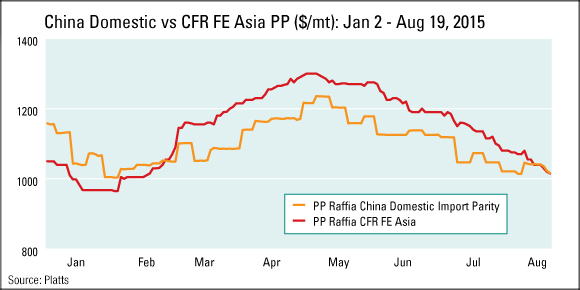

CFR Far East Asia PP raffia has fallen below Chinese domestic levels for the first time in six months Wednesday, as Chinese producers hiked prices in response to the government’s devaluation of the yuan.

China domestic PP raffia was assessed at Yuan 8,100/mt on August 19, or around $1,016/mt on an import parity basis, down Yuan 200/mt from the previous week but Yuan 250/mt higher from August 5, before the yuan devaluation.

CFR FE Asia was assessed $40/mt lower week on week at $1,015/mt, and down $55/mt since August 5.

The last time imported PP raffia slipped below Chinese domestic prices was on February 25, when CFR FE Asia was assessed at $1,040/mt, while China domestic level was at Yuan 8,200/mt, or $1,052/mt on an import parity basis at that time, Platts data showed.

China’s central bank on August 11, has changed the way it sets the yuan exchange rate against the US dollar, which led to a 1.9% devaluation of the domestic currency the same day.

The yuan has since depreciated by 2.9% as of Wednesday, with the US dollar-yuan exchange rate at 6.3976.

The depreciation of the yuan led Chinese PP producers to raise offers immediately, as a depreciation of the yuan would make exports more competitive and translates to higher earnings for their end-user buyers, market sources said.

But offers have since fallen because of lukewarm response from buyers this week.

One Northeast Asian producer noted that his end-user clients are keeping their PP stocks extremely low — at levels just enough to cover existing orders — in anticipation of further price cuts.

At the same time, international PP producers have lowered offers into China in reaction to the depreciation of the yuan — as a weaker yuan would technically make imports more expensive — amid a regional glut in supply.

Other market participants however, noted that many regional exporters have followed China’s lead, with countries such as India, Vietnam and South Korea depreciating their currencies, which could limit the potential competitive advantage for Chinese exports.