CL

-0.86%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

US1MT=X

-0.01%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

US2YT=X

-2.20%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

US10Y…

+0.04%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

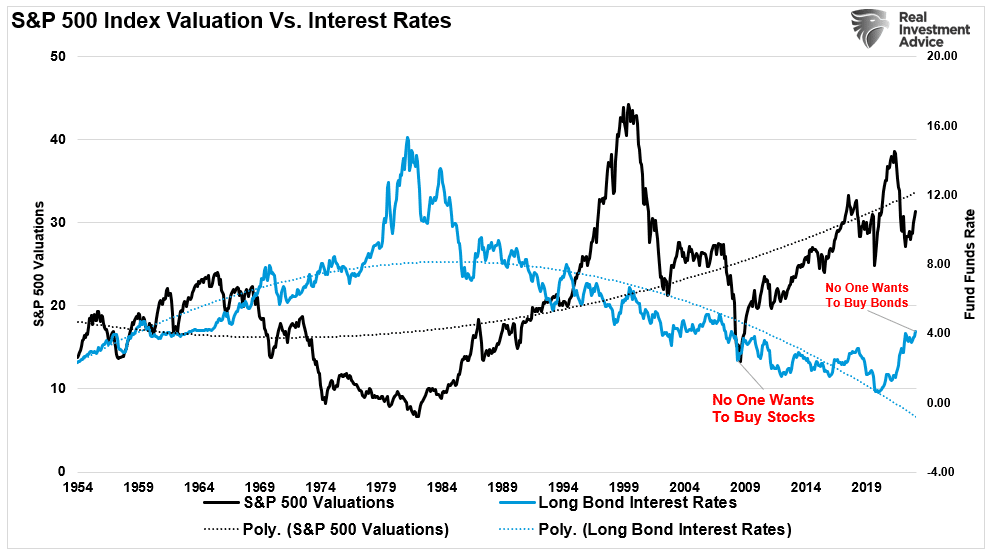

Psychology in markets is always fascinating. In February 2009, I wrote “8 Reasons For A Bull Market.” While in hindsight, it is easy to see that was the right call, overall, psychology was highly negative at the time.

The arguments for lower stock prices and a continued economic recession were rampant. Most importantly, investor psychology was extremely bearish, and stock valuations were dramatically cheaper. It is the opposite today, with investors shunning cheap bond valuations in favor of overvalued equities.

Stock Valuations vs Interest Rates.

Stock Valuations vs Interest Rates.

Another example was in 2021. Following the crash in oil prices and the ESG movement, we made the case for owning energy stocks as investors shunned energy companies.

They were the best-performing asset class in 2023.

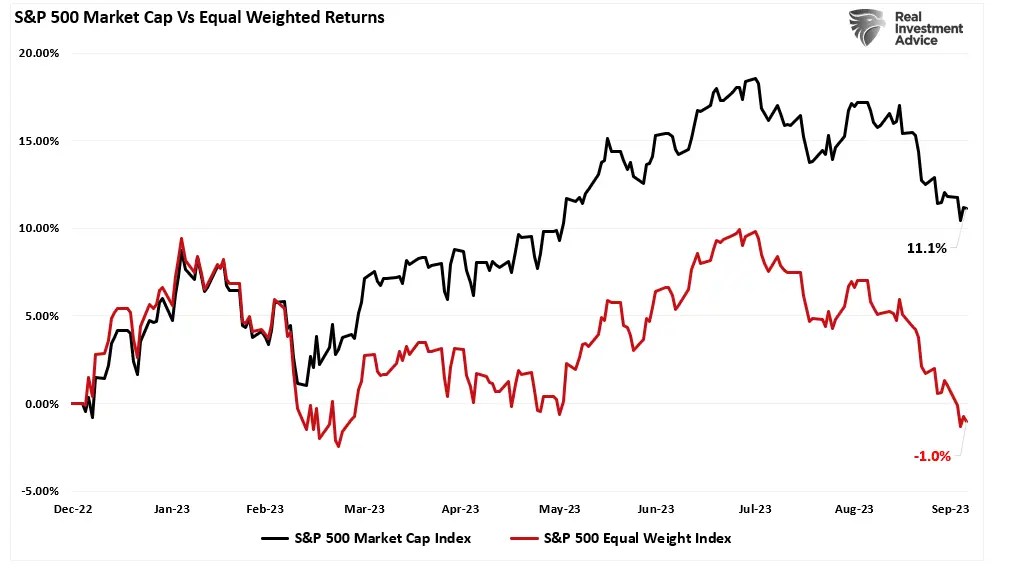

Again, in November 2022, we wrote an article discussing the perceived ‘death’ of FANG stocks. The reason was the extreme pessimism in the sector during the market correction. To wit:

“As investors seek out investments with sustainable earnings growth rates in a slowing economic environment, many FANG stocks will garner their attention. Combine that focus with the inflows from passive investors when the market cycle turns, ongoing share buybacks, and the liquidity needs of major investors; likely, FANG stocks will still find some favor.”

