NDX

+1.21%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

US500

+0.92%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

DJI

+0.66%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

IXIC

+1.38%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

META

+1.20%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

XLK

+1.03%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

ROKU

+8.58%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

PINS

+0.70%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

PLTR

+5.15%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

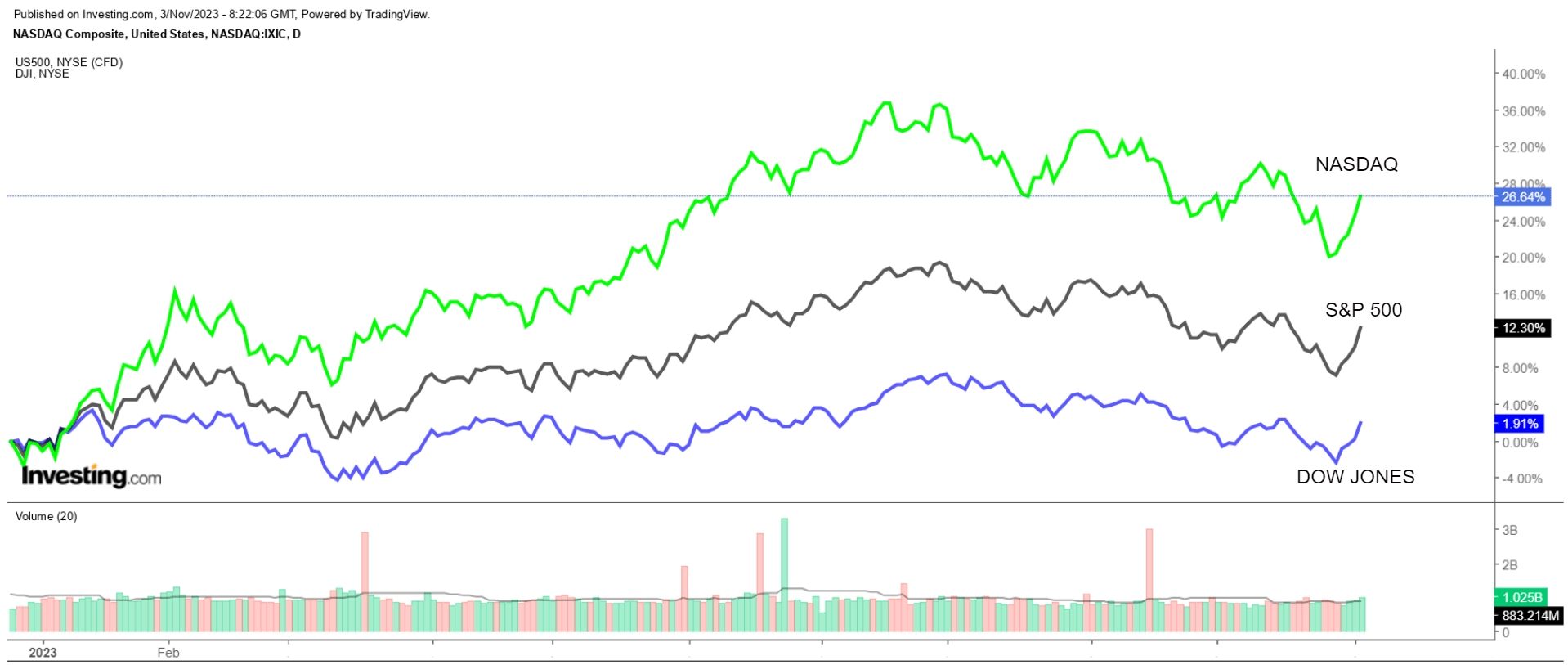

The tech-heavy Nasdaq Composite has outperformed the S&P 500 and the Dow Jones Industrial Average by a wide margin in 2023.

Optimism that the Federal Reserve is done raising rates will likely continue to boost companies in the tech sector.

As such, here are three growth stocks worth owning through the end of the year amid hope that the Fed’s interest-rate cycle has peaked.

Looking for more actionable trade ideas to navigate the current market volatility? Members of InvestingPro get exclusive ideas and guidance to navigate any climate. Learn More »

With just two months left to go in 2023, the technology-heavy Nasdaq Composite has been the top performer of the major U.S. indexes by a wide margin thus far, soaring 27% year-to-date.

That compares to an increase of 12.4% for the benchmark S&P 500 over the same time span and a 2.1% gain for the blue-chip Dow Jones Industrial Average.

