US500

+0.59%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

NQZ3

+0.28%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

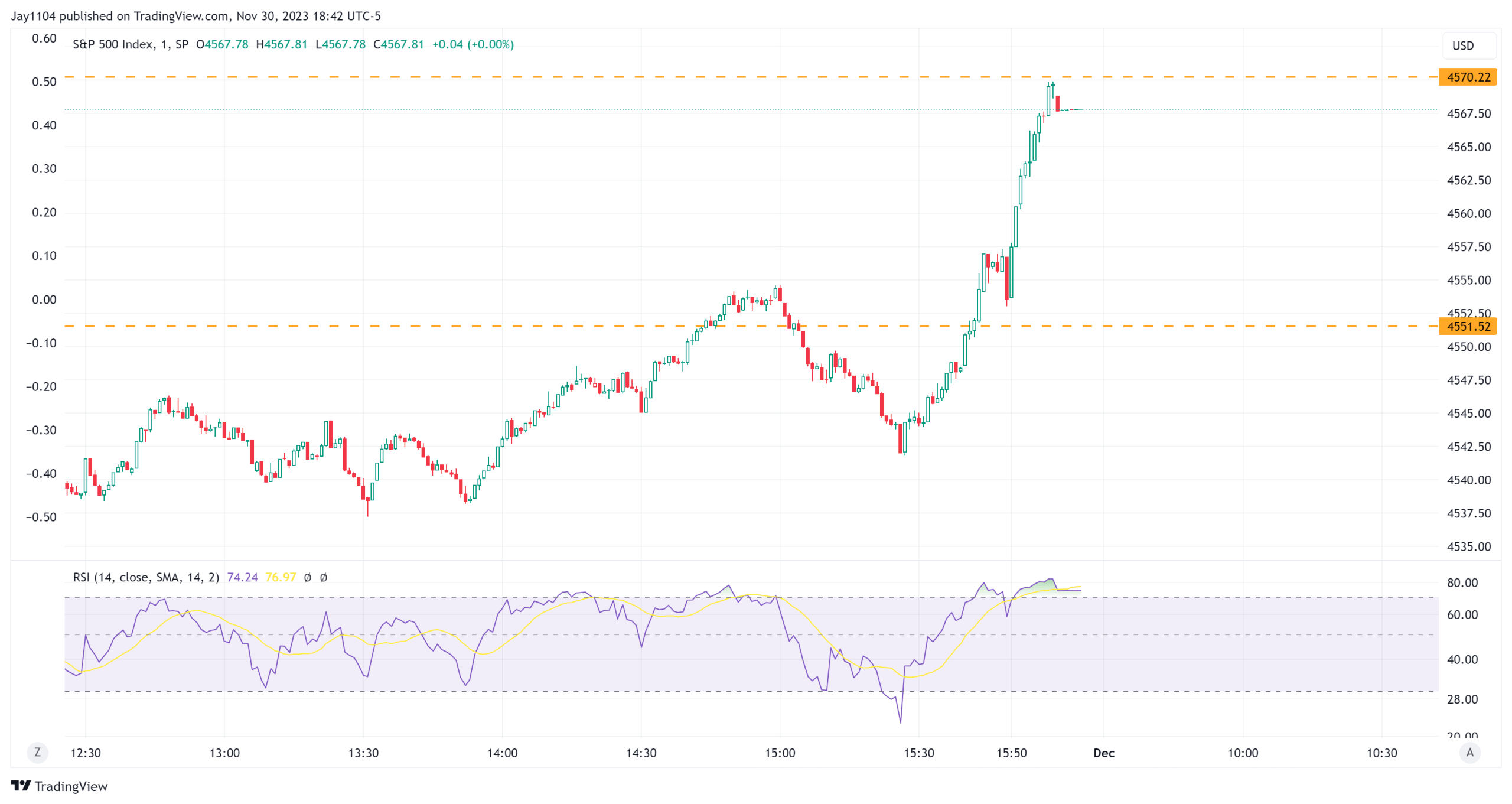

Stocks were down yesterday, but a $6.5 billion buy imbalance sent S&P 500 screaming higher into the close. Yesterday was month end, which can create large buy or sell imbalances. Generally speaking, the quarter ends generate enormous imbalances, but yesterday’s was almost equal to larger, driving the market higher in the final 30 minutes of trading.

These imbalances build over the day, starting at 2 PM on the NYSE, and so if you can see the imbalances and it builds up, you can get a sense of the size sometimes. By 3:30, it was obvious to those with the better seats that it would be large. The problem is that the real totals aren’t released until 3:50 PM ET, when all market or limit-on-close orders are published.

