USD/JPY

-0.12%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

DXY

-0.20%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

US10Y…

-1.29%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

Bank of Japan intervention aims to draw line in the sand for the yen

Meanwhile, yields continue to surge in the US

Against this backdrop, a bigger recovery for the Japanese currency remains highly unlikely

Once bitten, twice shy? Not with dollar bulls, and not when the prey is the yen.

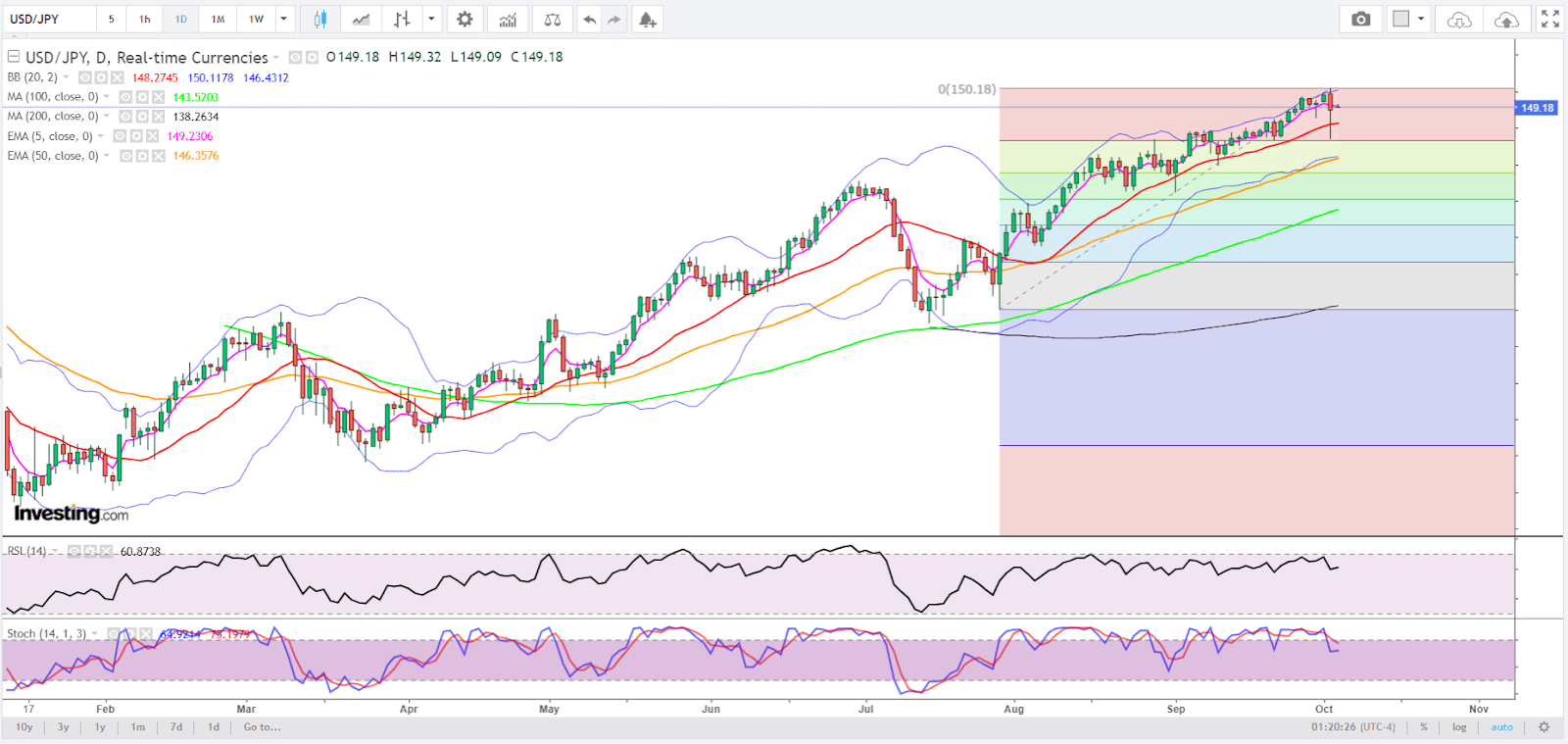

A day after an apparent intervention by the Japanese government, USD/JPY was bobbing at between 149.32 and 149.09 — having survived the year-low and line in the sand of 150 drawn by Tokyo.

Yet, few have illusions that those stalking the yen have been dissuaded by the events of Tuesday.

Well before the fightback many think was engineered by Japan’s finance ministry — as of Wednesday, the nation’s top currency official Masato Kanda declined to say if the government had indeed stepped into the ring against the greenback — the bigger target of USD/JPY bulls was 155.

USD/JPY Daily

USD/JPY Daily

Charts by SKCharting.com, with data powered by Investing.com

That seemed to be still in the sights of the dollar’s proponents, especially with the US currency laden with the Federal Reserve’s higher-for-longer rates ammo versus the yen, weighed by the Bank of Japan’s lower-for-the-foreseeable-future rates regime (despite BoJ pledges for change, which few believe).

Said David Scutt, forex and rates specialist and analyst at City Index:

“USD/JPY has morphed into a play on yield differentials between the United States and Japan rather than the risk appetite barometer it once was, meaning forecasts involving the pair are really a reflection of what’s likely to happen with interest rates.”

