US10Y…

-0.57%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

What is the “wealth effect,” and why is it important? It is a great question and reminded me of “A Funny Thing Happened on the Way to the Colosseum.“ The hysterical play by Craig Sodaro features a naive Swiss farmer heading for Rome.

His dream is to become a stand-up comedian. Little does he know what adventures are in store for him. Stumbling into the house of General Spurius Sillius in search of food, he’s mistaken for the dreaded gladiator, Terribilus, due to fight in the Colosseum the next day.

Simplcuss must figure out how to save himself. He overhears the General’s wife, Drusilla, and Senator Publius Piscious plotting to kill the Emperor’s daughter and the Emperor himself!

Without telling you the ending, there are many similarities to the market currently. Recently, there have been many “pundits” with stories of “Recessionus Terribulus.“ Such is not surprising, and as discussed in this article the recession indicators remain abundant.

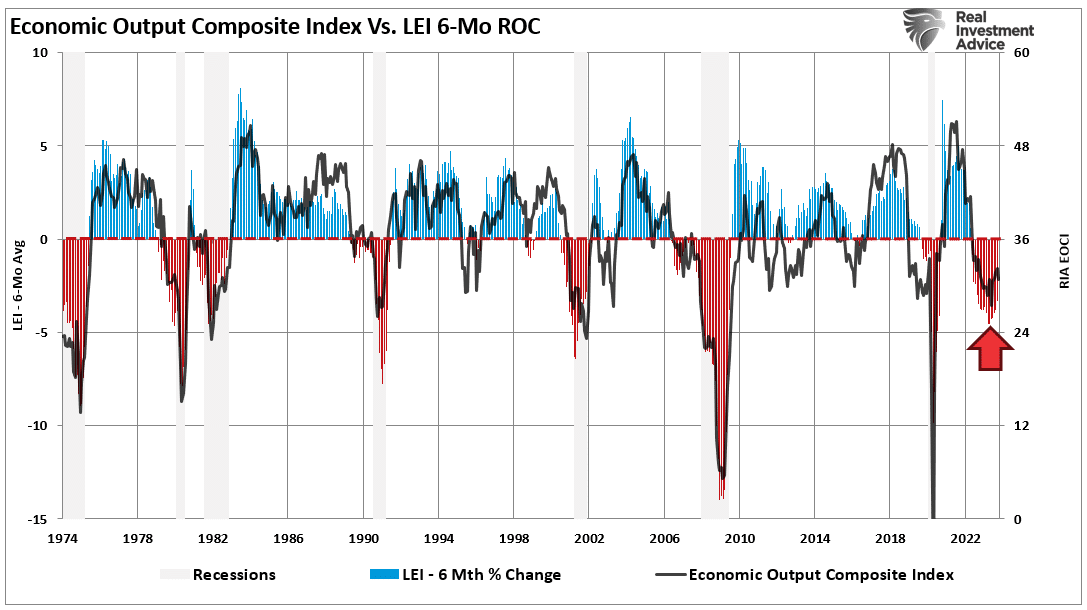

“As with market cycles, the economy cycles as well. There is little argument that the current economic data is fragile, whether you look at the Leading Economic Index (LEI) or the Institute Of Supply Management (ISM) measures.

The Economic Composite Index, comprised of 100 hard and soft economic data points, clearly shows the economic cycles. I have overlaid the composite index with the 6-month rate of change of the LEI index, which has a very high correlation to economic expansions and contractions.”

