US500

-0.01%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

US2000

-0.77%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

IWM

-0.85%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

IXIC

+0.35%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

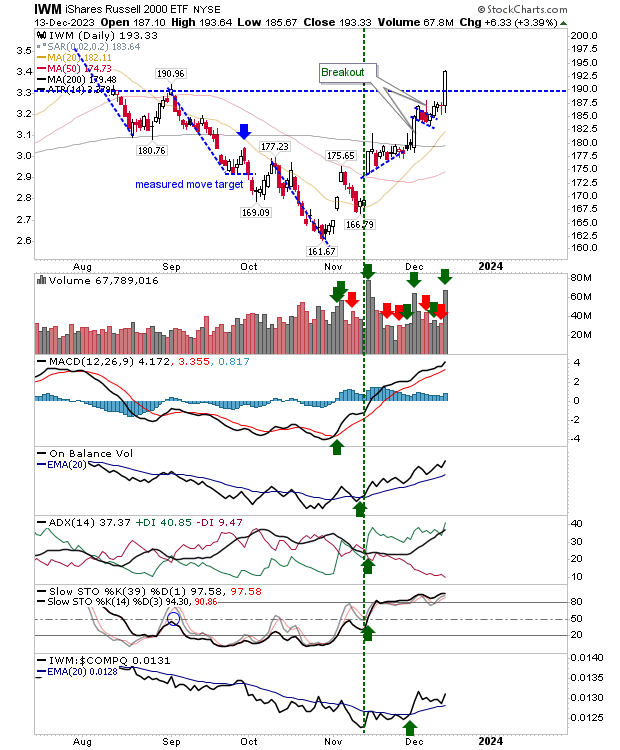

With the Fed signaling rate cuts for 2024, yesterday was another good day for markets, with the Russell 2000 (IWM) cashing in on its resistance pressure with a 3%+ gain. In doing so, it easily surpassed the August swing high on higher volume accumulation.

IWM-Daily Chart

IWM-Daily Chart

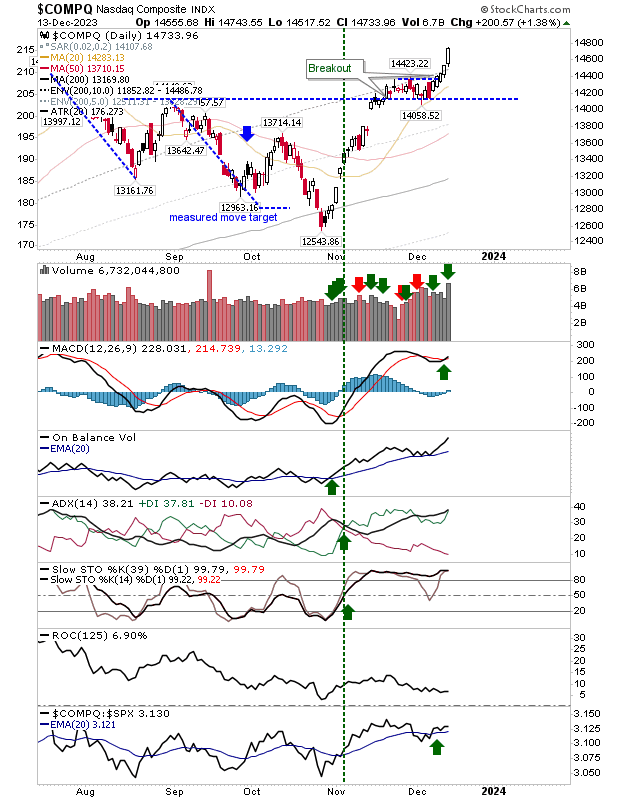

The Nasdaq had already posted solid gains, but it was able to add to its push higher for a fifth day in a row. With the gain came a new MACD trigger ‘buy’ to return technicals to a net positive state.

COMPQ-Daily Chart

COMPQ-Daily Chart

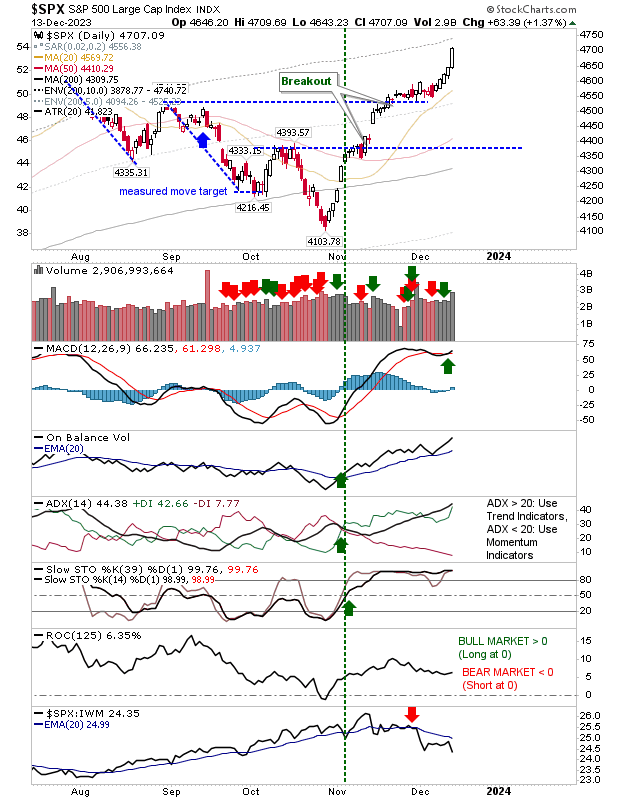

The S&P has extended itself to 9.2% above its 200-day MA and needs to be tracked to see when it reaches an historic extreme (above 10%); this is a good time to sell ‘covered calls’ or take profits on existing positions.

SPX-Daily Chart

SPX-Daily Chart

My day-trade experiment was done before I could take advantage of the Fed’s reaction. The Russell 2000 trade was well-telegraphed, but I was not in a position to benefit. I suspect we will see some profit-taking after a sequence of profitable days, this will make day trading difficult as we will probably see some inconsistent action.

Source: Investing.com