Monday, 24 August 2015 18:06

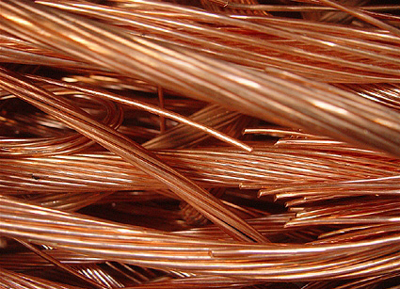

LONDON: Copper prices tumbled to six-year lows on Monday alongside Shanghai equities on growing nervousness about economic activity and demand prospects in top industrial metals consumer China.

LONDON: Copper prices tumbled to six-year lows on Monday alongside Shanghai equities on growing nervousness about economic activity and demand prospects in top industrial metals consumer China.

Benchmark copper on the London Metal Exchange fell more than 3 percent to $ 4,882 a tonne in early trade. The metal used in power and construction traded at $ 4,885 a tonne in official rings, from $ 5,055 at Friday’s close. “The market fears a severe deterioration in Chinese demand.

The perception that the Chinese government can control what is going on in the economy has been shattered,” said Carsten Menke, commodities analyst at Julius Baer. “You can see it in the equity market crash.

The fear is there might be further pockets of weakness we don’t see.”

Chinese stocks plunged more than 8 percent, posting their biggest one-day loss since the height of the global financial crisis in 2007 as disillusioned investors retreated after Beijing held back expected policy support at the weekend following last week’s 11 percent slide.

A major reason behind the sell-off in industrial metals was news on Friday that China’s manufacturing sector shrank at its fastest pace in almost 6-1/2 years in August.

Three-month aluminium fell to $ 1,506, its lowest since June 2009. The metal used in transport and packaging traded at $ 1,510.5, from $ 1,548 on Friday.

“Our latest speculative positioning estimates, as of Aug. 20, indicate that the spec short in aluminium has grown to 34 percent of open interest, the largest spec short in aluminium since July 2012,” Marex Spectron said in a note.

The aluminium market is also keeping an eye on a large long position for settlement in October, which could bring a period of potential tightness and price volatility.

Zinc and lead hit five-year lows of $ 1,709 and $ 1,632 respectively.

Zinc fell to $ 1,715 from Friday’s $ 1,767 and lead dropped to $ 1,632 from $ 1,702.

Tin was down more than 5 percent at $ 14,070, its lowest since July 13.

It was untraded in rings but bid at $ 14,350 from Friday’s $ 14,900.

The soldering metal has been under renewed pressure on expectations of rising shipments from top exporter Indonesia after PT Timah, the country’s top tin miner, was granted government clearance to resume exports.

Nickel fell nearly 8 percent to $ 9,395, its lowest since Aug. 12. It traded at $ 9,475 from $ 10,200.

Expectations of weak demand from Chinese stainless steel mills and high inventories have undermined nickel.