Unsurprisingly, 2023 has been the year of the “Mega-7” stocks driving the overall market returns.

S&P 500 Market Cap vs Equal Weighted Returns.

S&P 500 Market Cap vs Equal Weighted Returns.

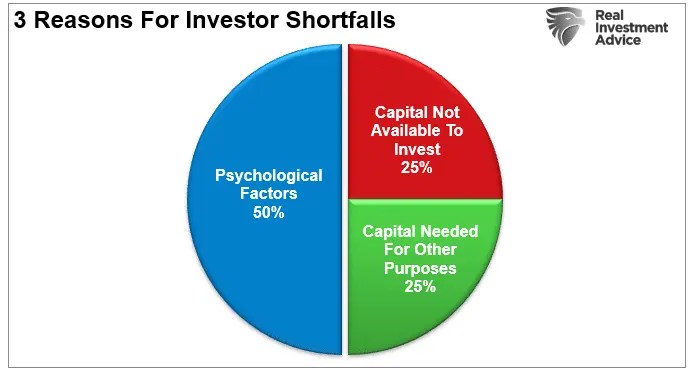

Throughout history, whenever most investors believed the worst about a particular asset class, such has often been the right time to start buying. As we have often discussed, psychological behaviors account for as much as 50% of the reasons investors consistently underperform the markets over the long term.

Dalbar Reasons For Underperformance

Dalbar Reasons For Underperformance

This brings us to the currently most hated asset class: bonds.

Bond Valuations Are Attractive

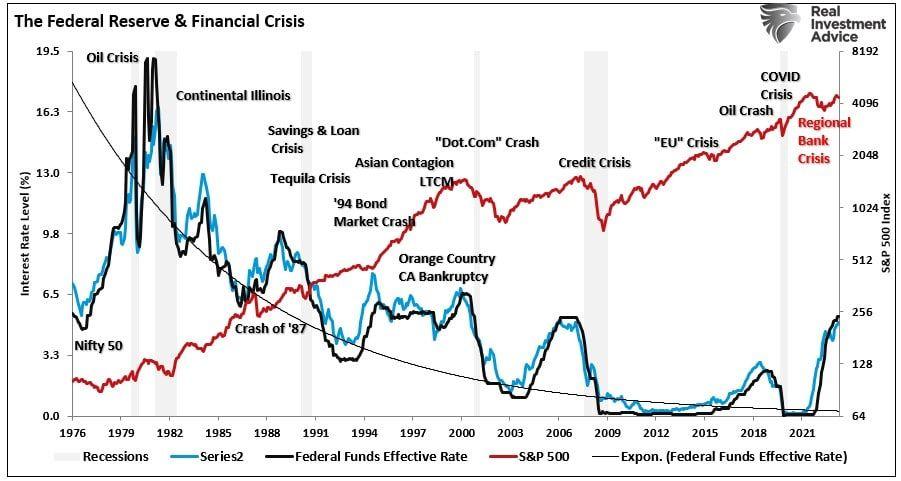

We have written many articles about the underlying economic drivers of interest rates and why “this time is not different.” To wit:

“On the short end of the Treasury curve, the 1-month to 2-year Treasury bonds are heavily influenced by the Federal Reserve’s monetary policy changes. As shown, there is an exceedingly high correlation between the Fed funds rate and the 2-year Treasury.”