I can tell you from real-life experience that when you are a “real” trader on a “real” buy side or sell side desk, and you see a market imbalance with 1 million shares of something to buy at 3:50 PM, and there are only 600,000 shares on the tape, you had better take the stock up to get the volume in or try to offset the imbalance, or you are going to have one angry PM calling you at 4:01 asking you what happened.

OK, and so how much did you buy?

Yeah, I can tell you from experience the conversation (“screaming”) didn’t go well.

This happens when the imbalances are released in full, and all those VWAP and “participating at 10% of the volume” traders have to catch up.

S&P 500 Index Chart

S&P 500 Index Chart

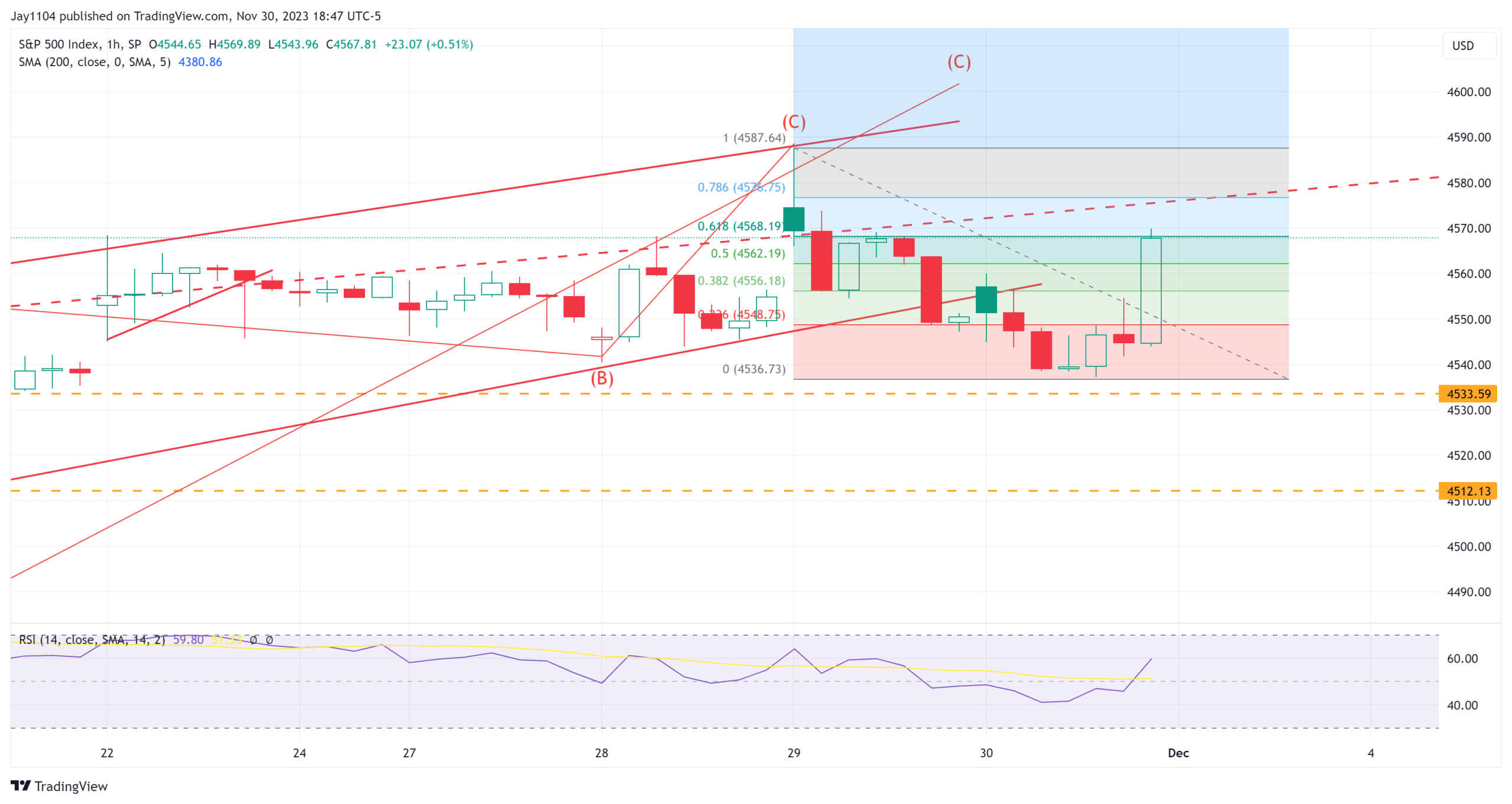

For me, yesterday’s price action changed very little, and the late-day rebound was pretty as expected because if that was the start of wave one down, then the move higher could mark a wave 2. What was nice about this, too, is that the wave two retracements ended right at the 61.8% level of wave 1.

