NDX

+0.59%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

US500

+0.52%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

DJI

+0.10%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

US2000

+0.15%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

IWM

+0.26%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

IXIC

+0.53%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

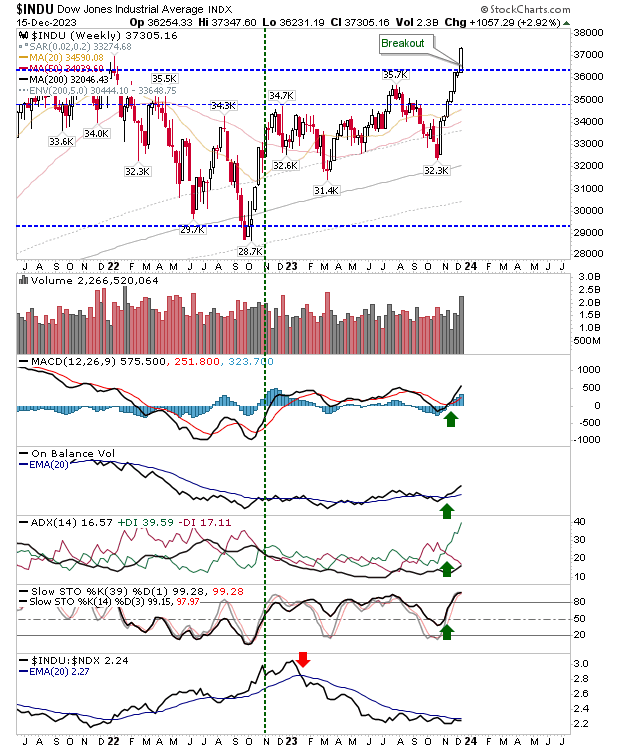

It was a classic breakout for the Dow as the index recorded a new all-time high.

Weekly buying volume was the highest since January 2022. Technicals are net positive with the index shifting to a relative outperformance against the Nasdaq 100.

INDU-Weekly Chart

INDU-Weekly Chart

On daily timeframes, the action was more mixed. I had expected the Nasdaq to be the index to come under selling pressure, but in the end, it was the Russell 2000 (IWM) that took the hit.

There is still a large trading gap to close that will act as a vacuum once prices drift into it. Despite this, selling volume was down on the previous week’s buying.

IWM-Daily Chart

IWM-Daily Chart

The Nasdaq closed with an indecisive doji on higher volume (options expiration). The index is outperforming the S&P 500, but this could still go either way.

COMPQ-Daily Chart

COMPQ-Daily Chart

The S&P 500 had already slowed the advance of its gains from Thursday, before marking a continued period of indecision Friday with a narrow range “spinning top”.

Volume surged to the highest in years on options expiration, but sellers have been unable to reverse the October-December trend.

Whether they can do so this week remains to be seen, but with the Santa rally to come, it would appear any concerted selling won’t happen until the new year.

SPX-Daily Chart

SPX-Daily Chart

With Christmas fast approaching I will be looking for a generally bullish bias into the New Year. However, at the start of 2024, I suspect the hangover off the back of a strong end-of-year will kick in and sellers will be much more aggressive.

However, with indices touching new all-time highs, the bear market that kicked in in 2021 appears to be over and a new secular bull market looks ready to go.

A worst-case scenario would be a trading range between September 2022 lows and 2021 highs, but let’s see what Q1 2024 brings.

Source: Investing.com