US500

-0.03%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

NVDA

-1.48%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

CRM

-0.04%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

SHEL

-1.19%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

AZN

-0.04%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

Mega-cap stocks have been a favorite for long-term investors, providing stability, global reach, and consistent dividends.

Using InvestingPro, we have curated a list of the top 36 mega-cap stocks.

Our analysis has ultimately led us to two mega-cap stocks with significant growth potential that could beat the index in 2024.

Missed out on Black Friday? Secure your up to 60% discount on InvestingPro subscriptions with our extended Cyber Monday sale.

Mega-cap stocks represent shares of companies listed on the US stock market with a market capitalization exceeding $200 billion, making them the largest publicly traded companies globally.

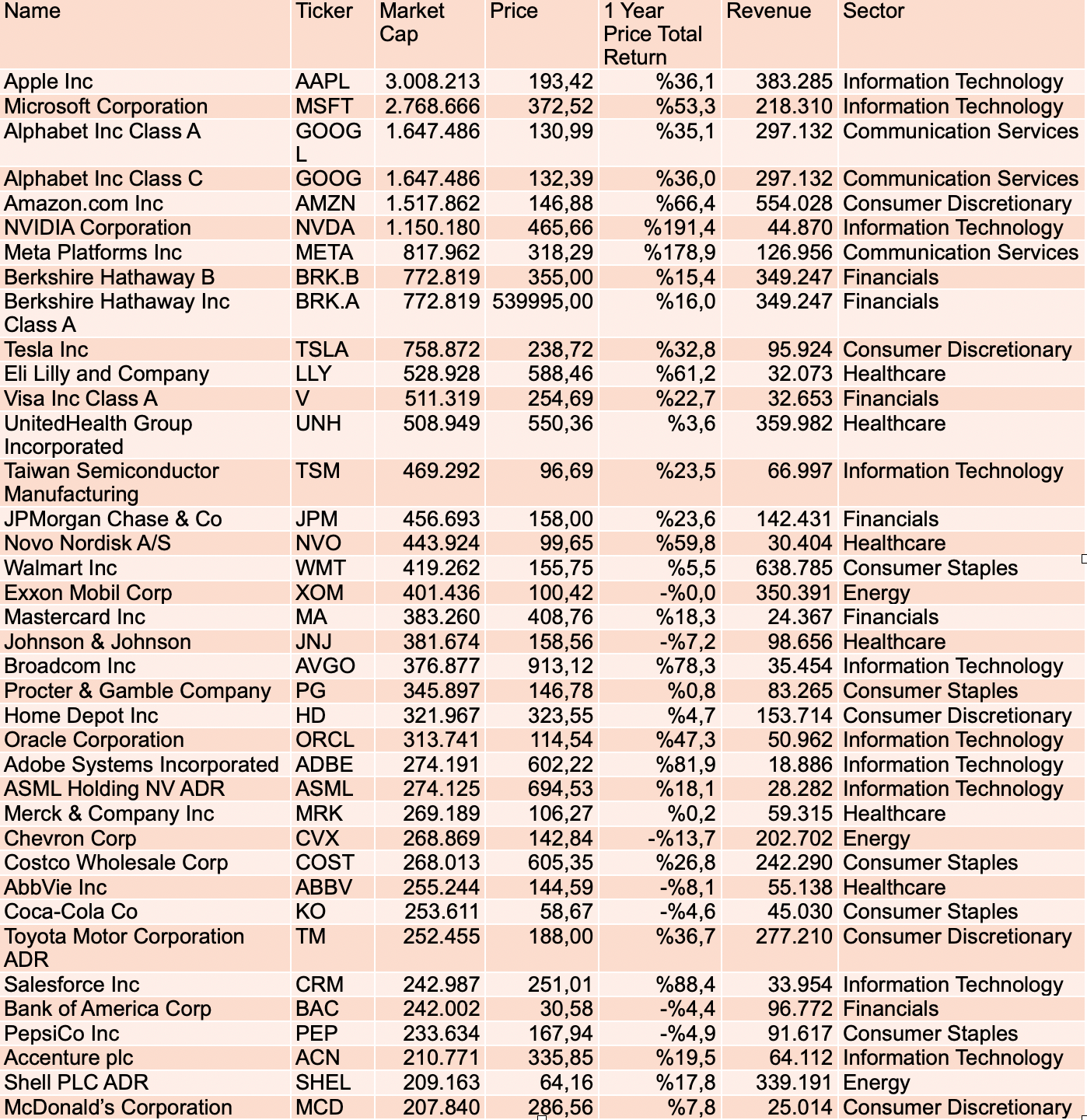

With the assistance of InvestingPro, let’s arrange the mega-cap stocks in descending order. Here is the current list of the top 36 stocks ranked based on market cap:

List of 36 Shortlisted StocksThese are well-established companies in the global financial markets with annual revenues in the billions of dollars, and they operate globally, not just in the US.