Fed Funds vs 2-Year Treasury vs S&P 500

Fed Funds vs 2-Year Treasury vs S&P 500

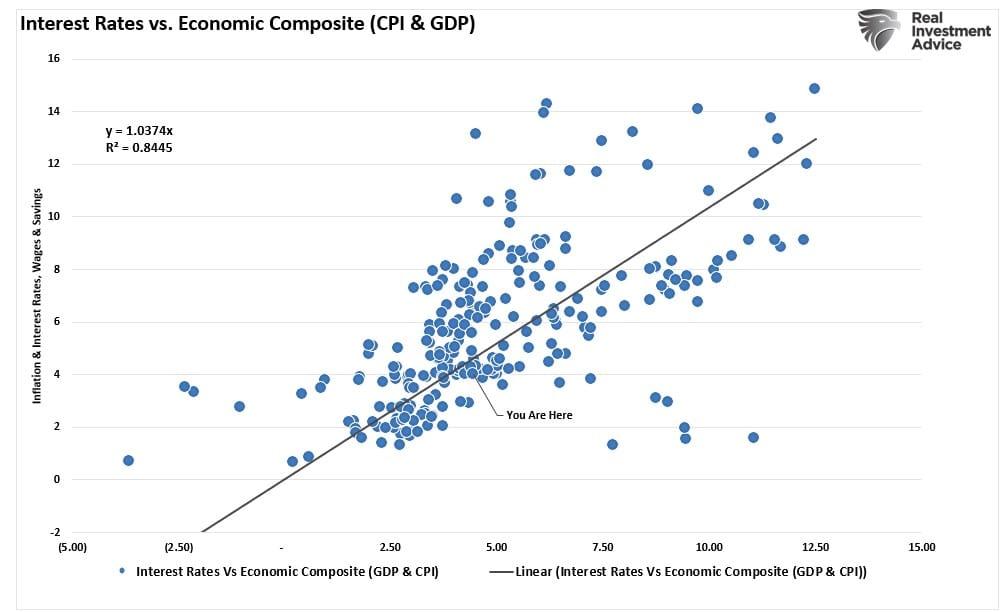

“However, the long-end of the yield curve, 10-year Treasury bonds or longer, are driven almost entirely by expectations for economic growth, inflation, and wages, as shown above. Notably, the correlation is very high.”

Interest Rates vs GDP-Inflation Composite

Interest Rates vs GDP-Inflation Composite

Of course, there are periods where interest rates can, and do, diverge from the underlying economic fundamentals. We are experiencing one of those periods which brings up the issue of valuations.

