EUR/USD

+0.26%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

DXY

-0.14%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

US10Y…

+1.16%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

The strength of the US dollar dominates forex markets, dimming the Euro’s prospects.

Geopolitical events in the Middle East fuel risk aversion, boosting the dollar’s safe-haven status.

Factors like Federal Reserve speeches and ECB’s stance shape the uncertain outlook for EUR/USD.

For currency traders, it’s hard to be a bull of anything except the dollar, it seems.

The EUR/USD is one of those forex pairs on the backfoot again this week after finally building some upward momentum from the middle of last week to Friday, as it caught a break from the double whammy of a Dollar Index at 11-month highs and US Treasury yields at 16-year peaks.

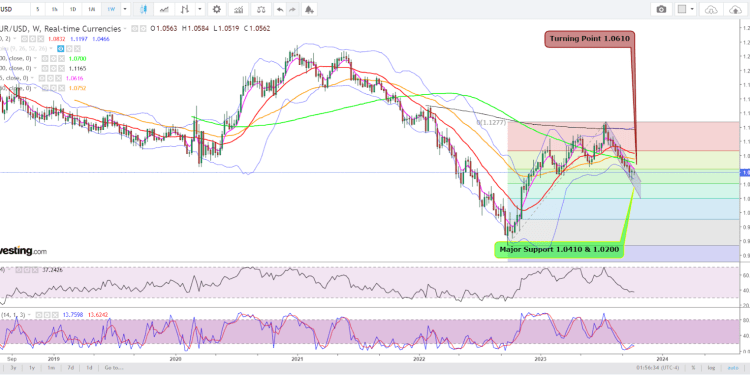

EUR/USD Weekly

EUR/USD Weekly

Charts by SKCharting.com, with data powered by Investing.com

As of Monday, the magic was gone for anyone who had turned long on the euro — or even contemplating it — as the weekend events in the Middle East led to refocus on geopolitical risk as never before since the Ukraine invasion.

Coming after the 2019 raid on Saudi oil facilities by Houthi rebels and ending four years of relative peace in the region that prevailed through the coronavirus pandemic, the flare-up in Israel-Palestine fighting ignited by the Saturday attacks of militant group Hamas on Gaza has also heightened the risk aversion in place since the start of October.

In its safe-haven role, the dollar is again the king of the forex heap, rubbing a little shine off everything it’s been paired with — even gold, as the spot price of bullion wallowed in the red again after a one-day rally Monday.

We’ll get to a detailed study of the EUR/USD outlook imminently with Investing.com’s regular technical charts collaborator Sunil Kumar Dixit. But let’s first examine market events and variables that may influence the euro-dollar relationship.

EUR/USD: What’s in the Pipe?

Federal Reserve speeches:

A number of officials from the US central bank are due to speak later Tuesday, ahead of the release of the minutes of the September monetary policy meeting on Wednesday and Thursday’s US Consumer Price Index data.

CPI data, due on Oct. 12, is expected to grow 3.6% in the year September, a notch lower than the 3.7% registered in August. But expectations for inflation are still high after blowout US non-farm payrolls growth in September that came in way above market expectations.

The dollar’s gains may be stunted somewhat if more Fed policy-makers stay on the path of caution with rates — like on Monday — instead of butting inflation head-on.

“If long-term interest rates remain elevated because of higher term premiums, there may be less need to raise the Fed funds rate,” Dallas Fed president Lorie Logan said on Monday.

Fed Vice Chair Philip Jefferson also said the central bank would need to “proceed carefully” given the recent rise in yields.

ECB Chief Lagarde’s Speech:

The euro has already drifted lower ahead of ECB chief Christine Lagarde’s speech at the IMF and World Bank annual meetings in Morocco, as European markets awaited the release of Italian industrial production figures for August.

ECB governing council member Klass Knot, who also heads the Dutch central bank, has already set the theme for Lagarde, saying on Monday that he would be comfortable with holding rates at where they were at the bank’s Oct. 26 meeting — or rather, lower-for-longer.

Italian inflation data is expected to show an annual fall of 5%, a deterioration from the previous month’s 2.1% drop, an indication of the difficulties the region is having the day after the equivalent German release added fuel to fears of a potential recession.

German industrial production already contracted more than expected but marginally improved relative to the July print. Overall, the European economic outlook remains bleak and will continue to weigh negatively on the local currency.

