EUR/USD

+0.24%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

US500

+0.39%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

DX

-0.21%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

The eagerly awaited release of CPI and Core CPI figures today is crucial, especially during a bullish market phase.

Today’s data release will also decide the year-end rally’s fate.

Anticipated declines in CPI and a stable Core CPI may impact market sentiment, influencing the upcoming Fed meeting.

Today is CPI day, and financial markets are eagerly anticipating the release of both CPI and Core CPI, covering monthly and annual changes.

Given the expectation of no major news from the Fed tomorrow, where unchanged rates are anticipated, it’s safe to say that today holds the utmost significance- likely the most crucial day not only of this week but possibly until the year’s end.

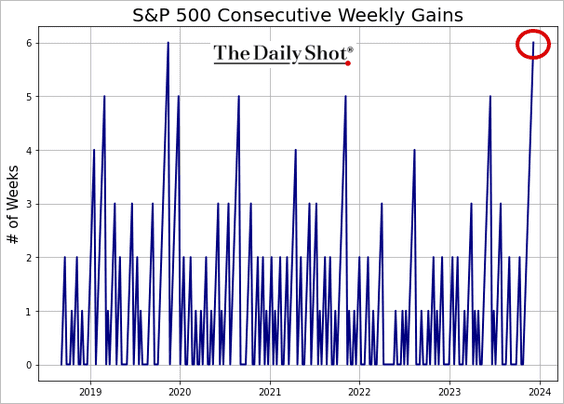

The importance of today’s inflation report is particularly due to the S&P 500 being in a bullish phase, after six consecutive weeks in positive territory (as illustrated below).

S&P 500 Consecutive Weekly Gains

S&P 500 Consecutive Weekly Gains

Source: The Daily Shot

Therefore, in the absence of quarterly or other relevant events (and especially hopefully no black swans either), this is the make-or-break event for the Christmas Rally.

So let’s go and see, based on the economic calendar, what to expect:

Economic Calendar

Economic Calendar

Analyzing the data, we anticipate an overall decline in the Consumer Price Index (CPI), particularly in the annual change, which is expected to decrease from 3.2% to 3.1%.

At the same time, the Core CPI, excluding volatile components and closely monitored by the Fed, is expected to maintain its position at the 4% level.

In contrast to Europe, where inflation appears to be under control, the US has not yet reached a similar level. This likely contributes to the recent strengthening of the dollar against the euro.

Lower-than-expected data could spur a positive market response, sparking another bullish week.

Conversely, higher-than-expected data might ground traders in reality, reinforcing the tone for the upcoming Fed meeting scheduled for tomorrow and potentially interrupting the rally that commenced in early November.

As always, the markets will have the final say.

***

You can easily determine whether a company is suitable for your risk profile by conducting a detailed fundamental analysis on InvestingPro according to your criteria. This way, you will get highly professional help in shaping your portfolio.

You can sign up for InvestingPro, one of the most comprehensive platforms in the market for portfolio management and fundamental analysis by clicking on the banner below.

Find All the Info you Need on InvestingPro!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.

Source: Investing.com