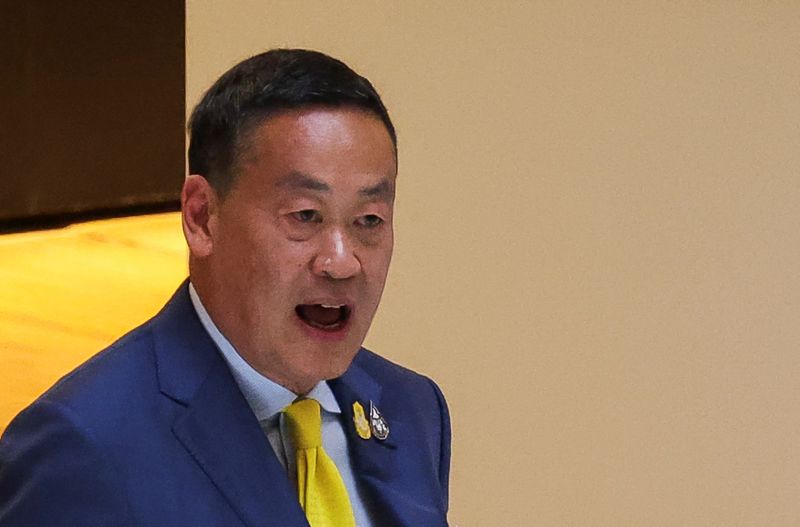

© Reuters. Thailand’s Prime Minister Srettha Thavisin delivers the policy statements of the Council of Ministers to the parliament, in Bangkok, Thailand, September 11, 2023. REUTERS/Athit Perawongmetha/File Photo

USD/THB

+1.26%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

By Satawasin Staporncharnchai and Chayut Setboonsarng

BANGKOK (Reuters) -Thailand’s Prime Minister Srettha Thavisin met the governor of its central bank on Monday, less than a week after an unexpected hike in interest rates seemed to clash with government efforts to stimulate the economy.

Earlier in the day Srettha had reiterated plans to inject 560 billion baht ($15 billion) into the economy next year through his signature digital wallet policy, the key election plank of his Pheu Thai Party.

“We exchanged opinions on economics and finance,” Srettha, a real estate mogul who is also finance minister, said in a posting on social media platform X, formerly known as Twitter, describing his meeting with the governor.

“It was productive and we will have these meetings on a monthly basis.”

The meeting came after the bank raised key rates last week to their highest in 10 years at 2.50%, while slashing its 2023 growth outlook to 2.8% from 3.6%, anticipating upside inflation risks from new government policies.

The bank raised its 2024 forecast to 4.4% from 3.8%. Growth was a sluggish 2.6% last year.

Srettha had already unveiled policies aimed at boosting short-term growth, from cutting electricity prices to waiving visa requirements for Chinese tourists.

Last month, BOT governor Sethaput Suthiwartnarueput said there was little need to boost consumption. After Friday’s rate hike, he said a pause was suitable “for now”.

All 20 economists in a Sept. 27-29 Reuters poll expected the BOT to hold rates at its next review on Nov. 29.

“Raising rates could slow down the economy because it delays investment,” said Siam Commercial Bank (OTC:SMUUY) economist Poonyawat Sreesing.

But as inflation comes into the range of 1% to 3%, rates are expected to hold, even if the economy grows at 5%, Poonyawat added.

The different approaches of the government and BOT are not at odds with each other, some analysts say.

“The central bank wants to ensure a stable recovery while the government wants the economy to return to normal … both want to see growth,” said Krung Thai Bank economist Phacharaphot Nuntramas.

The government’s approach poses some fiscal risks that have to be managed, the economist added.

In livestreamed remarks on Monday, Srettha reiterated the government would further reduce electricity prices and triple farmer incomes within four years, while pursuing new free trade pacts to draw foreign investors.

($1=36.7700 baht)

Source: Investing.com