List of 36 Shortlisted StocksThese are well-established companies in the global financial markets with annual revenues in the billions of dollars, and they operate globally, not just in the US.

These stocks also constitute the largest share in the S&P 500 index. Mega-cap stocks with a stable financial structure are especially favored by long-term investors, as they tend to offer more solid returns at low volatility. In addition, most of these stocks pay regular dividends and provide investors with a significant fixed income.

The stocks with the highest market capitalization, which are stable and relatively resistant to market fluctuations, are mostly companies operating in the technology sector.

Today, in our InvestingPro analysis, we evaluated the best mega-cap stocks to buy for 2024.

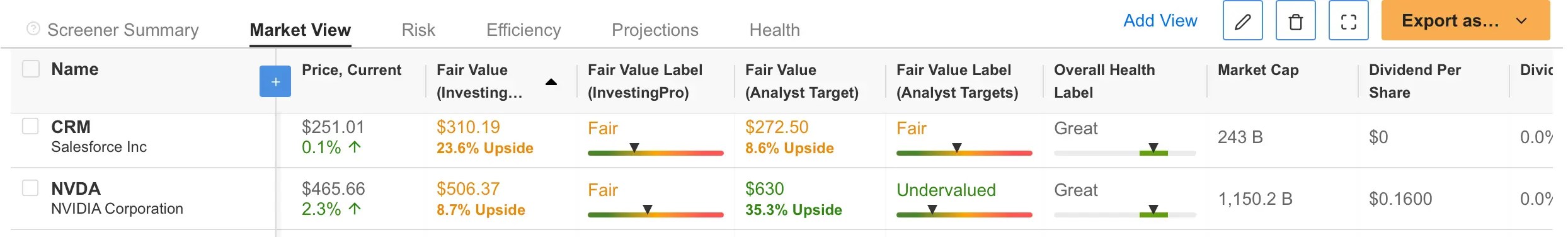

Among the stocks with a market capitalization of over $200 billion, we can see that two technology stocks stand out when we rank the shares of companies operating in the technology sector according to fair value and analyst targets.

InvestingPro Stocks Shortlist

InvestingPro Stocks Shortlist

Source: InvestingPro

The first of these stocks, Salesforce (NYSE:CRM), has the potential to rise close to 24% in a year according to InvestingPro.

The other stock, Nvidia (NASDAQ:NVDA), has an upside forecast of less than 10% in the InvestingPro fair value analysis.

However, while the consensus forecast of analysts is an increase in the 35% band, it is thought that the stock is currently moving below its value.