EUR/USD — Technical Outlook

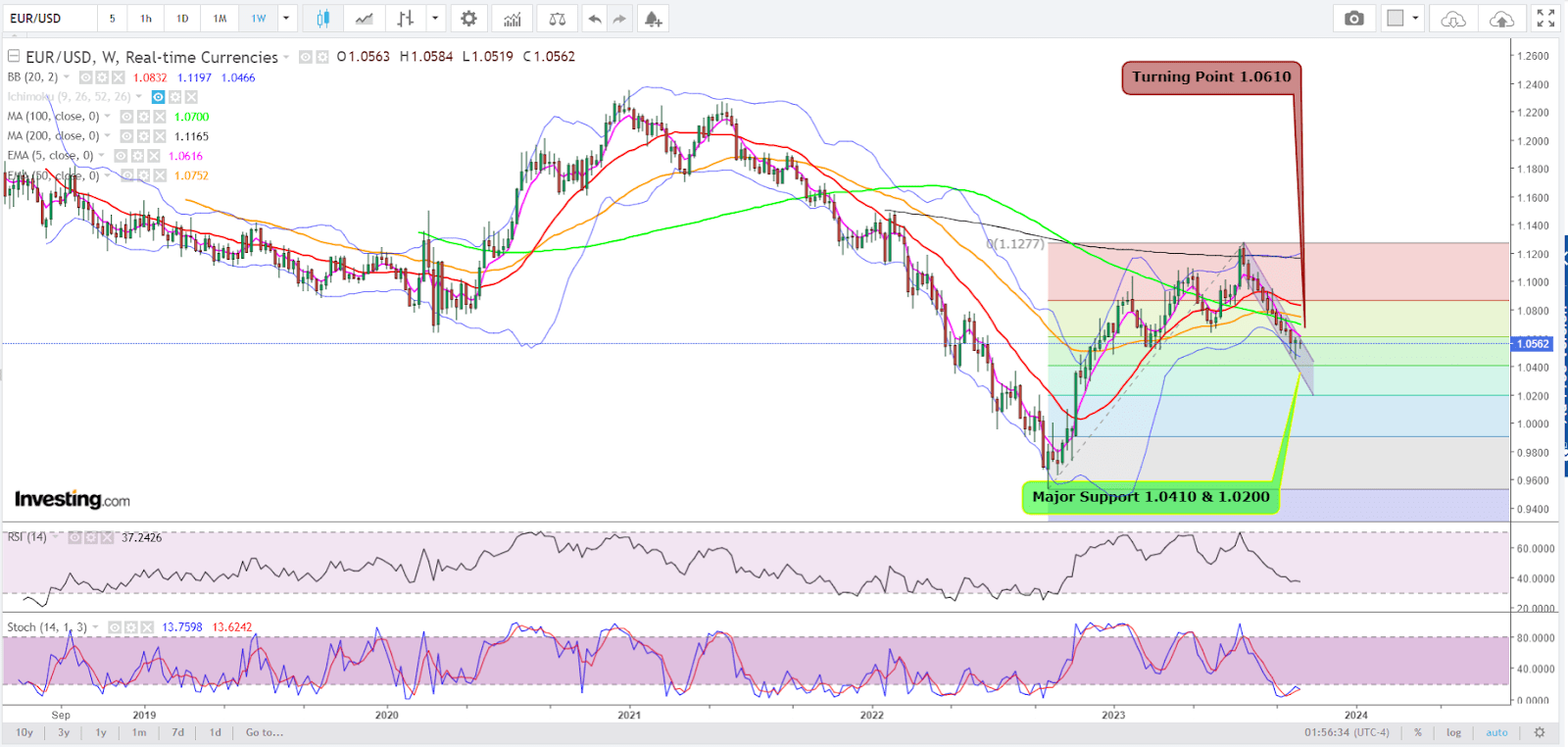

EUR/USD Daily

EUR/USD Daily

The euro-dollar pair has approached support at the 50% Fibonacci level of 1.0410 that retraces the bullish wave that went from 0.9535 to 1.1277, as per the reading of our charts collaborator Dixit, who heads SKCharting.com.

He adds:

“The daily chart structure of EUR/USD shows a downward correctional wave moving within a descending channel, while the current advance attempts to reach the channel resistance zone, marked by the Daily Middle Bollinger Band of 1.0593, which needs to be cleared for further challenge at the 38.2% Fibonacci zone of 1.0610.”

These levels could also be turning points for further direction of the pair, Dixit points out.

“A sustained break above this resistance zone with rising volume will eventually extend the upside momentum that targets the 50-day EMA, or Exponential Moving Average, of 1.0710. Major challenges are seen at the 200-day SMA, or Simple Moving Average, of 1.0820 and the 100-day SMA 1.0840, followed by the 23.6% Fibonacci zone of 1.0865.”

Dixit also cautions that if the pair fails to clear through the 1.0610 barrier, “we see high chances of a downward correctional wave to retest the swing low of 1.0450, extending to the 50% Fibonacci zone of 1.0410.”

***

Disclaimer: The aim of this article is purely to inform and does not in any way represent an inducement or recommendation to buy or sell any commodity or its related securities. The author Barani Krishnan does not hold a position in the commodities and securities he writes about. He typically uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables.

Source: Investing.com