XOM

+0.02%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

GOOG

-1.01%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

XLV

-0.85%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

XLE

-0.09%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

META

-0.63%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

BRKa

-1.37%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

CL

-1.15%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

UNH

+0.27%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

JNJ

-0.30%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

NDX

-0.56%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

QCOM

-0.13%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

GOOGL

-1.06%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

DE

-2.66%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

CSCO

+0.07%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

CAT

-2.06%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

CVX

+0.11%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

US2000

-2.59%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

US500

-0.89%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

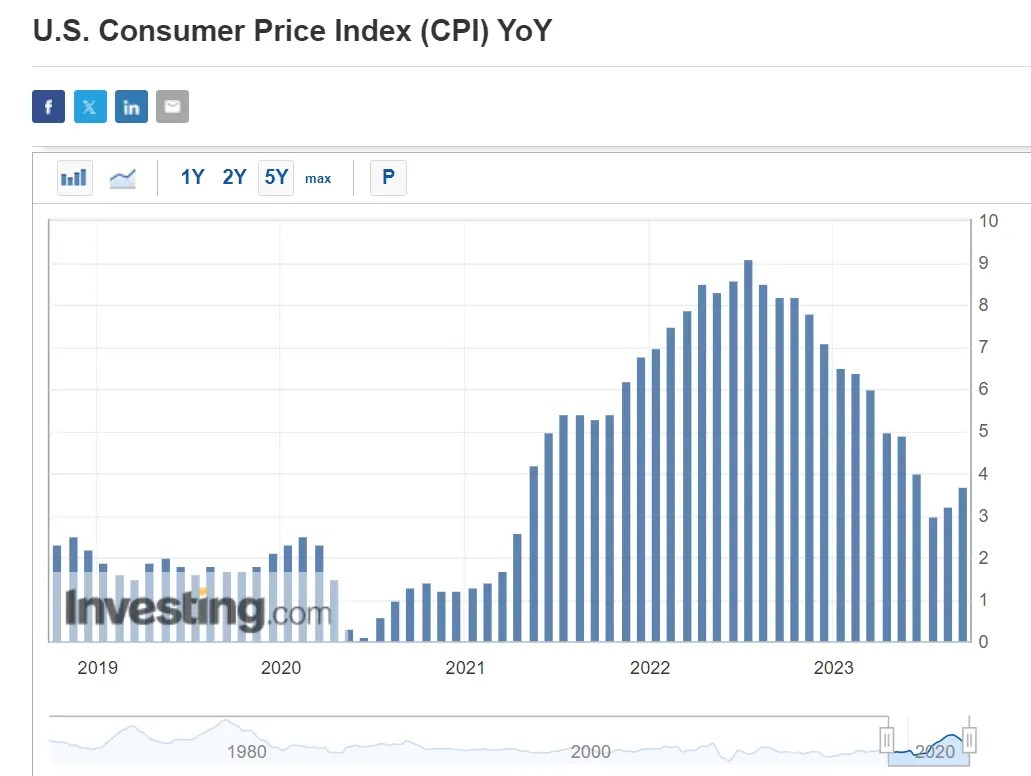

The September CPI report is due Thursday and is expected to show headline annual inflation rising 3.6% compared to the 3.7% reading seen in August.

Overall, while the trend is lower, I believe the data will emphasize the substantial risk of a renewed surge in inflation.

As such, I used the InvestingPro stock screener to identify some of the best stocks to own during periods of heightened CPI.

Looking for more actionable trade ideas to navigate the current market volatility? Members of InvestingPro get exclusive ideas and guidance to navigate any climate. Learn More »

U.S. stock investors are turning their focus to today’s highly anticipated inflation data, which could determine the near-term path of an equity rally that has wobbled in recent weeks.