S&P 500 Index-1-Hour Chart

S&P 500 Index-1-Hour Chart

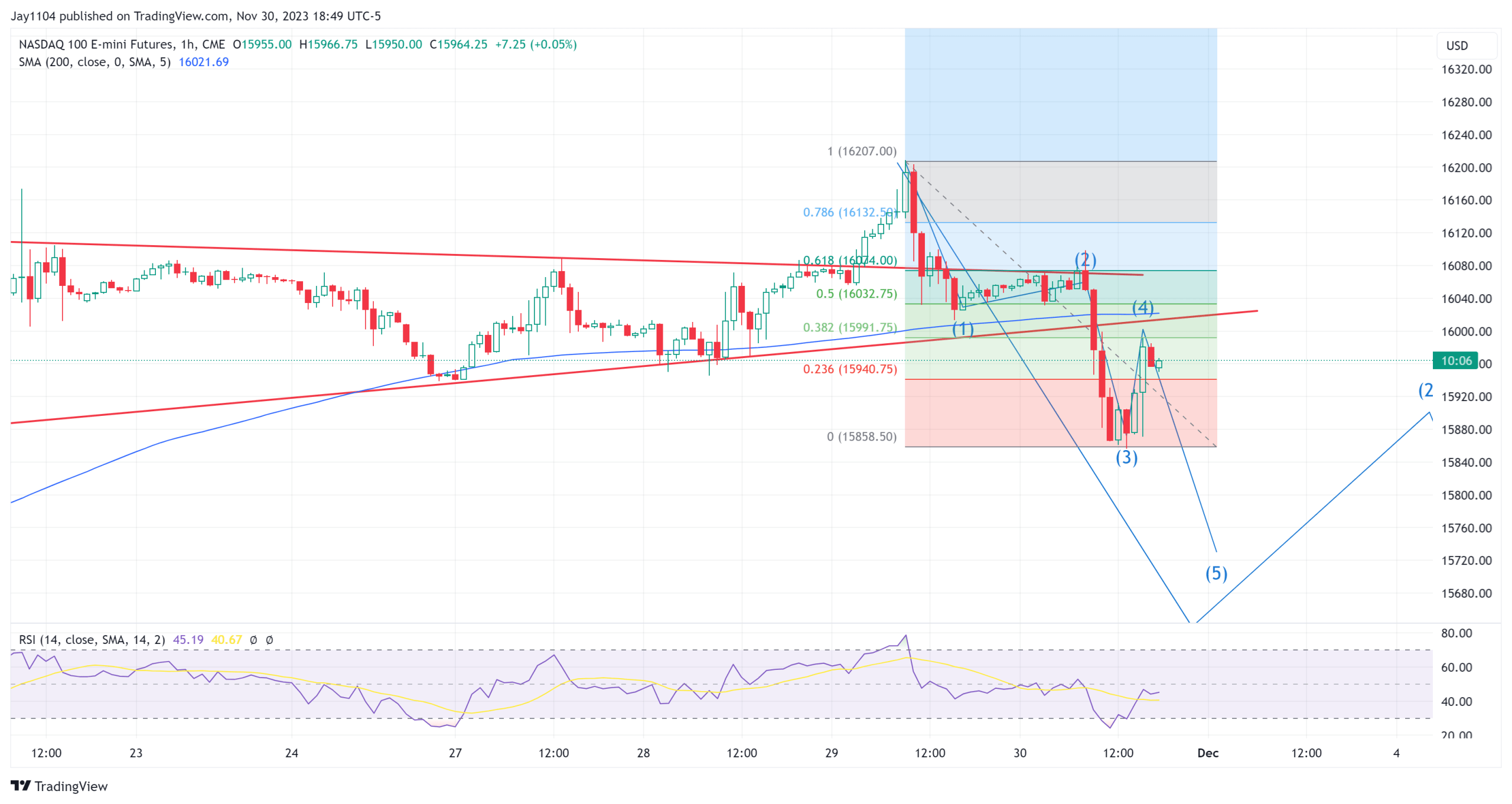

Meanwhile, the Nasdaq 100 futures appear to be a little more advanced in the process, with the end-of-day rebound taking the index to 38.2% retracement of the entire decline thus far. Does any of this mean the market can’t go higher?

Of course not. Elliott wave counts can make me, at times, feel like a fortune teller, but it does provide some guidance at points, and it is worth being open to these thoughts and processes.