EOCI vs LEI-6-M-ROC

EOCI vs LEI-6-M-ROC

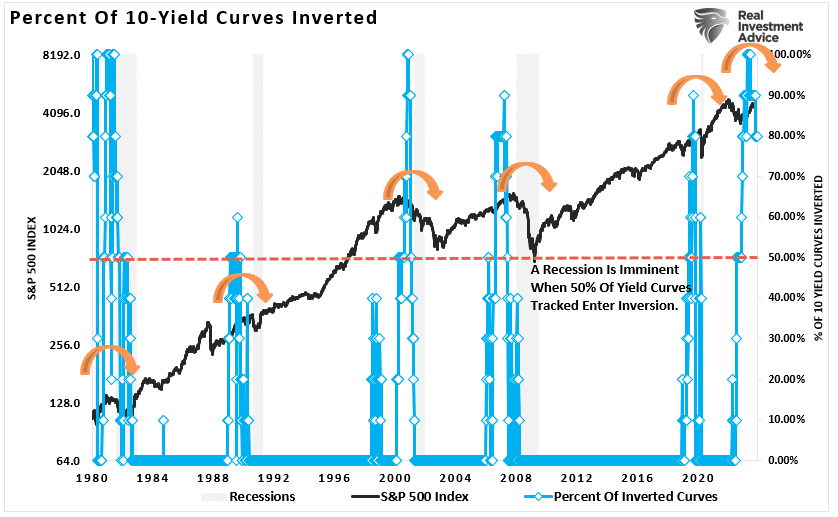

Furthermore, 80% of the 10-year yield spreads we track are negative. As such, the bond market accounts for weaker economic growth, earnings risk, elevated valuations, and a lack of monetary support. Historically, a recession followed when 50% or more of the tracked yield curves became inverted. Every time.

Yield Curve Inversion Composite Index

Yield Curve Inversion Composite Index

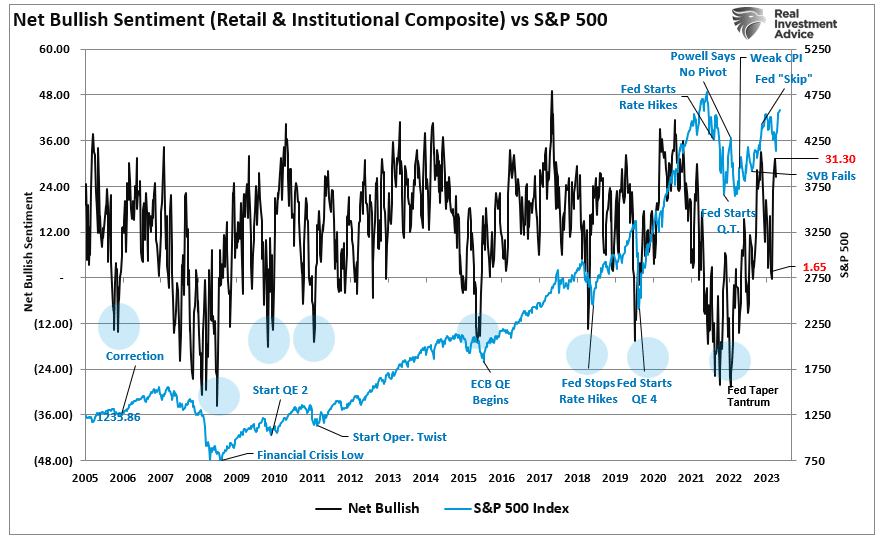

However, despite indicators suggesting recessionary risks, the financial markets surged roughly 20% to date. More importantly, investor sentiment, which was highly bearish last year, has become aggressively bullish.

Net Bullish Sentiment vs S&P 500

Net Bullish Sentiment vs S&P 500

More notably, it isn’t just investors becoming more optimistic. The consumer sentiment index is also increasing.

Consumer Sentiment Follow Suit

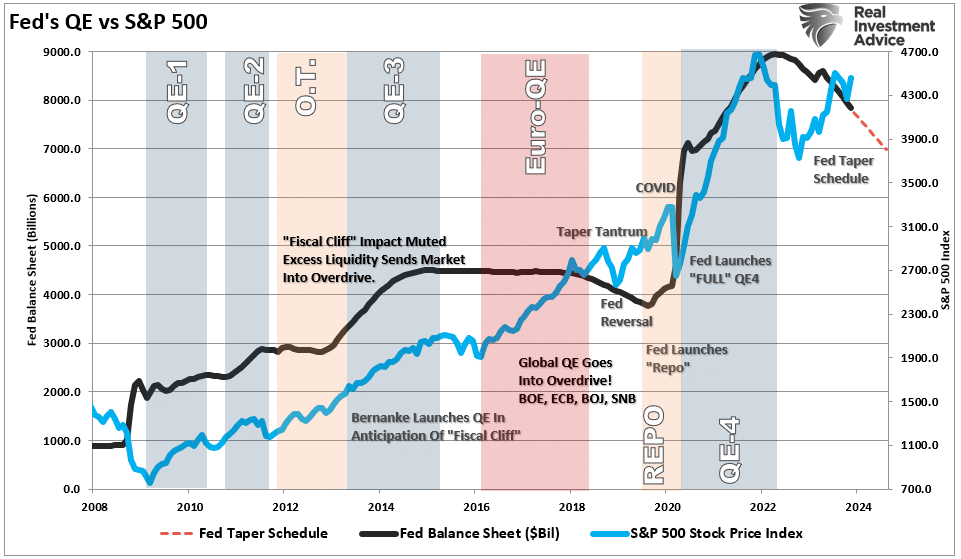

As noted earlier, over the last decade, the Federal Reserve has engineered a massive “Pavlovian response” by investors to actual and expected changes to monetary policy. To wit:

