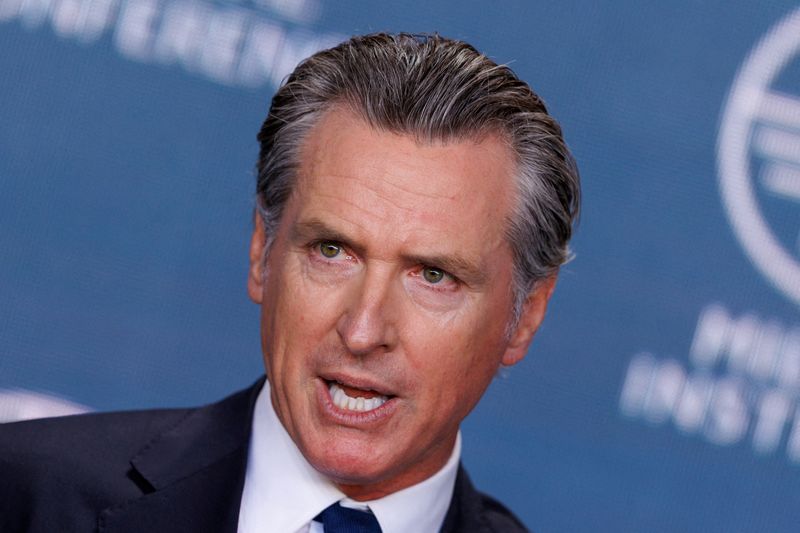

© Reuters. FILE PHOTO: Gavin Newsom, governor, state of California speaks at the 2023 Milken Institute Global Conference in Beverly Hills, California, U.S., May 2, 2023. REUTERS/Mike Blake/File Photo

PCG

-0.53%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

BOI

+0.61%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

IDBI

+3.40%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

INBA

+0.66%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

IGAS

+3.81%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

CWT

-1.63%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

INBF

-0.87%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

By Isla Binnie

(Reuters) – California’s new emissions laws could force companies to reveal more about their carbon footprint to the U.S. Securities and Exchange Commission (SEC), raising the risk of legal challenges to their climate claims, regulatory lawyers say.

California Governor Gavin Newsom signed rules into law this month requiring companies that are active in the state and generate revenue of more than $1 billion annually to publish an extensive account of their carbon emissions starting in 2026.

The SEC has drafted its own rules which would not go as far, giving companies discretion over disclosing some emissions they deem not material or not pertaining to their emission reduction targets.

The SEC’s rules would apply to all U.S.-listed companies, and one of the politicians behind the California law estimates that about 1,400 of those would also meet the threshold to report in the state.

The overlap could result in companies including emission information in SEC filings that they would have held back were it not for California’s rules, the regulatory lawyers and experts said. They added that this may expose companies to more SEC and shareholder scrutiny.

“Increased disclosure typically comes with increased liability risk and compliance efforts,” Kirkland & Ellis regulatory lawyer Abbey Raish said.

Newsom’s office declined to comment. An SEC spokesperson also declined to comment on California’s rules raising the legal risk, but pointed to comments by the agency’s Chair Gary Gensler to U.S. lawmakers last month on companies spending less to comply with SEC rules if they already report in California.

It would not be the first time that climate-related legislation originating in California has a broader impact. The state’s efforts to cut vehicle emissions pushed car makers to tighten their emissions standards nationwide.

Some of California’s new rules mandate the disclosure of so-called Scope 3 emissions, which are generated by companies’ customers and suppliers rather than the companies themselves. The SEC’s rules, as drafted, would require companies to only disclose Scope 3 emissions they deem material.

If Scope 3 emissions disclosed under California’s rules are large compared to their direct Scope 1 and 2 emissions, it will be hard to justify treating them as immaterial and not including them in SEC filings, the lawyers said.

“If the California bill did not exist and did not provide for disclosure of Scope 3, then it would be easier for companies to just say it’s not material without having to show their work or show how they came to that determination,” said Ron Llewellyn, who specializes in corporate governance at law firm Fenwick.

Only 54% of North American companies disclosed Scope 3 emissions in 2021, compared with 71% in Europe, according to a 2021 report commissioned by the World Resources Institute.

STRICTER STANDARD

While California’s rules insulate companies from liability in their reports on hard-to-calculate Scope 3 emissions until 2030, the legal “safe harbor” that the SEC’s rules include is limited, according to the legal experts.

Companies are not shielded from liability by the SEC’s safe harbor provisions if they can be shown not to be acting in good faith, neither are they protected from claims under various state laws, Norton Rose lawyers wrote in a note to clients.

Company directors can be held liable for inaccurate statements to investors. The SEC can impose fines or refer serious cases to criminal authorities. Shareholders can also sue corporate executives if they feel they have been misled by information in SEC filings or other public statements.

The SEC “is by far the most powerful regulator on the planet and it’s the scariest,” said Kentaro Kawamori, chief executive of climate disclosure software company Persefoni. “You think about the world and risk entirely differently” when facing that liability, he said.

California’s rules will also oblige companies to conform to a stricter reporting threshold. They require use of the Greenhouse Gas Protocol, an international standard for emissions accounting, whereas the SEC’s contemplated rules do not impose that methodology.

Newsom, a Democrat, said when he signed the bills that he was concerned about the costs to businesses and tight timelines, and has instructed state authorities to work to address these issues.

The pending rules from California and the SEC “will be rocket fuel for climate disclosures,” said Michael Littenberg, partner at law firm Ropes & Gray.

(This story has been corrected to fix the spelling of surname to ‘Kawamori’ from ‘Kowamori’ in paragraph 16)

Source: Investing.com