InvestingPro Stocks Shortlist

InvestingPro Stocks Shortlist

Source: InvestingPro

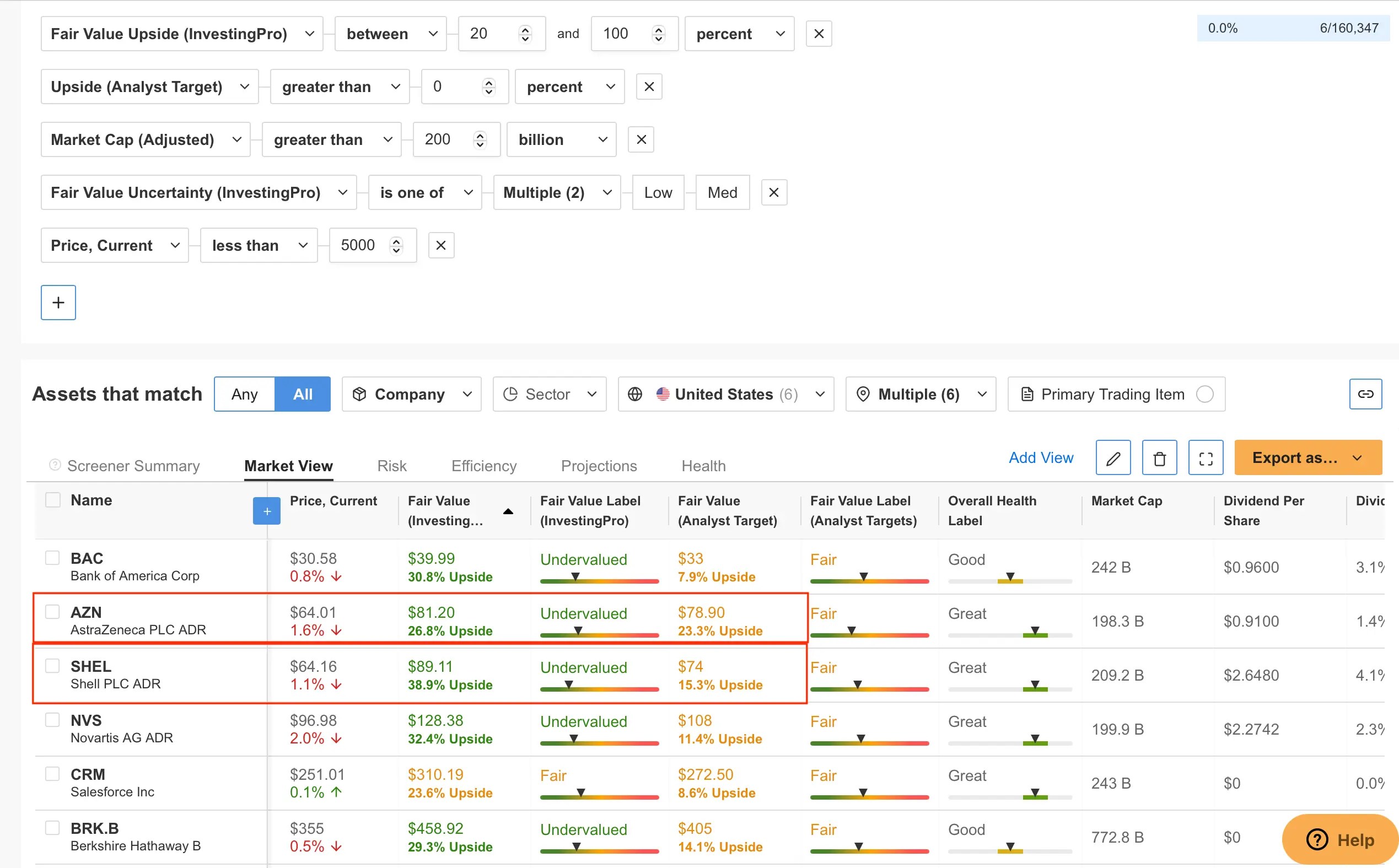

In 2024, when we expand the screening of mega-cap stocks with upside potential to cover all sectors, we come across 6 stocks according to the fair value analysis.

Among these stocks, Shell (NYSE:SHEL) has the highest potential to increase in value within a year, with an increase of nearly 40%.

AstraZeneca (NASDAQ:AZN) is the only stock with an upside potential of more than 20% according to both InvestingPro’s fair value analysis and analysts’ consensus estimate.

