Monday, 17 August 2015 23:04

LONDON: Copper prices slid on Monday on prospects for slowing demand in top consumer China, reinforced by last week’s move to weaken the yuan, and a higher dollar.

LONDON: Copper prices slid on Monday on prospects for slowing demand in top consumer China, reinforced by last week’s move to weaken the yuan, and a higher dollar.

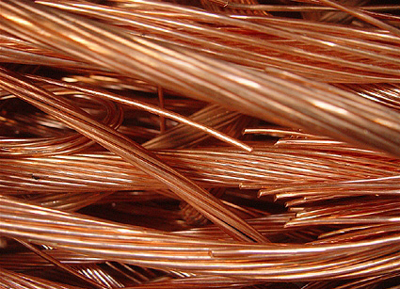

Benchmark copper on the London Metal Exchange was untraded at the close but was bid down 1 percent at $ 5,114 a tonne from $ 5,170 on Friday. The metal, used in power and construction, plunged to a six-year low of $ 5,062 last week.

China’s yuan posted its biggest weekly loss on record after the central bank’s surprise move to devalue its currency, seen as a bid to boost exports and growth.

But the move was also taken as a sign that Chinese authorities are seriously concerned about an economic slowdown turning into a hard landing.

“Broad-based weakness in base metals is very much related to growing fears about what’s going on in China, especially after last week’s currency shock there,” Julius Baer analyst Carsten Menke said.

“The interpretation is they want to foster export growth to make up for domestic weakness.”

A higher U.S. currency makes commodities such as copper more expensive for non-U.S. buyers.

Expectations for lower prices can be seen in speculative positioning data from Marex Spectron, which estimates that as of Aug. 13 the copper short was largely unchanged week-on-week at 19 percent of open interest.

“Meanwhile, the spec short on aluminium grew to 29 percent of open interest, making it … the biggest spec short registered in aluminium since August 2012,” Marex said in a note.

Three-month aluminium ended lower at $ 1,567 from Friday’s last bid at $ 1,580.

Aluminium has come under pressure in recent weeks due to a deluge of exports from top producer China, creating a global glut of the metal used in transport and packaging.

Zinc slipped to $ 1,815 from $ 1,830 and lead to $ 1,728.5 from $ 1,750. Tin was unchanged at $ 15,450.

Nickel firmed to $ 10,625 from $ 10,600.

The stainless steel ingredient was supported by expectations of tighter supplies due to a strike at South Africa’s Nkomati Nickel mine. Outages at Vale’s On?a Puma nickel mine in Brazil’s Amazon also helped.

“We won’t see meaningful rises (in nickel prices) until we see large falls in inventories,” a trader said.

Nickel stocks in LME approved warehouses at 454,818 tonnes account for about three months of global consumption, which is estimated at about 1.9 million tonnes this year.