“Importantly, for conditioning to work, the ‘neutral stimulus,’ when introduced, must be followed by the ‘potent stimulus’ for the ‘pairing’ to be completed. For investors, as each round of ‘Quantitative Easing’ was introduced, the ‘neutral stimulus,’ the stock market rose, the ‘potent stimulus.’”

Fed’s QE vs S&P 500

Fed’s QE vs S&P 500

Even though the Fed is currently restricting monetary policy, investors are “front running” the expected change to a more accommodative policy in the months ahead.

As noted in that article, there is a correlation between investor sentiment changes and the financial asset prices and consumers’ sentiment.

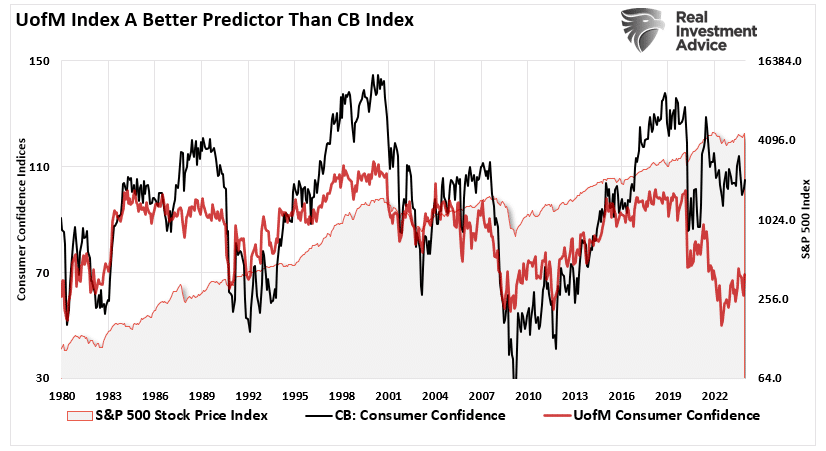

Both economists and market analysts use two different primary consumer sentiment indexes. The University of Michigan provides the first consumer sentiment index. The second sentiment index is from the Conference Board.

UofM vs CB Confidence Indexes

UofM vs CB Confidence Indexes

As you can see, while the two indices track each other over time, significant divergences tend to occur. To remove those divergences, we created a composite sentiment index that combines the two measures, as shown below.

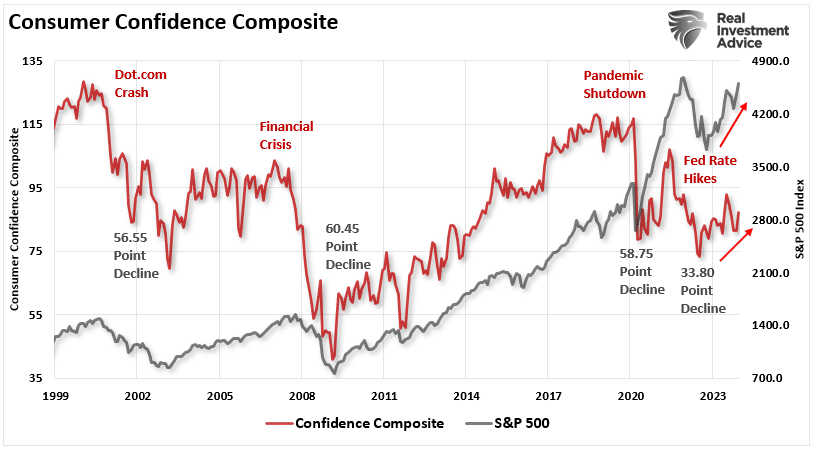

Consumer Confidence Composite vs SP 500

Consumer Confidence Composite vs SP 500

When looking at the composite index, we see declines in the composite sentiment index correlate to financial market declines. The opposite is also apparent. Such makes sense when you consider that changes to financial wealth affect consumer psychology.

