Wednesday, 19 August 2015 18:59

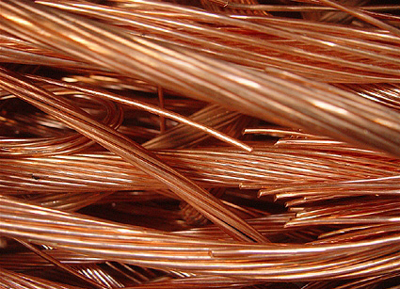

LONDON: Copper held steady on Wednesday as the dollar fell and Chinese stock markets staged a late recovery, though persistent concerns over Chinese demand kept prices near six-year lows.

LONDON: Copper held steady on Wednesday as the dollar fell and Chinese stock markets staged a late recovery, though persistent concerns over Chinese demand kept prices near six-year lows.

Chinese stocks reversed sharp declines to end higher on Wednesday after the central bank injected more funds into the financial system in a bid to calm panicky markets.

The recovery cut demand for the safe-haven dollar, easing pressure on dollar-priced metals. However, persistent worries over Chinese growth sent global equities and oil lower on Wednesday, while metals investors remain unnerved by stuttering factory growth in China and falls in power generation and property prices.

China consumes some 45 percent of the world’s copper.

Three-month copper on the London Metal Exchange dipped 0.1 percent to $ 5,018 a tonne by 0945 GMT, recovering a 1.5-percent loss in the previous session when it broke below $ 5,000 for the first time since July 2009, falling to $ 4,983.

“Sentiment is extremely bearish at the moment (but) we disagree that the situation in China is as dire as prices imply. Most metals in China are trading in backwardation and the price difference between Shanghai and London makes imports viable,” said Commerzbank analyst Eugen Weinberg. Giving copper prices some support was data showing cash copper trading at a discount of just $ 1.50 a tonne to the three month price, near its narrowest since May.

Also, the total net “short” or sell position of money managers trading LME copper fell on Friday from the previous week. But most analysts and investors remains firmly pessimistic about copper and other base metals for now.

“Chinese concerns have pushed base metal prices to multi-year lows, which are not (yet) reflected in demand and inventory data. Due to elevated uncertainty and limited upside potential, we advise against bottom-fishing in copper and aluminium,” said Julius Baer analyst Carsten Menke.

Investors are awaiting the minutes of the Federal Reserve’s July meeting due later on Wednesday for clues on the timing of a Fed rate increase, which would support the dollar and put further pressure on metals.

In other metals, tin rose 1.2 percent to $ 1,5330 a tonne, supported by a drop in available LME stocks that sent cash tin to its highest premium in six years against the benchmark contract on Tuesday at $ 540 a tonne.

Tin has also garnered support from a move by Indonesia to tighten its export rules, though investors are still awaiting evidence that exporters will abide by the rules and for signs of a turnaround in demand from the electronics sector.

Nickel edged up 0.6 percent to $ 10,425 a tonne.