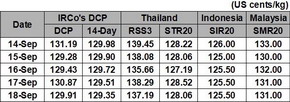

During the week of 14 – 18 September, IRCo’s Daily Composite Price (DCP) hovered around 130 US cents/kg level. The movement of DCP in last week was in line with the movement in physical and futures markets in the region.

Currently, NR prices are mainly influenced by the global economic uncertainty, slower Chinaeconomy and the strengthening of Japanese yen amidst the uncertainty on the timing of interest rates hike by U.S. Federal reserve (Fed).

Currently, NR prices are mainly influenced by the global economic uncertainty, slower Chinaeconomy and the strengthening of Japanese yen amidst the uncertainty on the timing of interest rates hike by U.S. Federal reserve (Fed).

However, the current prevailing low and unattractive price of NR is affecting the livelihood of rubber smallholders in all producing countries and this situation may force them to abandon their rubber plantation and switched to other economic activities. This resulted in a decrease of NR production as indicated by data published by the Association of Natural Rubber Producing Countries (ANPRC). NR production for ANRPC member countries which accounted for 93% of global NR production fell by 1.7% to 5.233 million MT for the first 8 months of 2015 as compared to 5.326 million MT in the same period in 2014.

In addition to that the newly established Rubber Authority of Thailand (RAOT) expected that Thai’s NR production to decrease to 4.206 million in 2015 MT from 4.324 million MT in 2014.

If NR price remains low and uneconomical to producers, rubber farmers may permanently switch to other economic activities and this would disrupt the supply of raw materials.