HONG KONG—Rubber has emerged as one of the worst performers amid the slump in global commodities in recent weeks, thanks to a continuing glut of the material, used in products from tires to condoms.

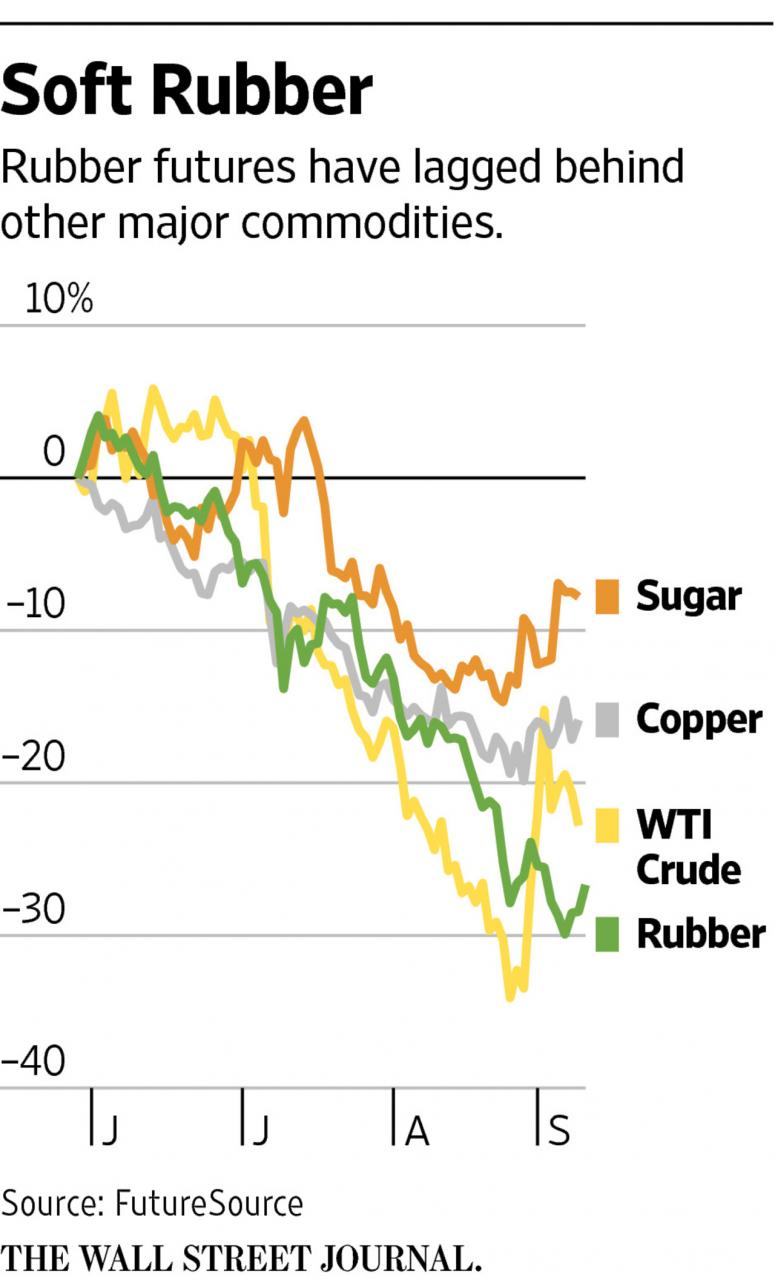

While copper is down 15% in the last three months and West Texas Intermediate crude oil has slumped 23%, benchmark rubber futures traded in Tokyo have sunk 27% to ¥167.80 a kilogram, around their lowest level for six years.

Rubber’s lack of bounce highlights how as demand growth slows in key markets, the most vulnerable commodities are those whose producers have been unable to tame output over recent years.

“Low rubber prices are a function of global supply and demand,” said Chris Pardey, head of physical trading at RCMA Group, a company that trades commodities and provides logistical support for the industry in Singapore. “We have seen three years of surplus production and stock build.”

At just over 3 million tons at the end of the first quarter—the most recent point for which data are available—global stocks of natural rubber were already enough to supply the market for more than three months, according to data from the International Rubber Study Group, a Singapore intergovernmental organization composed of producers and consumers.

The commodity is produced by tapping into rubber trees and collecting and processing the liquid, known as latex, that drips out.

Supply has remained high despite the fact that three countries—Indonesia, Thailand and Malaysia—control nearly 70% of the world’s rubber output. The three are members of the International Tripartite Rubber Council, a body that has been likened to the Organization of the Petroleum Exporting Countries given its potential control over the market , although OPEC members collectively account for only about a third of global oil production.

The council’s efforts to reduce their rubber production, notably at the end of 2014, have cut into overall output, but only to a limited extent.

Total production from the Association of Natural Rubber Producing Countries, comprised of 11 countries that produce around 92% of the world’s natural rubber, fell 2.1% in the seven months to July 31.

Yet stocks remain high, keeping the pressure on prices. With supplies ample, signs of weakness in China’s economy and the general unease induced by its falling stock market couldn’t have come at a worse time for rubber. China is by far the world’s leading rubber consumer, accounting for around 40% of demand.

For sure, agricultural product markets aren’t always as closely correlated to the Chinese economy as those for other commodities, because other factors—notably weather—can play a significant role in prices too. Still, unlike most other so-called soft commodities, rubber’s uses are primarily industrial.

That makes it vulnerable to market concerns about the Chinese economy, especially since Beijing unexpectedly devalued the yuan, the Chinese currency, last month. Investors interpreted the move as a sign that economic troubles there—and the outlook for demand—were worse than believed. A weaker yuan also made rubber more costly for buyers in China.

Rubber’s fall could have further to run, said Hiroyuki Nakayama, head of marketing at Phillip Securities in Japan, given signs that China’s downturn was as yet only in its “initial stage”.

As is often the case when asset prices dive, some are blaming speculators for piling in to make bets that rubber prices will fall, exacerbating its decline.

Rubber futures markets have mostly been used by producers and for hedging physical transactions. Now, though, a growing number of traders and funds are entering the market, making it more apt to react to concerns about the macroeconomic outlook than the balance between supplies and demand.

While it is hard to assess the impact of so-called speculators, there has been growing interest from professional investors in rubber markets. Proprietary traders and funds accounted for 37% of trading volume in rubber futures on the Singapore Exchange last month, up from 26% a year ago, exchange data show.

“The [rubber] price has crashed down because traders…are not concerned about demand, they just followed the [Chinese] stock market and decided the risks were not very good so they took a short position,” said Gu Jiong, an analyst at Yutaka Shoji, a Tokyo commodity brokerage.