Tuesday, 25 August 2015 17:01

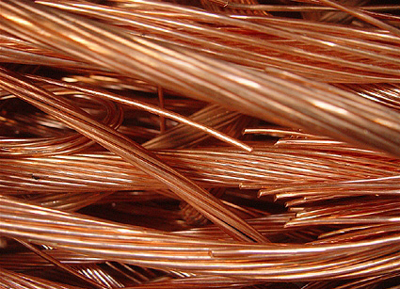

LONDON: Copper prices rose on Tuesday after China cut its benchmark interest rates, raising hopes the move will help bolster economic growth and increase demand in the world’s largest consumer of industrial metals.

LONDON: Copper prices rose on Tuesday after China cut its benchmark interest rates, raising hopes the move will help bolster economic growth and increase demand in the world’s largest consumer of industrial metals.

Benchmark copper on the London Metal Exchange, which was steady before the rate cut announcement, was up 1.7 percent at $ 5,040 a tonne after the news at 1040 GMT. The metal used in power and construction hit a six-year low of $ 4,855 a tonne on Monday.

China’s central bank cut interest rates and banks’ reserve requirements to boost liquidity and said the world’s second-biggest economy still faces downward pressure.

“There’s a short-covering rally going on. These are more measures designed to help underpin the Chinese economy,” said Leon Westgate, analyst at Standard Bank. “We’ll have to wait and see if the rally is sustainable.”

The rate cut followed cuts earlier this year amid concern in Beijing that money wasn’t flowing to some sectors of China’s economy that needed help.

However, copper’s reaction was seen as relatively muted, and traders said another leg down could not be ruled out if economic data reinforces the negative sentiment engulfing markets in recent weeks.

China accounts for about half of global consumption of industrial metals such as copper.

“China’s authorities have huge resources at their disposal to kickstart the economy if needed,” said Caroline Bain, commodity strategist at Capital Economics.

“China is a very large consumer of commodities, you could get quite a bounce once it turns because the market is short.”

Problems facing the metals and mining industry were highlighted by BHP Billiton, the world’s biggest mining house and second-biggest copper producer, which reported a 52 percent slump in annual profit on Tuesday.

“In the near term, new supply under development is expected to keep the (copper) market well supplied,” BHP Billiton’s Chief Executive Andrew Mackenzie said. Three-month aluminium rose to $ 1,556, from $ 1,521.5 at Monday’s close. Traders said commodity trading advisors, which use mathematical models to generate buy and sell signals, had been covering short positions.

But a glut of aluminium on the global market is expected to keep the metal under pressure. Zinc rose to $ 1,750 from $ 1,707, lead to $ 1,677 from $ 1,659 and tin advanced to $ 14,170 from $ 14,050.

Nickel was recovered to $ 9,690 a tonne, from $ 9,520 a tonne on Monday when it lost nearly 7 percent.