.com