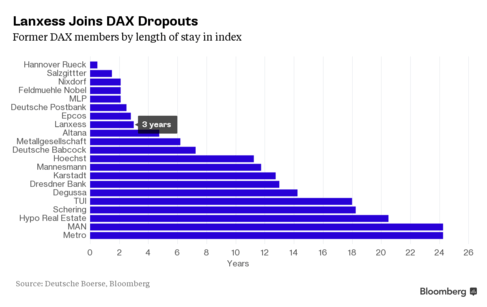

Just three years after advancing into Germany’s benchmark index, chemical makerLanxess AG is set to drop out of the DAX again after a slump in demand and lower selling prices for rubber offerings cut its market value.

Lanxess, which gets about 40 percent of sales from the car and tire industries, will leave the 30-member index on Sept. 21, the German stock exchange said in a statement late Thursday. Vonovia SE, formerly Deutsche Annington, will advance after acquisitions helped it grow into Europe’s biggest landlord. Lanxess shares have languished since this time last year, losing 4.6 percent, while Vonovia has climbed 38 percent.

Erstwhile a success story, Lanxess transformed itself from a hodge podge of unprofitable units spun off from Bayer AG into the world’s biggest maker of synthetic rubber. After its DAX ascent, a rubber glut that the company itself exacerbated with new factories led to abandoned profit goals, a first-ever annual loss and a halved dividend. Since taking the helm in April 2013, Chief Executive Officer Matthias Zachert has streamlined production, cut jobs and tried to find a partner for the rubber business to reduce exposure to that industry.

The exit from the DAX may prompt money managers to shift holdings to match the index adjustments. Deutsche Boerse, the operator of the German stock exchange, has a regular index membership review every year in September when it looks at market value and trading volume rankings. Index changes are also possible every quarter under so-called fast exit and entry rules. Lanxess will drop into the MDAX of medium-sized companies.

Zachert, who was previously chief financial officer of Lanxess, rejoined the company as CEO after a stint at Merck KGaA. The rubber business may be carved out as early as December and whether Lanxess will give up a majority stake has yet to be decided, the executive said on Aug. 6. Saudi Arabian Oil Co. is among the potential partners, people familiar with the matter have said.

“There are open questions for the rubber unit on a joint venture with a supplier or a competitor,” said Oliver Schwarz, an analyst at MM Warburg. “At the moment with the bad news out of China, it’s looking more difficult. They aren’t negotiating from a position of strength.”

Zachert has said he wants to turn his attention to growth once the reorganization has been completed. The company will look at acquisitions for its two non-rubber divisions. The performance chemicals division, which makes additives for a broad range of plastics, will expand its network of factories, especially in Asia, as well as merging businesses that target similar customer segments.