XAU/USD

-0.57%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

Gold

-0.76%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

DXY

+0.34%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

Gold’s response to the latest Middle East conflagration has gone from boring to scintillating

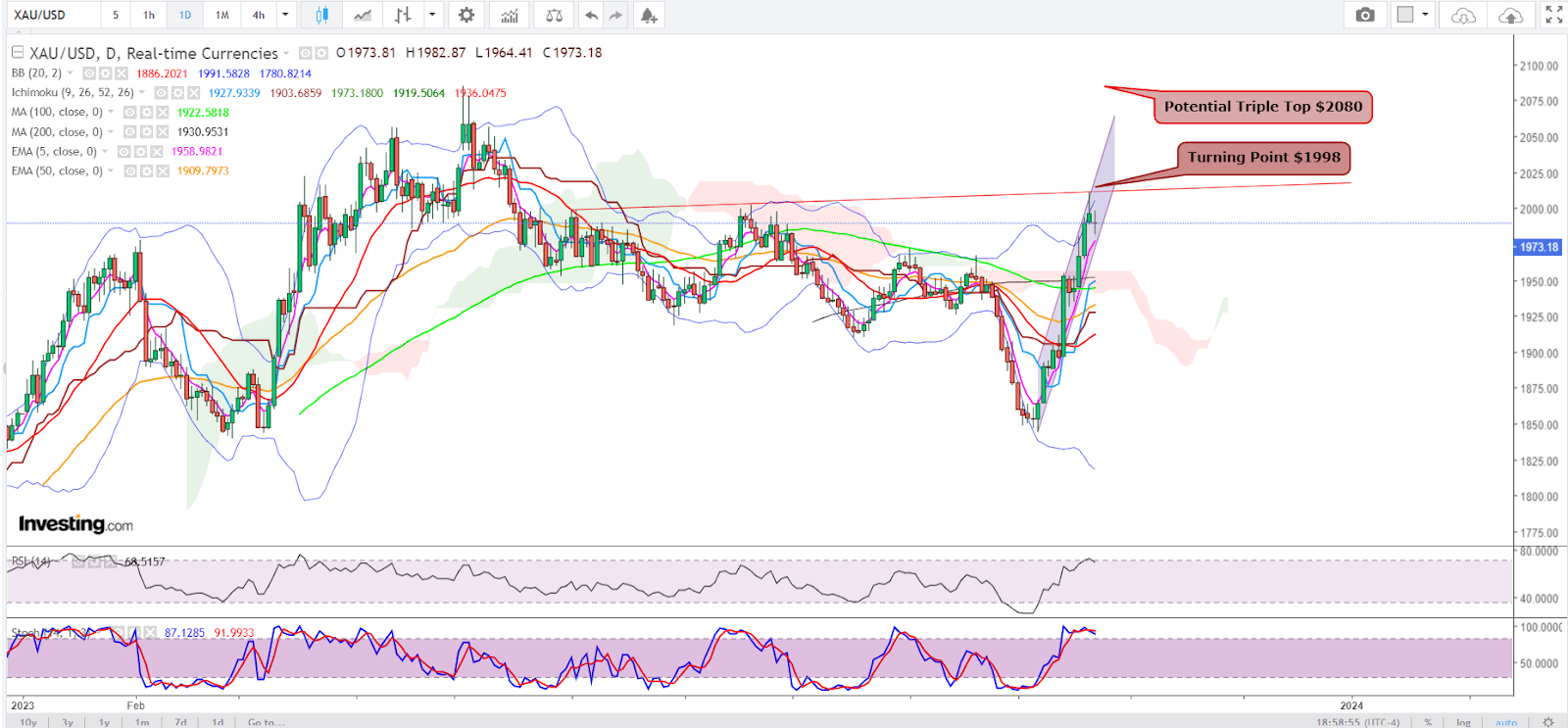

While a triple-top typically scares traders from accumulating further longs, the bull fervor in gold could outrun expectations

$2,070-$2,080 may just be an intermediary high for the spot price, with an eventual target of $2,150-$2,170

A snap of the trend could eventually bring lows of $1,945-$1930

Gold bulls always feel the yellow metal doesn’t get due love or honor in a haven universe where the dollar has become a parallel. Bears in the game feel the lustrous bars stored in central bank vaults across the world are overrated. The truth is probably somewhere in between.

The tug-of-war over gold has gotten a lot more intense in the two weeks since Hamas gunmen paraglided their way into Israel on Oct. 7 to start a rampage that has had the entire world convulsing.