AstraZeneca Stock Summary

AstraZeneca Stock Summary

Source: InvestingPro

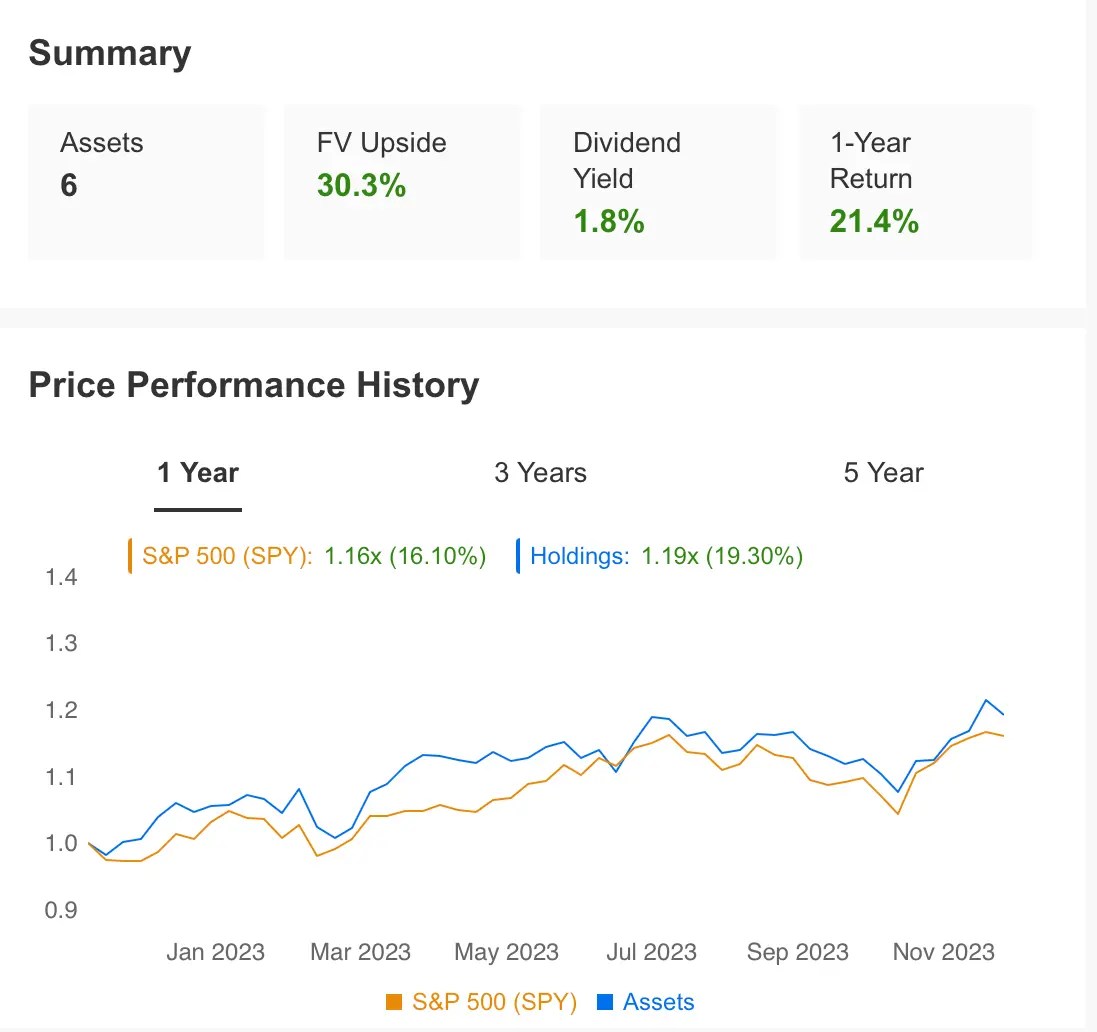

On the other hand, when the portfolio of these stocks is compared to the one-year performance of the S&P 500, it can be seen that it provides an above-index return with a value increase of nearly 20%.

The average dividend yield of the shares was calculated as 1.8%.

***

You can easily determine whether a company is suitable for your risk profile by conducting a detailed fundamental analysis on InvestingPro according to your criteria. This way, you will get highly professional help in shaping your portfolio.

In addition, you can sign up for InvestingPro, one of the most comprehensive platforms in the market for portfolio management and fundamental analysis, much cheaper with the biggest discount of the year (up to 60%), by taking advantage of our extended Cyber Monday deal.

Claim Your Discount Today!

Disclaimer: The author does not own any of these shares. This content, which is prepared for purely educational purposes, cannot be considered as investment advice.

Source: Investing.com