Thursday, 13 August 2015 21:07

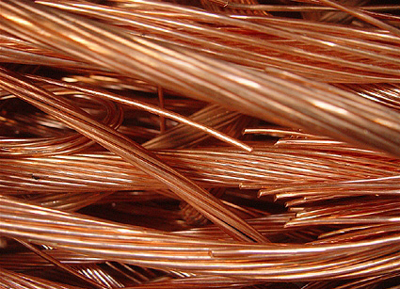

LONDON: Copper steadied on Thursday above the previous session’s six-year low after China’s central bank said there was no basis for further yuan depreciation, dampening concerns that the country’s appetite for metals imports could wane.

LONDON: Copper steadied on Thursday above the previous session’s six-year low after China’s central bank said there was no basis for further yuan depreciation, dampening concerns that the country’s appetite for metals imports could wane.

Weighing on base metals, however, was a stronger dollar, which makes dollar-priced metals costlier for non-U.S. investors.

Three-month copper on the London Metal Exchange had gained 0.2 percent to $ 5,200 a tonne by 1440 GMT.

The metal swung wildly on Wednesday. It plunged to a six-year trough of $ 5,062 a tonne in reaction to China allowing the yuan to weaken again after a mini-devaluation on Tuesday but recovered to finish the day with a gain of 1.3 percent.

“The initial reaction to the devaluation was overdone. We’ve just had a bit of relief when the market realised this is not going to be a series of devaluations,” said Grant Sporre, metals analyst at Deutsche Bank.

A weaker yuan makes imports for China, the world’s top metals consumer, more expensive.

The yuan, also known as the renminbi, dropped for a third straight day on Thursday, though its fall slowed after China’s central bank said there was no basis for more depreciation.

“With the renminbi unlikely to go into freefall, and with commodity prices currently very low, we still expect China’s commodities’ demand to pick up in tandem with industrial activity and exports later in the year,” Standard Chartered said in a note.

Nickel added 0.7 percent to $ 10,670 a tonne, having plunged 15 percent to a six-year low of $ 9,100 on Wednesday.

Matt Fusarelli, head of research at consultancy AME Group, said nickel should rebound by the end of the year.

“As prices approach $ 4.80 per lb ($ 10,582 per tonne), around 65 percent of finished nickel producers are making a loss on a cash cost basis,” he told the Reuters Global Base Metals Forum. “We expect December quarter prices to average around $ 14,000 a tonne, or $ 6.35 per lb.”

However, metals were also pressured by a rebound in the dollar, which extended gains after an upbeat report showing U.S. retail sales jumped in July, which should strengthen expectations of an interest rate rise as early as next month.

Aluminium dropped 0.7 percent to $ 1,578 a tonne, the sharpest fall in the base metals complex. The light metal hit a six-year low of $ 1,553.50 on Wednesday.

In industry news, miner and commodities trader Glencore said its first-half copper output from its own sources fell 3 percent to 730,900 tonnes and full-year output would be between 1.5 million and 1.55 million tonnes.