“As such, whether the Federal Reserve continues running monetary policy at restrictive levels, or if the BOJ manages to unwind its array of easing measures, will likely play a significant role in determining how USD/JPY closes out 2023.”

It’s Not Really About Saving the Yen; It’s About Fighting the Dollar

From a range of plausible scenarios examined by Investing.com, including that of Japanese currency officials playing bogeymen again to defend the yen, none seem to offer a long-term fix for the ills plaguing the JPY.

Just two months ago, the dollar was in a far less enviable position than now amid the notion that the Fed was done hiking after 11 increases between March 2022 and July 2023 that added 5.25 percentage points to a base rate of just 0.25%.

Everything, however, changed when the Fed’s projections for September — despite its pause on rates then — showed its determination to put in another quarter point increase in either November and December. Jawboning by an assortment of Fed officials since, on why rates need to stay restrictive, catapulted the Dollar Index to 11-month highs as of Tuesday.

The Fed Doesn’t Have to Hike; Markets May Do Its Work

Even if the Fed doesn’t hike any more, the markets may do its work in keeping inflation under control by continuing to increase bond yields to tighten financial conditions for the real economy, increasing borrowing spreads for corporates and households and inducing greater volatility in asset prices (including putting a leash on oil). The central bank may not — or may never — get to its cherished 2% per year target for inflation, with the current 3.7% possibly stabilizing at 3.0-3.2%.

Bond yields, meanwhile, could continue going north unless a major crisis of confidence shakes the United States. A temporary government shutdown was staved off this week through a bipartisan pact, though that has led to another crisis involving the removal of the speaker in Congress by Republicans furious with his capitulation to the Democrats. That may still not be enough to earn America a new negative credit rating.

The end result of all these is that the yield on the 10-year Treasury note could be charting new peaks well beyond Tuesday’s near 4.8%, which is already the highest since August 2007. The dollar will get pulled along for the ride and that’s all that will matter to USD bulls.

Time … and Every Imaginable Odd Stacked Against the Yen

With the yen though, the odds are stacked against it at every turn. Firstly, the chance of the BOJ doing a policy U-turn before the end of the year is highly remote. The odds don’t get better even over the longer time horizon. The yield on the Japanese 10-year note has barely budged above 0.76%.

The BOJ’s real problem, as multiple analyses suggest, is time — or rather, the lack of it.

Right now, Japan’s central bank can’t abandon its ultra-easy monetary policy settings because the ‘virtuous cycle’ between wage growth and inflation is not yet self-sustaining. While Japan is battling inflation, it’s also fighting sluggish economic growth, challenging demographics and a deflationary mindset among its people that make a sustainable pickup in wages next year anything but certain.

Until that becomes a plausible scenario in itself, the BOJ is unlikely to significantly alter yield curve control – the policy of suppressing bond yields lower than where market forces would normally dictate – nor lift its key overnight policy rate from -0.1%.

So, we may go into late 2024 — or well beyond that, provided it even gets there — for the BOJ to unwind its super-easy settings.

Thus, back to the question: Can Japan effectively defend the yen?

After traversing the Japanese financial, macro, social and forex landscape, the short answer from our analysis at Investing.com is “highly unlikely”.

Scutt of City Index has a far more elaborate take on it:

“If the BOJ acts on behalf of the government to boost the value of the yen by intervening in the currency market, it will be near-useless beyond the immediate impact if not accompanied by a narrowing in yield differentials.”

“Regardless of how Japanese policymakers frame persistent weakness in the yen, it’s being driven by fundamental factors of their own doing. If the BOJ were to intervene without a compression in yield differentials, it would likely result in markets attempting to reverse the move once the apparent threat of further intervention has subsided.”

Diego Colman, another currency strategist writing on the Daily FX platform, concurs with similar conclusion:

“While Tokyo’s FX intervention could provide brief respite to the yen and curb speculative activity from time to time, it will not alter the currency’s depreciatory trajectory as long as the underlying market fundamentals remain the same.”

“These dynamics and yield differentials clearly favor USD/JPY strength.”

Outlook for USD/JPY

An analysis on USD/JPY would be remiss without an outlook on where the pair is headed.

Sunil Kumar Dixit, chief technical strategist at SKCharting.com and a regular collaborator on commodities charting with Investing.com, believes USD/JPY may be headed for 152 if all defense of the yen fails.

USD/JPY Weekly

USD/JPY Weekly

“While the broader outlook remains bullish as long as the dollar-yen pair maintains stability above the 5-week EMA, or Exponential Moving Average, of 148.33, a break below the zone will eventually extend decline to 146.50 and 144.50 over short term.”

“But if 147.30 low is not breached, the bullish formation remains intact, extending the rally that targets 151 and 152.”

Dixit also notes intraday consolidation below the 4-Hour Middle Bollinger Band of 149.50 that may cause sideways trades and a retest of the Simple Moving Average of the 4-Hour 100 SMA of 148.35 and the 200 SMA of 147.35.

Scutt, meanwhile, thinks a range trade of between 145 and 152 looks probable over a three-month time horizon, “with directional risks outside this range biased higher”.

USD/JPY 4-Hourly

USD/JPY 4-Hourly

***

Disclaimer: The aim of this article is purely to inform and does not in any way represent an inducement or recommendation to buy or sell any commodity or its related securities. The author Barani Krishnan does not hold a position in the commodities and securities he writes about. He typically uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables.

Source: Investing.com