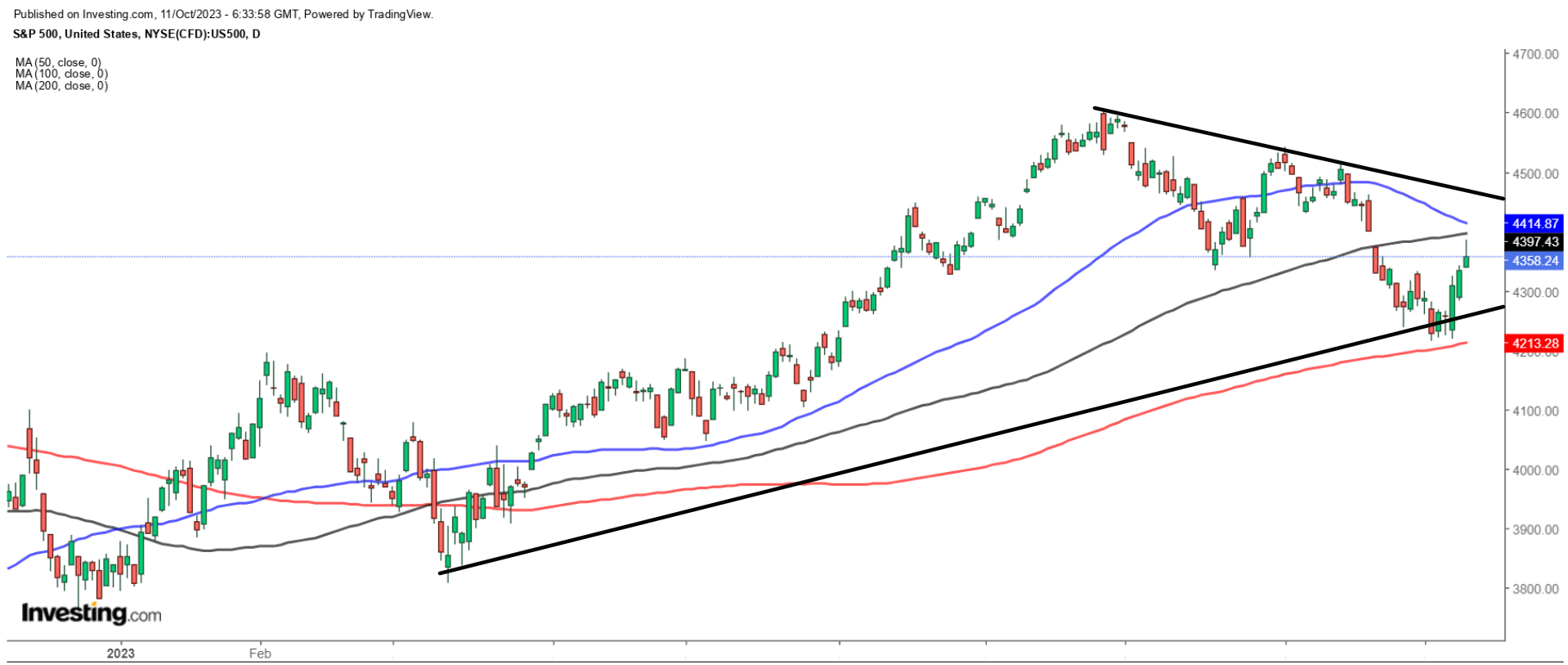

After coming within 4% of its January 2022 all-time high at one point during the summer, the benchmark S&P 500 has come under pressure amid worries that restrictive interest rates will be in place for longer than expected.

S&P 500 Daily Chart

S&P 500 Daily Chart

Ahead of the report, financial markets saw an 88% chance of the Fed holding rates at current levels in November, according to Investing.com’s Fed Rate Monitor Tool, and a 12% chance of a quarter-percentage point rate hike.

For December, they are pricing in a more divided 70% chance for a pause and a 30% chance of a rate increase.

With the U.S. central bank being data-dependent, today’s CPI inflation data takes on extra importance as investors weigh what the Fed will do next.

