US500

+0.18%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

US2000

-1.31%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

IXIC

+0.30%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

ARKK

-1.66%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

The Fed’s decision to leave rates unchanged triggered a significant change in market sentiment, leading to an impressive market rebound

November, with its historical strength, presents the potential for a shift to a bullish market trajectory

Meanwhile, the Nasdaq-to-Russell 2000 ratio could surpass previous highs, indicating that bich tech will continue to lead

I’ve often mentioned October as a possible game-changer for bullish market trends, and it’s surprising how quickly things can shift.

To give you an idea, let’s take a look at what happened just last week. We witnessed a big shift in market sentiment.

The S&P 500 index had experienced a three-month decline before this shift, compounded by widespread concerns over geopolitical turmoil in the Middle East.

However, a game-changing moment came with the Fed’s decision to halt rate hikes, at least for the immediate future, in response to lackluster labor market data.

This surprising development had an overwhelmingly positive impact on the market. An excellent case in point is the ARK Innovation ETF (NYSE:ARKK), which had previously endured substantial losses, surpassing -60%.

It managed to record its best week ever, surging by a remarkable 18%. The market’s recovery was driven by oversold conditions and shifts in interest rate expectations, leading the S&P 500 back above its 200-day moving average.

As for the future of this market rally, uncertainty prevails. However, it’s crucial to recognize that it’s relatively easy to adopt a bearish perspective when the majority of market participants share the same sentiment.

Conversely, adhering to one’s own investment perspective and strategy can be exceptionally challenging when it places you in the minority.

In terms of market seasonality, we’ve navigated through a period of market weakness extending from July to October.

Now, we are entering November, historically recognized as one of the most favorable months for the stock market. The S&P 500, for example, has generated average returns of +1.73% in November since 1950.

Given the recent positive weekly performance, this moment presents an opportune juncture for the market to potentially shift back into a bullish trajectory for the remainder of the year, contingent on confirmation from key indicators, notably the S&P 500’s performance exceeding the 4400 level.

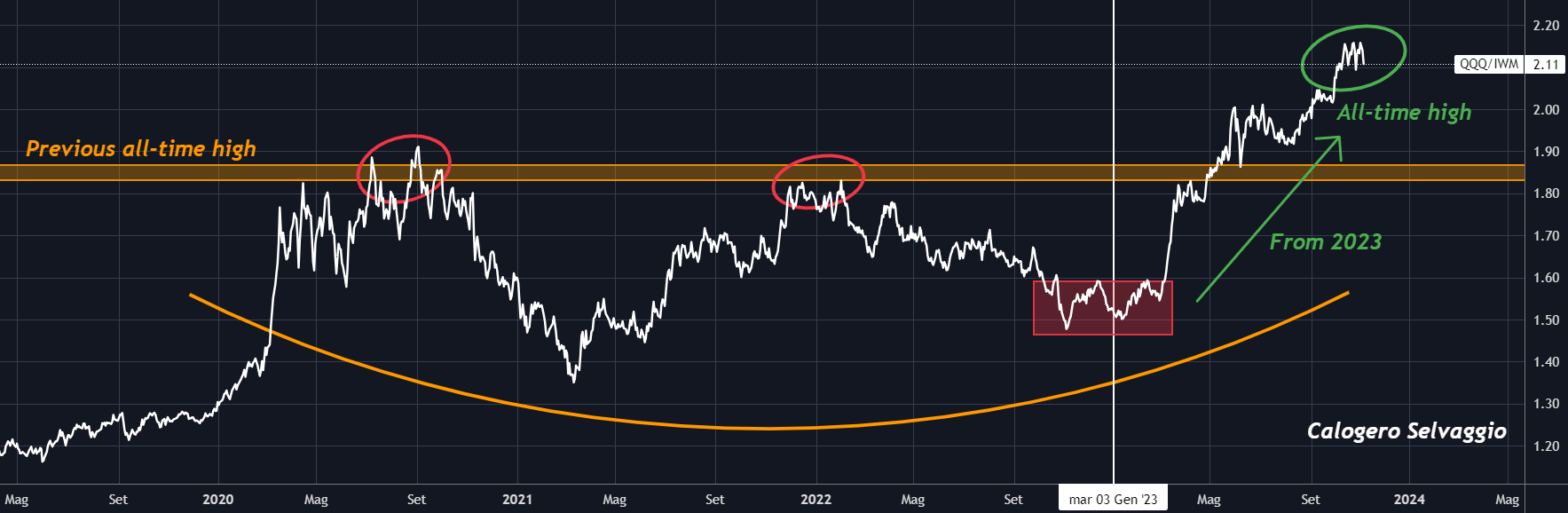

One of the ratios that continually captures my attention is the relationship between the Nasdaq and the Russell 2000.

Nasdaq Vs. Russell 2000

Nasdaq Vs. Russell 2000

Examining the chart, it becomes evident that over the past three years, the Nasdaq-to-Russell 2000 ratio has struggled to surpass the highs witnessed during the dot-com bubble and the more recent 2020 peaks.

As long as this trend persists and new highs are achieved, it implies that big tech companies are likely to remain preferred and maintain their leadership position in the market.

Conclusion

Last week’s market shift, triggered by the Fed’s decision, underscores the rapid changes in sentiment.

The future remains uncertain, but with November’s historical strength, there is potential for a bullish market shift and stocks ending the year with a flourish.

***

Find All the Info You Need on InvestingPro!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.

Source: Investing.com