When wealth declines, consumer spending contracts, slowing economic growth and earnings. As such, financial market declines are logical. When financial wealth rises, consumers “feel wealthier” and are more willing to make expenditures.

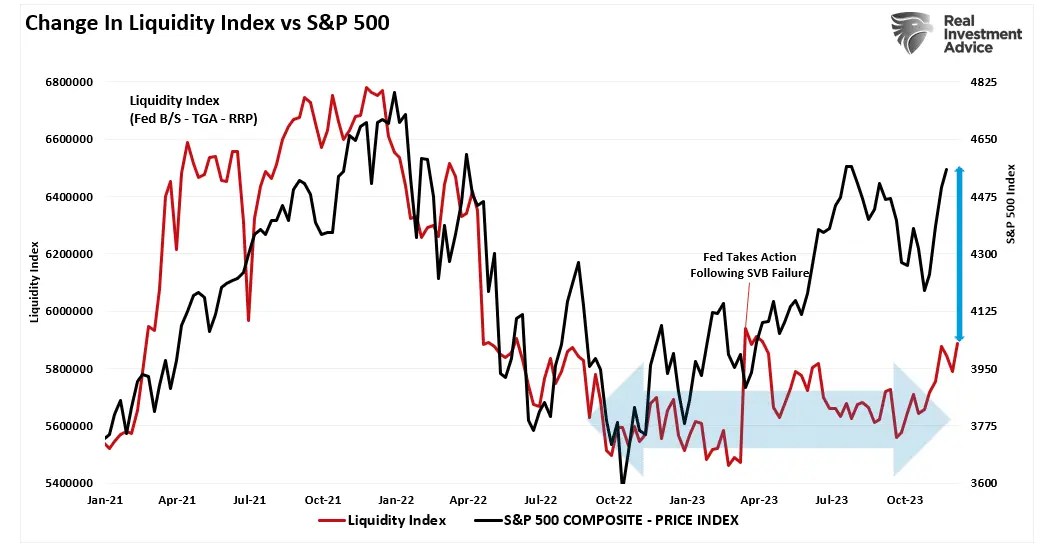

Unsurprisingly, since the lows of last October, asset prices have increased sharply as liquidity increased. As discussed in the linked article above, that linkage between the Fed and investors is complete.

Fed Liquidity Index vs S&P 500

Fed Liquidity Index vs S&P 500

The result of that increase in the “wealth effect” has been a sustained improvement in consumer confidence, which supports economic growth.