Nasdaq Futures-1-Hour Chart

Nasdaq Futures-1-Hour Chart

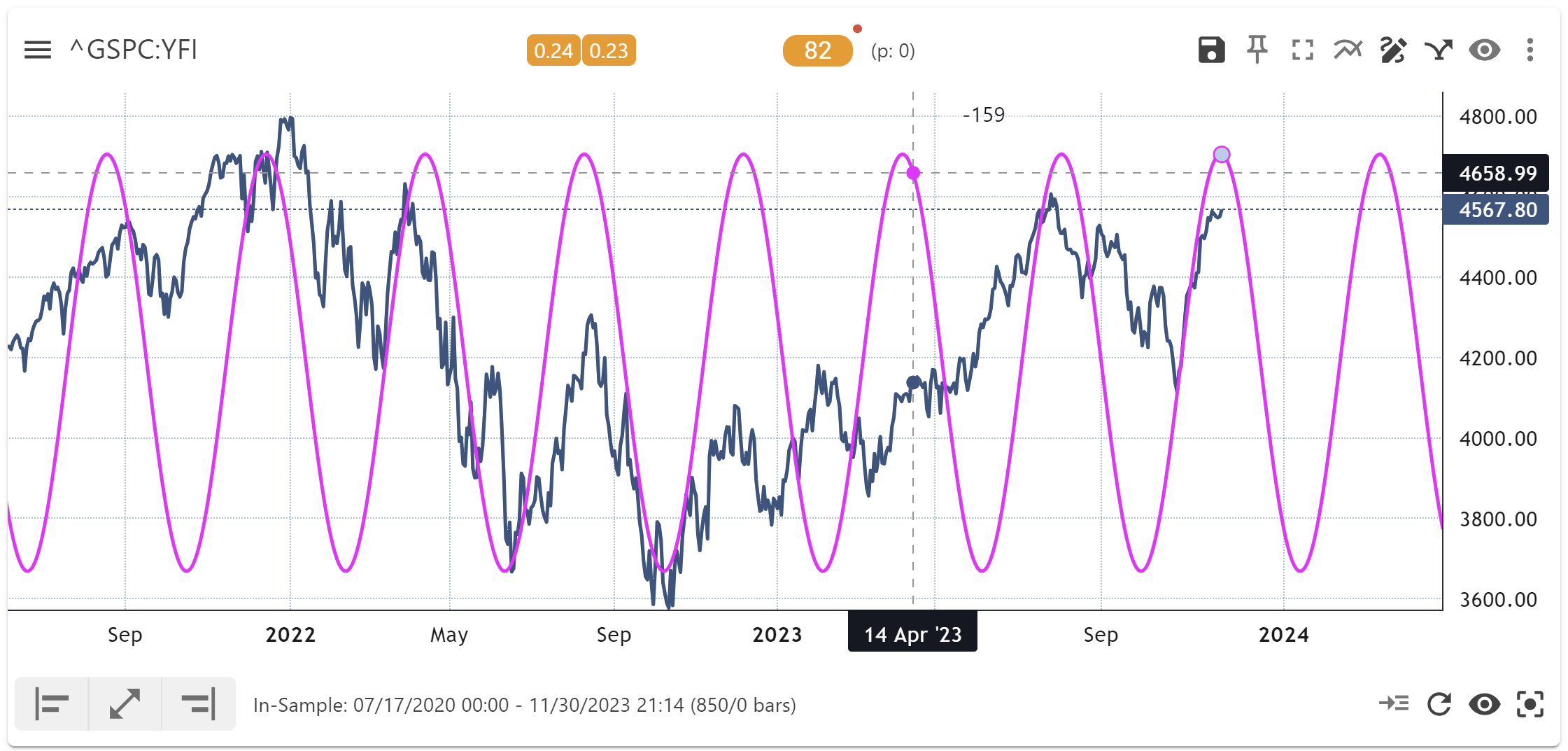

It is just like the 82-day cycle that seems to be clicking again. If it works, great; if it doesn’t, oh well. However, the point is that it says we have peaked. If you think cycle analysis is garbage, then I can’t help. Unfortunately, we live in a world of cycles, like the sun rising and setting predictable every day, the moon, or the rise and fall of the tides. We all have the same life cycle, from birth to adolescence, adulthood, and death. So, if everything around us can have a cycle, then it seems quite possible that even markets can have a cycle or rhythm.

GSPC-YFI

GSPC-YFI

Markets are supposed to be random, and predicting them is incredibly challenging. I have been through two of the most brutal cycles in market history in 2000 and 2008. Was 1929 brutal? Yeah, I’m sure it was. 1987, brutal. But the 2000 bust was demoralizing and went on for what felt like forever because every time you thought we bottom, we made a lower low. 2008 was frightening, not knowing if a bank would collapse over a weekend.

I’m not trying to say that we will see a market collapse, but it has become clear to me that it is very dangerous. I think there is a significant risk to the downside, and if you are a real investor and not one of these people just throwing darts, then being patient may pay off this time, which is why I continue to own high-quality stocks and hold plenty of cash.

Original Post

Source: Investing.com