Spot Gold DailyCharts by SKCharting, with data powered by Investing.com

Spot Gold DailyCharts by SKCharting, with data powered by Investing.com

From Boring to Scintillating

Gold’s response to the latest conflagration in the Middle East began predictably, in the same way it had been reacting to most geopolitical events of the past decade: Slow and steady, to the point of being boring.

But along the way, the market exploded as the death toll and retribution promised by Jerusalem over the invasion turned out to be more than the world expected.

As the crisis enters its 18th day at the time of writing, it’s clear the Israelis have little appetite for diplomacy or for that matter anything other than fulfilling their pledge of exterminating Hamas once and for all from Gaza. T

he only thing holding them back from a full land-based assault of the territory is the estimated 200 Jewish hostages or so in Palestinian hold, that the United States and other world powers are negotiating to get back.

$2,070-$2,080 May Just Be an Intermediary High

The politics aside, both the bears and bulls seem astounded at how gold has embraced its safe-haven role in the conflict, leaving the dollar in the dust, as New York-traded futures of the yellow metal went from mid-$1,800 an ounce to $1,900, $1,950 and finally $2,000 on Friday.

Spot Gold WeeklyWhile the spot price of gold, which is more closely tracked by some than futures, had retreated to below $1,990 at the time of writing, there seems to be little question that another breach of the $2,006 wouldn’t be impossible.

Spot Gold WeeklyWhile the spot price of gold, which is more closely tracked by some than futures, had retreated to below $1,990 at the time of writing, there seems to be little question that another breach of the $2,006 wouldn’t be impossible.

In fact, most technical charts are indicating that spot gold will run to $2,010 at least and $2,080 on the high end.

Craig Erlam, analyst at online trading platform OANDA, captured the phenomenon succinctly in a commentary from Friday:

“Gold’s safe haven status has been questioned on a number of occasions over recent years but times like this highlight that in times of significant uncertainty, traders look for assets with a track record. Of course, the circumstances are quite favorable for gold as US yields are rapidly rising at the same time, reducing Treasuries’ appeal in the short-term.

But the combination of geopolitical and economic uncertainty, both of which could have implications for inflation and interest rates, is increasing gold’s appeal, for now.”

The problem is gold prices are also flagging something else: A triple top formation, which in market lingo shows three peaks that typically signal that an asset may have moved from rally mode to selloff.

Yet, some commodity technicians who have spent considerable time studying the gold charts say the outcome might be surprisingly different. Sunil Kumar Dixit, chief technical strategist at SKCharting.com and a regular collaborator with Investing.com, is one of them.

The Triple Top: How to Trade It

Says Dixit:

“While triple tops are usually considered as potentially bearish formation, this time the scenario indicates an exception to the thumb rule.”

“The current price action seems to be waiting for a break above the horizontal resistance zone of $1,998 to prompt a rather quick run into the benchmark $2070-$2080 orbit.”

With the geopolitical crisis in the Middle East fraught with contagion risks and the dollar looking likely instead to dive to below the 105.40 critical support, the odds are increasing for gold to retest major resistance at between $2,070 and $2,080, Dixit said, adding:

“Contrary to the popular concept of triple-tops resulting in massively bearish reversal, this time the gold market is showing readiness to make a quick breakout above the previous supply zone and begin a new leg of bull run.”

A sustained break above $2,070-$2,080 — with a daily or weekly close above the zone — will set the stage for a quick $70-$80 advance into the $2,150-$2,170 area, which may be followed by a consolidation phase for the ritual retest of the breakout zone.

And Watch Out For a Break in the Trend

But like all the trades, this one has its risks too and could flip before going too high.

Spot Gold 4-HourlyDixit cautions that failure to establish a break above the immediate resistance of $1,998 will likely extend the consolidation which starts with the downdraft to below $1,970 and could reach $1,945-$1930.

Spot Gold 4-HourlyDixit cautions that failure to establish a break above the immediate resistance of $1,998 will likely extend the consolidation which starts with the downdraft to below $1,970 and could reach $1,945-$1930.

He adds:

“Major bullish waves often shake/scare buyers away from the market before embarking on the flight.”

“As a result, most traders are found to be in the sell-trap when the market gathers parabolic buying momentum.”

***

Disclaimer: The aim of this article is purely to inform and does not in any way represent an inducement or recommendation to buy or sell any commodity or its related securities. The author Barani Krishnan does not hold a position in the commodities and securities he writes about. He typically uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables.

Source: Investing.com