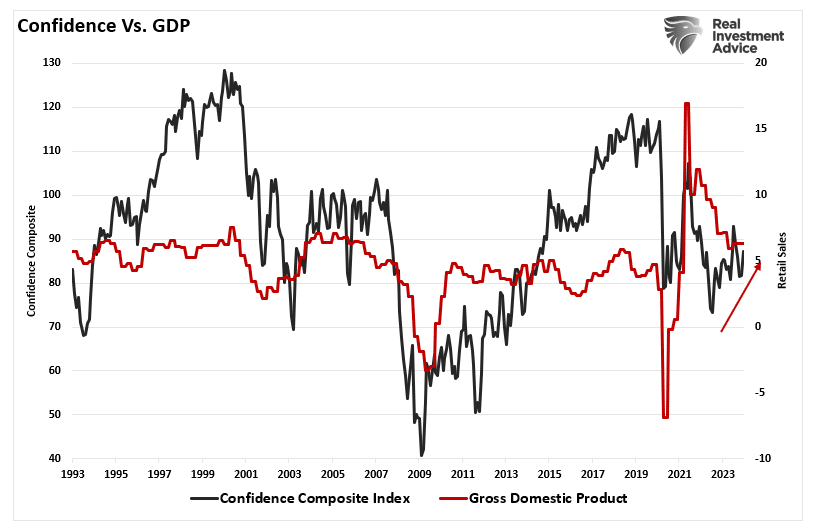

Consumer Confidence vs GDP

Consumer Confidence vs GDP

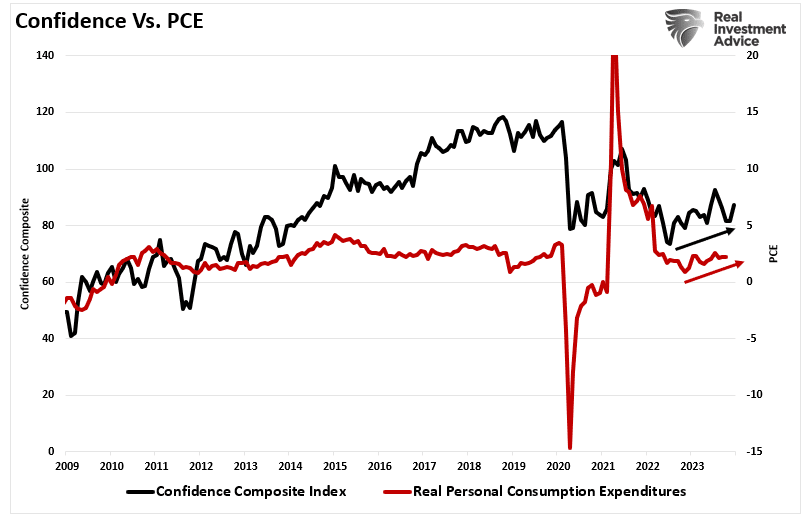

Notably, since nearly 70% of the GDP calculation comprises personal consumption expenditures (PCE), the “wealth effect” increase has stumped those expecting a near-term recession as spending remains robust.

Consumer Confidence Index vs PCE

Consumer Confidence Index vs PCE

The question is whether the increased “wealth effect,” boosting consumer confidence, will be enough to create the elusive “soft landing” in the economy.

The Elusive “Soft Landing”

The most widely received comment recently is the certainty of a recession in 2024. However, at the same time, an increasing proportion of Wall Street analysts and economists suggest just an economic slowdown or a mild recession at worst.

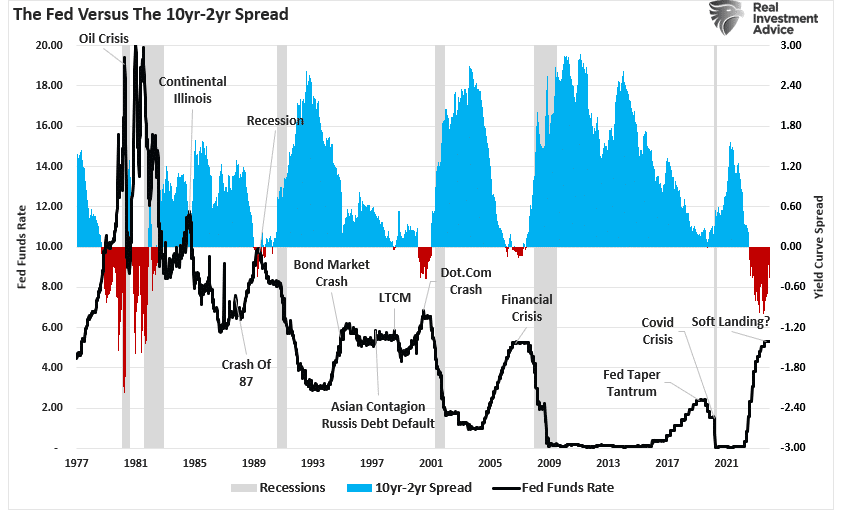

The hope is a repeat of 1995. This is the elusive “soft landing” scenario where the Fed hikes interest rates and cools economic growth and inflation but avoids a recession.

Fed Funds vs 10-2-Inversions and Recession

Fed Funds vs 10-2-Inversions and Recession

Notably, while the Fed hiked rates and the economy avoided a recession, it was not without consequence. That process caused a bond market crash, a debt default, and the failure of Long-Term Capital Management.

However, it is worth noting that during that entire phase, the yield curve DID NOT invert until 1998. Following that inversion, the economy fell into recession in 2000, and a stock market crash began.

Today, the yield curve is the most inverted since 1980, and hopes are high that inflation will cool and a recession will be avoided. While such seems impossible on many fronts, we must remain aware of two crucial factors.