Nasdaq Vs. Dow Jones Vs. S&P 500

Nasdaq Vs. Dow Jones Vs. S&P 500

The ongoing tech rally has been fueled by investor optimism that the Federal Reserve’s rate-hike cycle is all but over, even though the central bank left the door open for more.

Taking that into consideration, I recommend buying shares of Palantir (NYSE:PLTR), Pinterest (NYSE:PINS), and Roku (NASDAQ:ROKU) as the Fed seems unlikely to raise rates further in the months ahead.

All three companies still offer further upside in my view, despite their impressive year-to-date gains, and have plenty of room to grow their respective businesses, making them solid long-term investments.

1. Palantir Technologies

Year-To-Date Performance: +179.9%

Market Cap: $38.7 Billion

Palantir (NYSE:PLTR) shares look set to extend their powerful rally in the weeks ahead as investors dial back expectations for future rate hikes and the economy continues to undergo a sea change of digitization.

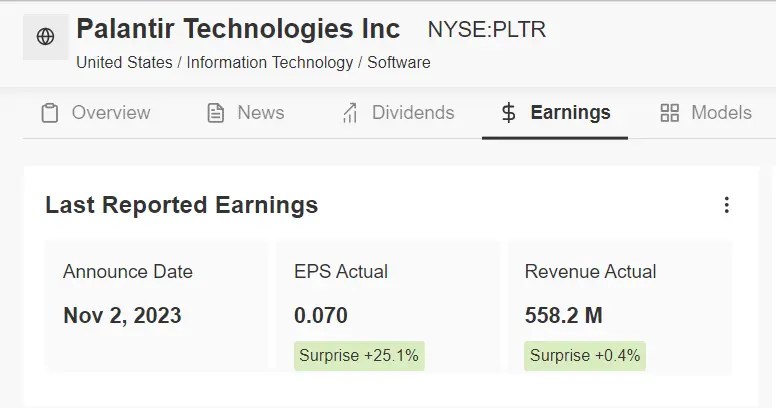

The data-mining specialist delivered an ‘earnings triple play’ on Thursday, delivering profit, sales growth, and guidance which all exceeded consensus expectations thanks to soaring demand for its new artificial intelligence platform.

Palantir posted adjusted earnings per share of 7 cents, up 600% from EPS of 1 cent in the year-ago period. The company’s third-quarter results mark its fourth-straight quarter of profitability, making it eligible for inclusion in the S&P 500.

Revenue jumped 17% year-over-year to $558.2 million as it benefited from robust demand for its data analytics tools and services from both government and commercial clients amid the current geopolitical environment.

Palantir Earnings

Palantir Earnings

Source: InvestingPro

CEO Alex Karp said in a letter to shareholders that the strength is attributable to “growing demand” for the company’s recently launched generative AI platform, which it calls AIP.

“Companies across industries in the United States are scrambling to deploy software platforms that will allow them to leverage the power of the latest large language models,” Karp wrote in the letter. “And we have built what they need.”

For the fourth quarter, Palantir is projecting revenue of $599 million to $603 million, at the middle of the range and just slightly above the Street consensus at $600 million. The company expects to again be GAAP profitable in the quarter.

Palantir Chart

Palantir Chart

Shares of the data analytics software maker are up a whopping 179.9% year-to-date, outperforming the broader market by a wide margin over the same period, thanks to excitement over the company’s promising AI initiatives and improved profitability outlook.

PLTR stock ended Thursday’s session at $17.98, earning the Denver, Colorado-based big-data firm a valuation of around $38.7 billion. Notwithstanding the recent turnaround, the stock still trades well below the software maker’s all-time intraday high of $45.00 set in late January 2021.

2. Pinterest

Year-To-Date Performance: +26.5%

Market Cap: $20.7 Billion

Receding inflation worries and easing fears about further Fed rate hikes will likely continue to boost shares of Pinterest, which has seen its growth prospects perk up lately thanks to an improving fundamental outlook.

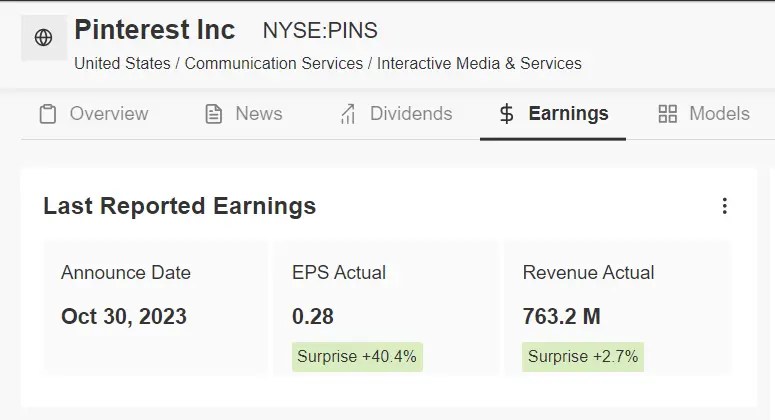

The social media platform trounced expectations for earnings and revenue when it delivered third-quarter financial results this week, and it included strong user engagement data.