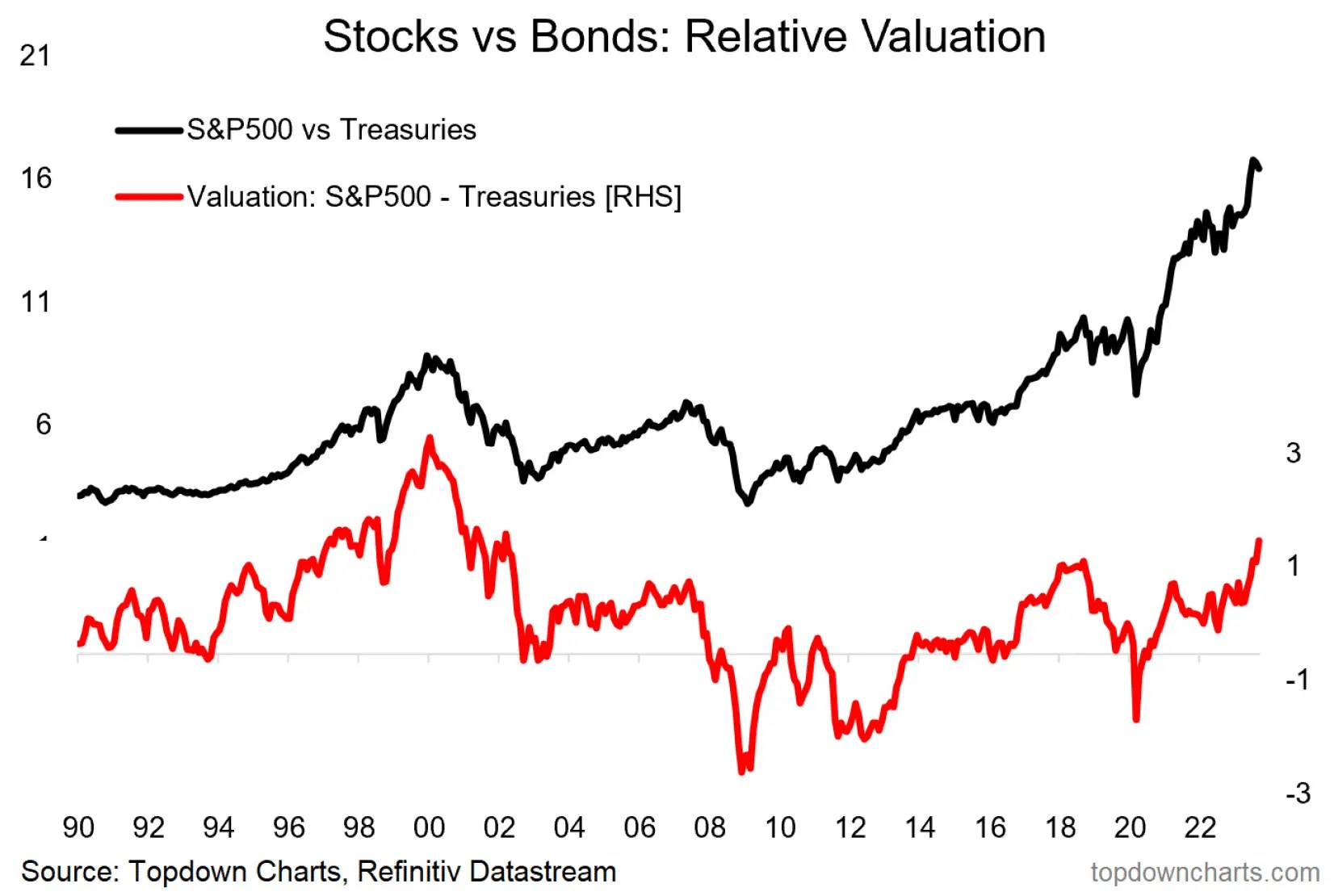

Just as stocks can detach from underlying fundamental realities and become over or under-valuated, so can bonds. As we noted last week, the record short position in bonds and computerized algorithmic trading has pushed yields substantially higher than the economic data and, ultimately, bond valuations would suggest. As noted recently by Top Down Charts:

“The higher the indicator, the more expensive stocks are relative to bonds (and the greater the odds are that bonds outperform stocks over the medium term). As you might guess, the lower it is, the cheaper stocks are vs bonds (and the greater the odds are that stocks outperform bonds. (For example, there were low readings in both 2009 and 2020).

As things currently stand, stocks are expensive versus bonds and expensive versus their own history. Conversely, bonds are similarly increasingly looking outright cheap as well as being cheap versus stocks.

While stocks have had an amazing run versus bonds since the 2020 bottom, we should not expect a repeat of this performance going forward. We always get told in those boilerplate investment disclaimers that the past performance does equal future returns, and in this case, it is actually sage advice. Along with the mounting evidence that stocks are expensive and bonds are cheap, that advice should well be heeded.” – Callum Thomas, Top Down Charts

Stocks vs Bonds Relative Valuation

Stocks vs Bonds Relative Valuation

In other words, expect bonds to outperform stocks in the future.

Contrarian Investing Is Hard

From a contrarian investing view, everyone is so bearish on bonds that it is a bullish signal. The problem with contrarian investing is that it is hard to do and harder to go against seemingly common wisdom. As Howard Marks once wrote:

“Resisting – and thereby achieving success as a contrarian – isn’t easy. Things combine to make it difficult; including natural herd tendencies and the pain imposed by being out of step, particularly when momentum invariably makes pro-cyclical actions look correct for a while.

Given the uncertain nature of the future, and thus the difficulty of being confident your position is the right one – especially as price moves against you – it’s challenging to be a lonely contrarian.”

However, as Dalbar notes above, the psychological failings of investors continually lead to long-term underperformance.

Think about it this way. If the goal of investing is to buy something when it is cheap, those opportunities don’t exist in bull markets. Buying something of value but is truly undervalued can ONLY occur when no one wants to own a particular asset. There are a couple of caveats to that statement. As an investor, you must know the asset’s actual value and be willing to hold it long enough for the market to recognize it.

For most investors, investing and being willing to “be wrong” for an extended period is difficult. Eventually, psychological pressures outweigh investor convictions. Whether it’s performance chasing, herding, or loss aversion, eventually, investors abandon their positions before the value is recognized.

As Howard Marks said:

“In good times, skepticism means recognizing the things that are too good to be true; that’s something everyone knows. But in bad times, it requires sensing when things are too bad to be true. People have a hard time doing that.

The things that terrify other people will probably terrify you too, but to be successful, an investor has to be a stalwart. After all, most of the time the world doesn’t end, and if you invest when everyone else thinks it will, you’re apt to get some bargains.“ – Howard Marks

Valuations are always the key to winning the long-term investing game.

For us, bonds remain one of the best values around.

Source: Investing.com