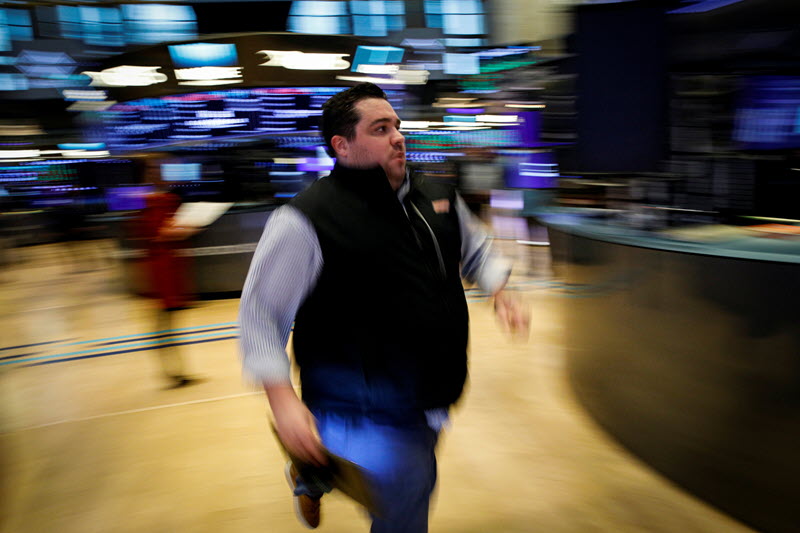

© REUTERS

DJI

+0.39%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

US500

+0.81%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

INTC

+0.67%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

MSFT

+1.78%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

GOOGL

+2.12%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

AAPL

+0.73%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

MRO

-4.98%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

DVN

-5.25%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

SLB

-4.74%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

IXIC

+1.35%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

Investing.com — The Dow closed higher to snap a three-day losing streak on Wednesday as data showing the pace of private job growth slowed to a 32-month low eased fears somewhat that the Federal Reserve may not need to hike again before year-end, halting the recent rise in Treasury yields.

The Dow Jones Industrial Average rose 0.4%, 127 points, Nasdaq surged 1.4%, and the S&P 500 rose 0.8%,

Slowing private job gains, weaker services data keep lid on Treasuries yields

private payrolls grew by 89,000 in September, a sharp decline from the 180,000 in August, according to a report released Wednesday by ADP and Moody’s (NYSE:MCO) Analytics. That was well short of economists’ forecast of 153,000 and the pace of slowest growth since January 2021.

The slowing job gains seen last month pointing to the easing tightness in the labor market contrasted with data released Tuesday showing an unexpected labor strength in demand.

The fewer private job gains last month has also coincided with a “steady decline in wages in the past 12 months,” Nela Richardson, chief economist at ADP, said.

U.S. services activity, meanwhile, slowed slightly in September, adding to hopes that the Fed’s higher for longer rates are starting to bite into growth in services sector, which remains a key driver of inflation.

Treasury yields took a breather from their recent melt up following the data amid easing bets that the Fed will be forced to hike rates in November.

About 22% of traders expect the Fed to raise rates in November, down from nearly 30% a day earlier, according to the Investing.com’s Fed Rate Monitor Tool.

Tech in vogue as rates storm calm; Intel gains on spin off plans for programmable chip business

Growth sectors of the market including tech were back in demand underpinned by easing Treasury yields, with Alphabet Inc Class A (NASDAQ:GOOGL) and Microsoft Corporation (NASDAQ:MSFT) leading to the upside.

Apple Inc (NASDAQ:AAPL) closed nearly 1% higher despite KeyBanc downgrading the iPhone maker to sector weight from overweight, citing valuation concerns.

Intel (NASDAQ:INTC) rose after detailing plans late Tuesday to separate its programmable chip business into a standalone entity starting Jan. 1, paving for initial public offering in two to three years

The move suggests that Intel “isn’t done restructuring its assets through shareholder friendly strategies, creating room for more potential value creation moving forward,” Wedbush said.

Energy slips on falling oil prices as gas inventories jump, OPEC+ holds the line on production

Energy stocks failed to join in on the broad market rally as oil prices slumped more than 5% after gasoline inventories jumped and ministers from OPEC and allies led by Russia, or OPEC+, decided to keep production levels unchanged.

Marathon Oil (NYSE:MRO), Devon Energy Corporation (NYSE:DVN), and Schlumberger NV (NYSE:SLB) were among the biggest decliners on the day.

The decision to stand pat on production was widely expected, while Saudi Arabia and Russia reiterated they will persist with supply cuts through year end.

The supply cuts are needed to offset slowing demand growth and support prices.

“OPEC+ leaders need to remain committed to supply restraint—and keep output near current levels over the next year—to keep oil inventories generally low and prices high,” S&P Global said in a report earlier this week.

Source: Investing.com