Pinterest reported adjusted earnings per share of 28 cents for the three months ended in September, rising 150% from earnings of 11 cents per share in the same quarter last year.

Revenue rose 11.4% annually to $763.2 million, compared with the Wall Street consensus estimate for sales of $744 million.

Despite worries over an industry-wide slowdown in digital ad spending, Pinterest has seen companies flock to its platform as they seek to avoid the toxic and controversial content seen on other social media networks, such as Facebook (NASDAQ:META), Instagram, TikTok, and X.

Pinterest Earnings

Pinterest Earnings

Source: InvestingPro

Pinterest’s global monthly active users (MAUs) increased 8% from a year earlier to 482 million. Analysts were expecting Pinterest to report 473 million global MAUs.

The social media site’s outlook was also solid, reflecting its improving fundamentals, stabilizing user growth trends, and increasing monetization potential.

“Our users are engaging deeply and we’re delivering better results for advertisers through improved measurement and innovation across the full funnel,” CEO Bill Ready said in the earnings release.

Pinterest Chart

Pinterest Chart

PINS stock broke out to a fresh 52-week high of $31.23 on Thursday, a level not seen since January 2022, before closing the day at $30.71. At its current valuation, Pinterest has a market cap of about $21 billion.

Shares of the San Francisco-based company are up 26.5% year-to-date. Despite its recent turnaround, the stock remains roughly 65% away from its all-time peak of $89.90 reached in February 2021.

3. Roku

Year-To-Date Performance: +91.8%

Market Cap: $11.1 Billion

With the Fed likely to end its monetary tightening cycle in the months ahead, I believe that Roku is one of the best companies to own amid the current environment as it benefits from the ongoing recovery in the digital video advertising market.

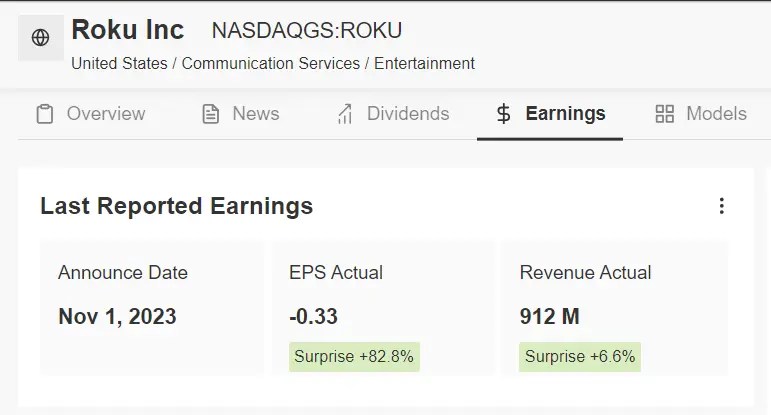

The streaming media company’s third-quarter update released earlier this week made it clear that it is executing well despite a difficult economic backdrop of rising rates and elevated inflation.

Roku reported revenue of $912 million for its September quarter, up nearly 20% from the same period last year, and above the $857 million expected by analysts, thanks to broad strength in its core ad-revenue business.

Roku Earnings

Roku Earnings

Source: InvestingPro

The streaming pioneer’s active accounts also beat forecasts, rising 2.3 million from the second quarter to 75.8 million. Analysts were expecting 75.3 million.

For the fourth quarter, Roku forecast revenue of about $955 million, topping the $952 million expected by Wall Street. It also projected $10 million in adjusted earnings before interest, taxes, depreciation, and amortization.

Roku said in a letter to shareholders that it remains committed to achieving positive EBITDA for full year 2024 with continued improvements after that.

Roku Chart

Roku Chart

Shares of the San Jose, California-based company have been on a major uptrend since the start of the year, rising around 92% in 2023, reflecting the company’s impressive active account growth, and improving monetization of existing and new users.

ROKU stock – which is still about 84% below its all-time high of $490.76 reached in July 2021 – closed Thursday’s session at $78.05. At current levels, the digital media player manufacturer has a market cap of $11.1 billion.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading decisions.

***

Find All the Info You Need on InvestingPro!

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Technology Select Sector SPDR ETF (NYSE:XLK).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Source: Investing.com