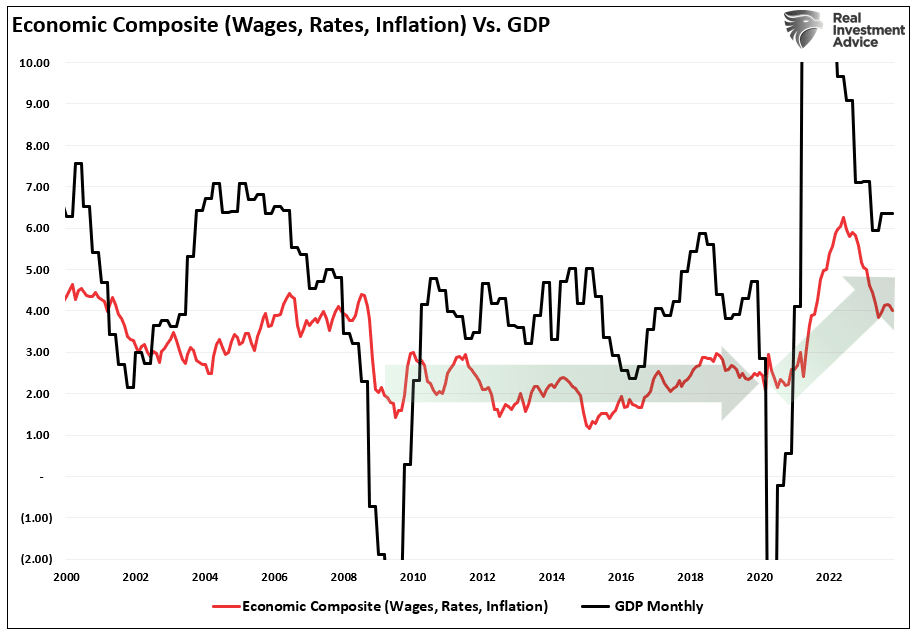

First, falling inflation, interest rates, and wage growth support the economy. The composite index of wages, inflation, and interest rates remains well elevated above the post-Financial Crisis trend.

While it is reversing, which corresponds with weaker economic growth rates, it is not near levels suggestive of an economic recession.

Economic Composte vs GDP

Economic Composte vs GDP

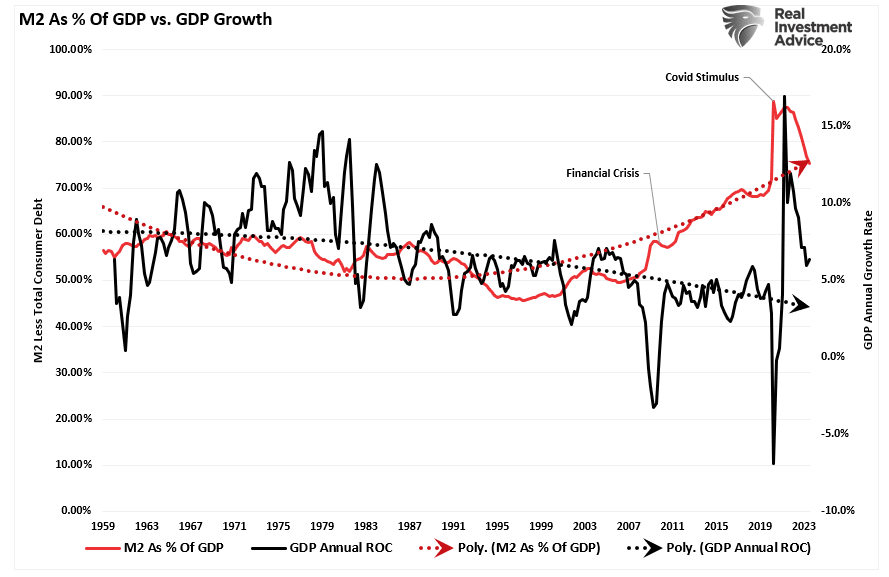

Secondly, the monetary and fiscal impulse from 2020 and 2021 remain in the system. Like the economic composite, M2 is declining as a percentage of GDP but remains well elevated above anything previously witnessed since 1960.

This monetary support and lower interest and inflation rates will likely keep the economic growth engine running through 2024.

M2 as % of GDP vs GDP Growth

M2 as % of GDP vs GDP Growth

Conclusion

While there are undoubtedly many bearish arguments currently, as investors, we must remember that markets tend to be forward-looking. Expectations of a deeper recession due to aggressive rate hikes by the Federal Reserve, tight lending standards from banks, and still high inflation are undoubtedly valid.