What to Expect?

The U.S. government will release the September CPI report today at 8:30AM ET and the numbers will likely show that prices continue to increase far more quickly than what the Fed would consider consistent with its 2% target range.

As per Investing.com, the consumer price index is forecast to rise 0.3% on the month after edging up 0.6% in August. The headline annual inflation rate is seen rising 3.6%, slowing from a 3.7% annual pace in the previous month.

CPI peaked at a 40-year high of 9.1% last summer, and has been on a steady downtrend since. Still, numbers are still rising at a pace far more quickly than what the Fed considers healthy.

CPI

CPI

Meanwhile, the September core CPI index – which does not include food and energy prices – is expected to rise 0.3% on the month, matching the same increase in August. Estimates for the year-on-year figure call for a 4.1% gain, compared to August’s 4.3% reading.

Core CPI

Core CPI

The core figure is closely watched by Fed officials who believe that it provides a more accurate assessment of the future direction of inflation.

Overall, while the trend is lower, I believe the data will emphasize the substantial risk of a renewed surge in inflation. A surprisingly higher reading, in which the headline comes in at 3.8% or above, will keep the pressure on the Fed to maintain its efforts in combating rising consumer prices.

The Fed held its benchmark interest rate unchanged last month and struck a hawkish tone as the central bank’s ongoing battle against inflation appears to be far from over.

FOMC officials said they still see one more 25 basis point rate hike before the end of 2023, with the Fed funds target rate peaking in the 5.50%-5.75% range.

“We’re prepared to raise rates further if appropriate, and we intend to hold policy at a restrictive level until we’re confident that inflation is moving down sustainably toward our objective,” Fed Chair Jerome Powell said in the post-meeting press conference.

Indeed, some inflation alarms are ringing again amid the ongoing rally in energy and food commodity prices. A lasting spike in fuel and food costs would unravel progress on the inflation front, potentially forcing the Fed to continue its rate-hike campaign for longer than currently expected.

Key Takeaway

Rising prices for oil and food, which the Fed has little sway over, may have more influence on inflation. I wouldn’t be surprised to see CPI potentially picking up from here, with the headline figure rising back towards 5% in the months ahead.

Therefore, I hold the opinion that the current environment is not indicative of a Fed that will need to pivot on policy and there is still a long way to go before policymakers are ready to declare mission accomplished on the inflation front.

Taking that into consideration, stubborn inflation may force the Fed to leave rates higher for longer than currently anticipated.

What to Do Now?

To help you successfully navigate through the uncertain macro backdrop, I used the InvestingPro screener to identify some of the best stocks to own during periods of persistently high inflation.

Not surprisingly some of the most notable names to make the list include Google-parent Alphabet (NASDAQ:GOOGL), Meta Platforms (NASDAQ:META), Berkshire Hathaway (NYSE:BRKa), UnitedHealth Group (NYSE:UNH), ExxonMobil (NYSE:XOM), Johnson & Johnson (NYSE:JNJ), Chevron (NYSE:CVX), Cisco (NASDAQ:CSCO), Caterpillar (NYSE:CAT), Qualcomm (NASDAQ:QCOM), and Deere (NYSE:DE).

InvestingPro Stock Screener

InvestingPro Stock Screener

For the full list of stocks that made my watchlist, start your 7-day free trial with InvestingPro.

If you’re already an InvestingPro subscriber, you can view my selections here.

Sign Up for a Free Week Now!

***

Disclosure: At the time of writing, I am short on the S&P 500, Nasdaq 100, and Russell 2000 via the ProShares Short S&P 500 ETF (SH), ProShares Short QQQ ETF (PSQ), and ProShares Short Russell 2000 ETF (RWM). Additionally, I have a long position on the Energy Select Sector SPDR ETF (NYSE:XLE) and the Health Care Select Sector SPDR ETF (NYSE:XLV).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Source: Investing.com