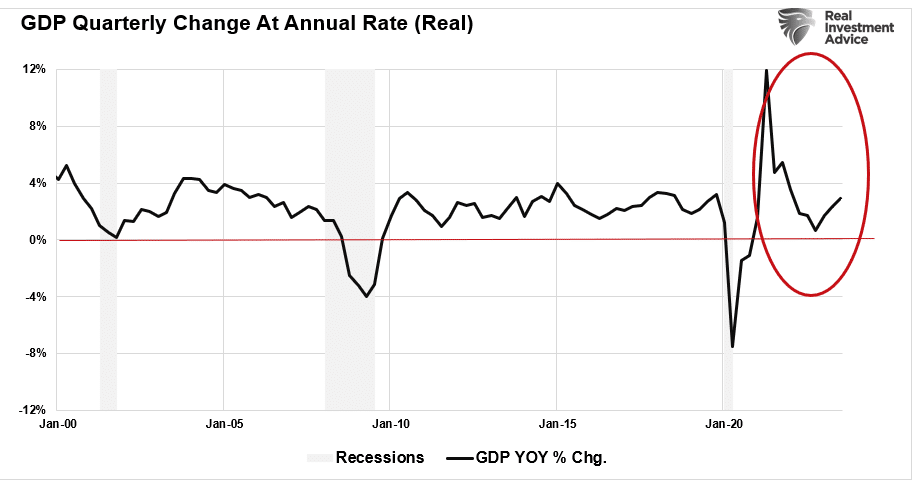

However, high levels of monetary liquidity and improved consumer confidence from an increased “wealth effect” could keep economic growth from contracting into recessionary territory. We must also consider that the economy has contracted sharply over the last 24 months.

Had the economy been running at 2%, as previously, a recession would have been assured. The difference was that the contraction occurred when the economy ran at an accelerated annualized rate of nearly 12% due to $5 Trillion in liquidity.

As shown below, the contraction has reversed the entirety of that previous growth. On an equivalent basis, the decline during the Pandemic shutdown was roughly equal in magnitude.

The difference was that the decline started with the economy running just above 2% annualized. In other words, on a normalized basis, the contraction has been equally as significant as the 2020 recession and nearly twice as large as the “Financial Crisis.”

GDP-Qtrly Chg at Annual Rate

GDP-Qtrly Chg at Annual Rate

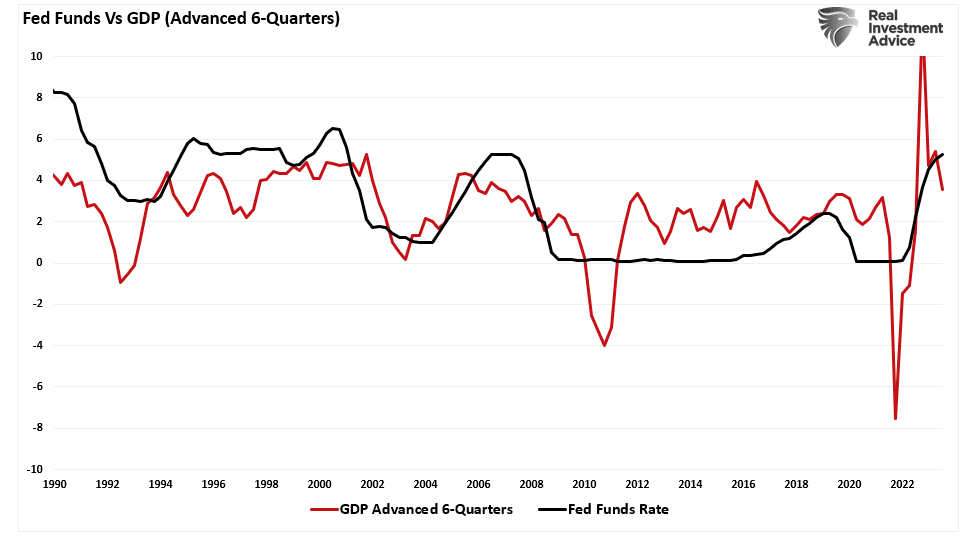

We know that Federal Reserve actions regarding hiking rates have about a 6-quarter lead over changes to economic growth. Given the last Fed rate hike was in Q2 of this year, such would suggest a further slowing in economic activity into next year. But such does NOT ensure a “recession” in 2024.

Fed Funds vs GDP (Advanced 6-Quarters)

Fed Funds vs GDP (Advanced 6-Quarters)

Therefore, given this uncertainty, we must continue to weigh the possibility that Wall Street economists are correct in their more optimistic predictions.

Will there eventually be a recession? Absolutely. But betting on one to occur next year could lead to disappointing outcomes for your investment portfolio.

Source: Investing.com